Kodak 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In conjunction with fresh start accounting, Kodak recorded a $54 million indefinite-lived intangible asset related to the Kodak trade name. The

Kodak trade name was valued using the income approach, specifically the relief from royalty method based on the following significant

assumptions: (a) forecasted revenues ranging from September 1, 2013 to December 31, 2022, including a terminal year with growth rates

ranging from 0% to 3%; (b) royalty rates ranging from .5% to 1% of expected net sales determined with regard to comparable market

transactions and profitability analysis; and (c) discount rates ranging from 27% to 32%, which were based on the after-tax weighted-average

cost of capital.

The carrying value of the Kodak trade name is evaluated for potential impairment annually or whenever events or changes in circumstances

indicate that it is more likely than not that the asset is impaired. Kodak elected October 1 as the annual impairment assessment date.

For the 2013 annual impairment test of the Kodak trade name, Kodak elected to utilize the qualitative assessment due to the fresh start

valuation being performed as of September 1, 2013. In performing the qualitative assessment, Kodak compared actual results to forecasted

revenues and considered the extent to which adverse events and circumstances could affect the fair value of the Kodak trade name since the

fresh start valuation. Based on the results of this assessment, no impairment of the Kodak trade name was indicated.

Subsequent to the annual impairment test of the Kodak trade name and due to Kodak revising its projected 2014 revenue estimates, Kodak

concluded that the carrying value of the Kodak trade name, estimated as part of fresh start accounting, exceeded its fair value. Kodak recorded

a pre-tax impairment charge of $8 million that is included in Other operating expense (income), net in the Consolidated Statement of

Operations. The fair value of the Kodak trade name was valued as of December 31, 2013 using the income approach, specifically the relief

from royalty method based on the following significant assumptions: (a) forecasted revenues ranging from January 1, 2014 to December 31,

2022, including a terminal year with growth rates ranging from -3% to 3%; (b) royalty rates ranging from .5% to 1% of expected net sales

determined with regard to comparable market transactions and profitability analysis; and (c) discount rates ranging from 26% to 31%, which

were based on the after-tax weighted-average cost of capital. Additional impairments of the Kodak trade name could occur in the future if

expected revenues decline or if there are significant changes in the discount or royalty rates.

Kodak’s long-lived assets other than goodwill and indefinite-lived intangible assets are evaluated for impairment whenever events or changes

in circumstances indicate the carrying value may not be recoverable. When evaluating long-lived assets for impairment, Kodak compares the

carrying value of an asset group to its estimated undiscounted future cash flows. An impairment is indicated if the estimated future cash flows

are less than the carrying value of the asset group. The impairment is the excess of the carrying value over the fair value of the long-lived asset

group.

As part of fresh start accounting, Kodak fair valued property, plant and equipment and revised depreciable lives to reflect the remaining

estimated useful life of the assets. Kodak depreciates the value of property, plant, and equipment over its expected useful life in such a way as

to allocate it as equitably as possible to the periods during which services are obtained from their use, which aims to distribute the value over

the remaining estimated useful life of the unit in a systematic and rational manner. An estimate of useful life not only considers the economic

life of the asset, but also the remaining life of the asset to the entity. Impairment of long-lived assets other than goodwill and indefinite lived

intangible assets could occur in the future if expected future cash flows decline or if there are significant changes in the estimated useful life of

the assets.

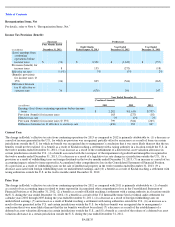

Income Taxes

Kodak recognizes deferred tax liabilities and assets for the expected future tax consequences of operating losses, credit carry-forwards and

temporary differences between the carrying amounts and tax basis of Kodak’s assets and liabilities. Kodak records a valuation allowance to

reduce its net deferred tax assets to the amount that is more likely than not to be realized. Kodak has considered forecasted earnings, future

taxable income, the geographical mix of earnings in the jurisdictions in which Kodak operates and prudent and feasible tax planning strategies

in determining the need for these valuation allowances. As of December 31, 2013, Kodak has net deferred tax assets before valuation

allowances of approximately $1,008 million and a valuation allowance related to those net deferred tax assets of approximately $953 million,

resulting in net deferred tax assets of approximately $55 million. If Kodak were to determine that it would not be able to realize a portion of its

net deferred tax assets in the future, for which there is currently no valuation allowance, an adjustment to the net deferred tax assets would be

charged to earnings in the period such determination was made. Conversely, if Kodak were to make a determination that it is more likely than

not that deferred tax assets, for which there is currently a valuation allowance, would be realized, the related valuation allowance would be

reduced and a benefit to earnings would be recorded. Kodak considers both positive and negative evidence, in determining whether a valuation

allowance is needed by territory, including, but not limited to, whether particular entities are in three year cumulative income positions. During

the eight months ended August 31, 2013, Kodak determined that it was more likely than not that a portion of its deferred tax assets outside the

U.S. would not be realized due to changes in the business resulting from the KPP Global Settlement and the related sale of the Business. As a

result, Kodak recorded a tax provision of $100 million associated with the establishment of a valuation allowance on those deferred tax assets.

PAGE 27