Kodak 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

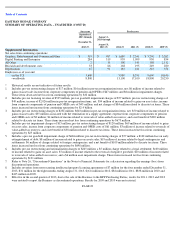

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the

reader understand the results of operations and financial condition of Kodak for the four months ended December 31, 2013, eight months ended

August 31, 2013 and for the years ended December 31, 2012 and 2011. All references to Notes relate to Notes to the Financial Statements in

Item 8. “Financial Statements and Supplementary Data.”

OVERVIEW

Prior to emergence from chapter 11 Kodak took many actions to reduce legacy obligations and improve the profitability of its emerging

commercial imaging business. These actions included the following:

Kodak expects to continue to improve its profitability by focusing on the placement of equipment and the generation of profitable annuities in

its Digital Printing, Packaging and Enterprise businesses as well as the continued generation and enhancement of profits in its large

consumable-based Graphics business through differentiation from the competition with its process free technology. Kodak also expects

functional printing to contribute to profitable growth in 2014 and beyond.

As of December 31, 2013, Kodak has total assets of $3.2 billion, total liabilities of $2.6 billion and equity of approximately $650 million.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The accompanying consolidated financial statements and notes to consolidated financial statements contain information that is pertinent to

management’s discussion and analysis of the financial condition and results of operations. The preparation of financial statements in

conformity with accounting principles generally accepted in the United States of America requires management to make estimates and

assumptions that affect the reported amounts of assets, liabilities, revenue and expenses, and the related disclosure of contingent assets and

liabilities.

Kodak believes that the critical accounting policies and estimates discussed below involve the most complex management judgments due to the

sensitivity of the methods and assumptions necessary in determining the related asset, liability, revenue and expense amounts. Specific risks

associated with these critical accounting policies are discussed throughout this MD&A, where such policies affect Kodak’s reported and

expected financial results. For a detailed discussion of the application of these and other accounting policies, refer to the Notes to Financial

Statements in Item 8.

Revenue Recognition

Kodak’s revenue transactions include sales of products (such as components and consumables for use in Kodak and other manufacturers’

equipment, and film based products), equipment, software, services, integrated solutions, and intellectual property licensing. The timing and the

amount of revenue recognized depend upon a variety of factors, including the specific terms of each agreement and the nature of the

deliverables and obligations. For equipment sales, revenue recognition may depend on completion of installation based on the type of

equipment, level of customer specific customization and other contractual terms. In instances in which the agreement with the customer

contains a customer acceptance clause, revenue is deferred until customer acceptance is obtained, provided the customer acceptance clause is

considered to be substantive.

PAGE 24

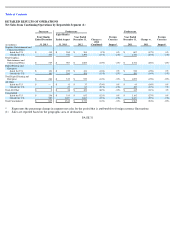

ITEM 7.

MANAGEMENT

’

S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

• In November 2012, the Bankruptcy Court entered an order approving a settlement agreement between the Debtors and the retiree

committee appointed by the U.S. Trustee related to its U.S. postretirement benefit plans. Under the settlement agreement, the

Debtors no longer provide retiree medical, dental, life insurance, and survivor income benefits to current and future retirees after

December 31, 2012 (other than COBRA continuation coverage of medical and/or dental benefits available to active employees or

conversion coverage as required by the plans or applicable law).

• In February 2013, Kodak received approximately $530 million related to the sale and licensing of certain of its intellectual property

assets and repaid approximately $419 million of the then outstanding term loan under the DIP Credit Agreement.

• On the Effective Date, Kodak received net cash consideration of $325 million for the sale of certain assets and liabilities of its

Personalized Imaging and Document Imaging businesses as part of the KPP Global Settlement, which also included the settlement

of the U.K. pension plan liability.