Kodak 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

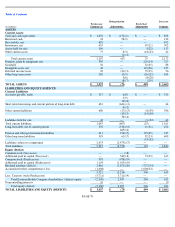

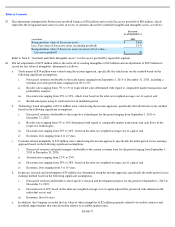

Gross goodwill and accumulated impairment losses were $1.543 billion and $1.411 billion, respectively, as of December 31, 2011 and 2012

and $1.544 billion and $1.488 billion, respectively, as of August 31, 2013. As part of fresh start accounting, Kodak adjusted the carrying value

of goodwill (see Note 3, “Fresh Start Accounting”).

Effective in the first quarter of 2013, the Intellectual Property and Brand Licensing reporting unit was reported in the Graphics, Entertainment

and Commercial Films Segment. Goodwill assigned to the Intellectual Property and Brand Licensing reporting unit of approximately $113

million as of December 31, 2012 was previously reported in the Personalized and Document Imaging Segment. Due to the sale of its digital

imaging patents during the first quarter of 2013, Kodak concluded that the carrying value of goodwill for its Intellectual Property and Brand

Licensing reporting unit exceeded the implied fair value of goodwill. The fair value of the Intellectual Property and Brand Licensing reporting

unit was estimated using an income approach in which the future cash flows, including a terminal value at the end of the projection period,

were discounted to present value. Kodak recorded a pre-tax impairment charge of $77 million that is included in Other operating expense

(income), net in the Consolidated Statement of Operations.

Effective in the second quarter of 2013, due to the Personalized and Document Imaging disposal group being reported as assets held for sale,

Kodak has two reportable segments: the Graphics, Entertainment and Commercial Films Segment and the Digital Printing and Enterprise

Segment. The Graphics, Entertainment and Commercial Films Segment has three goodwill reporting units: Graphics, Entertainment Imaging

and Commercial Films and Intellectual Property and Brand Licensing. The Digital Printing and Enterprise Segment has four goodwill reporting

units: Digital Printing, Packaging and Functional Printing, Enterprise Services and Solutions, and Consumer Inkjet Systems. The remaining

goodwill in the Personalized and Document Imaging Segment was reported as a component of assets held for sale as of June 30, 2013 and

subsequently written-off as part of the loss on sale of the Personalized and Document Imaging Businesses.

Based upon the results of Kodak’s October 1, 2013 annual impairment test analysis, no impairment of goodwill was indicated.

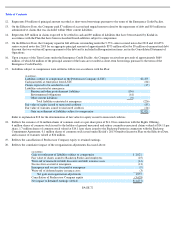

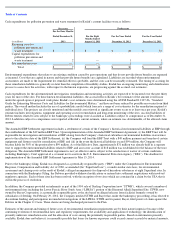

As part of fresh start accounting, Kodak wrote-off existing intangibles and accumulated amortization and recorded an adjustment of $235

million to reflect the fair value of intangibles. Refer to Note 3, “Fresh Start Accounting.” Due to Kodak revising its projected 2014 revenue

estimates, Kodak concluded that the carrying value of the Kodak trade name, estimated as part of fresh start accounting, exceeded its fair value.

In the fourth quarter of 2013 Kodak recorded a pre-tax impairment charge of $8 million that is included in Other operating expense (income),

net in the Consolidated Statement of Operations.

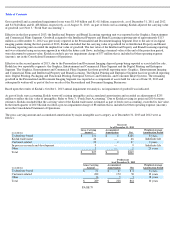

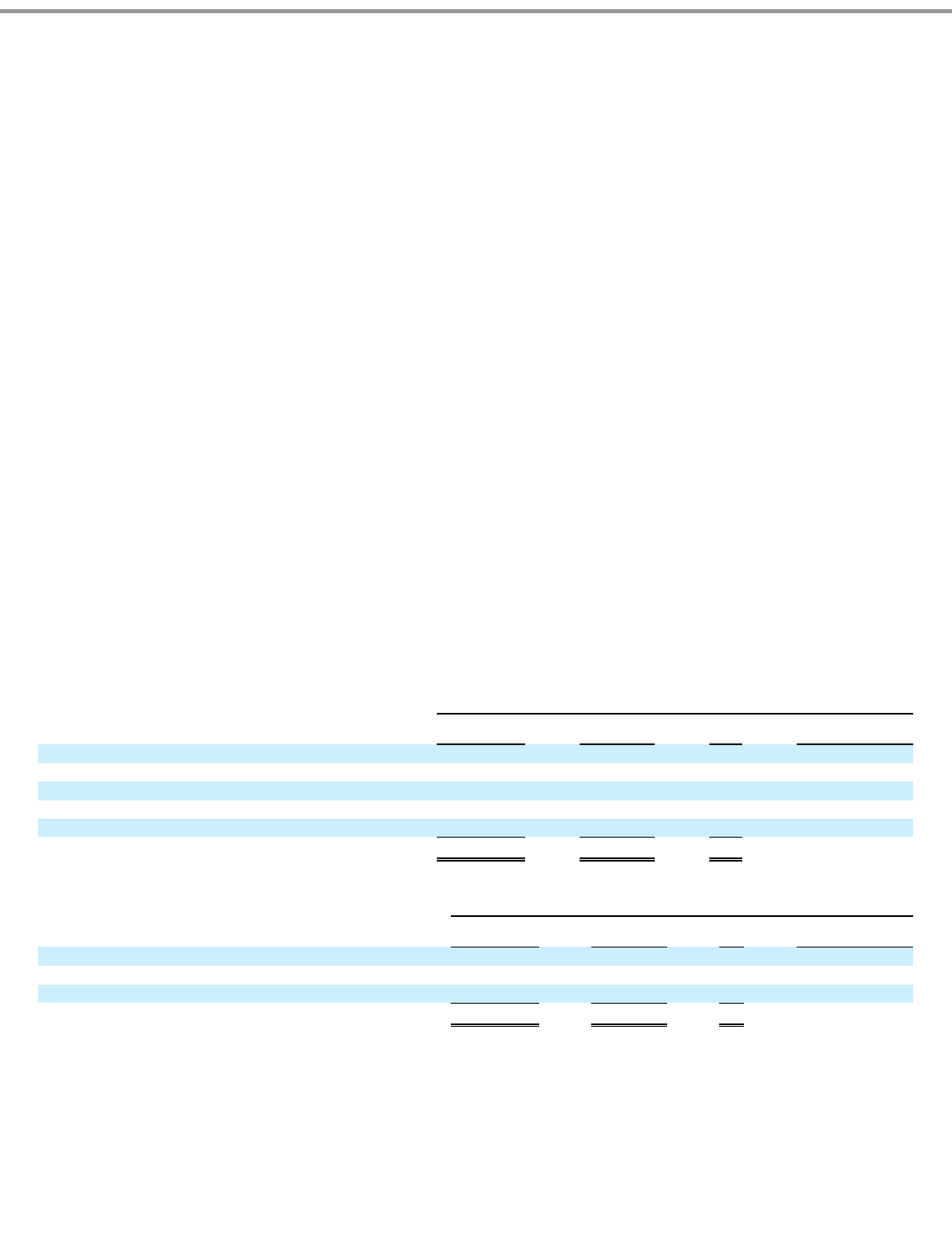

The gross carrying amount and accumulated amortization by major intangible asset category as of December 31, 2013 and 2012 were as

follows:

PAGE 79

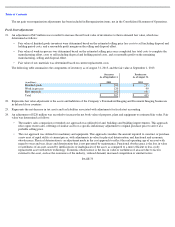

Successor

As of December 31, 2013

(in millions)

Gross Carrying

Accumulated

Weighted

-

Average

Amount

Amortization

Net

Amortization Period

Technology-based

$

131

$

6

$

125

8 years

Kodak trade name

46

—

46

Indefinite life

Customer

-

related

39

2

37

9 years

In

-

process research and development

9

—

9

Indefinite life

Other

2

—

2

25 years

Total

$

227

$

8

$

219

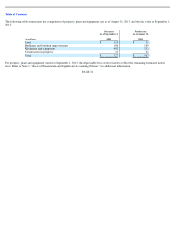

Predecessor

As of December 31, 2012

(in millions)

Gross Carrying

Accumulated

Weighted

-

Average

Amount

Amortization

Net

Amortization Period

Technology-based

$

51

$

47

$

4

8 years

Customer

-

related

222

172

50

10 years

Other

16

9

7

18 years

Total

$

289

$

228

$

61

10 years