Kodak 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

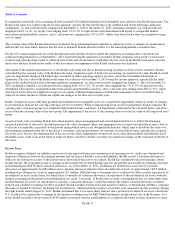

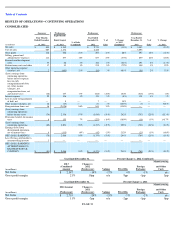

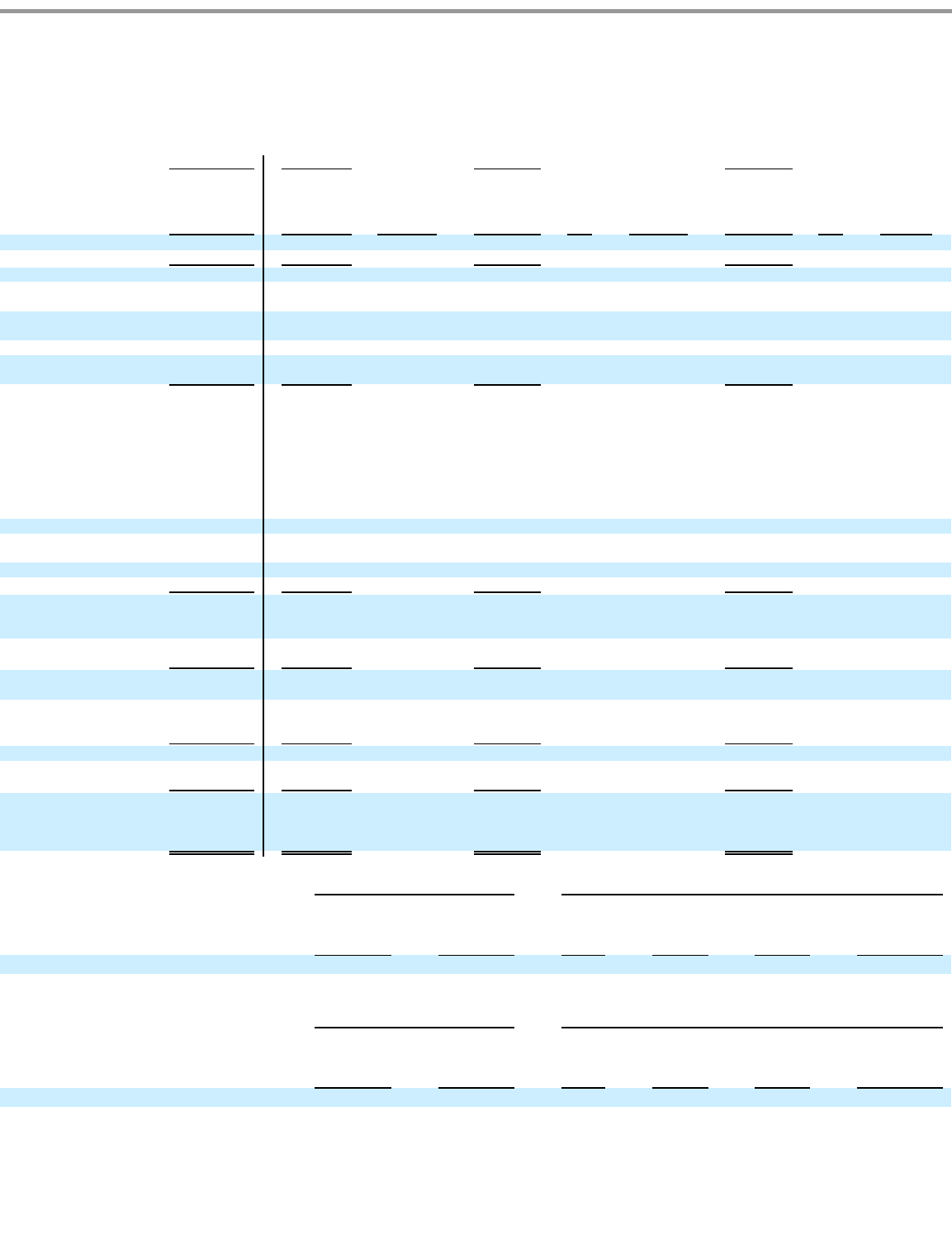

RESULTS OF OPERATIONS—CONTINUING OPERATIONS

CONSOLIDATED

PAGE 33

Successor

Predecessor

Predecessor

Predecessor

(in millions)

Four Months

Ended December

31, 2013

Eight Months

Ended August

31, 2013

% of Sales

(Combined)

Year Ended

December 31,

2012

% of

Sales

% Change

vs. 2012

(Combined)

Year Ended

December 31,

2011

% of

Sales

% Change

vs. 2011

Net sales

$

805

$

1,542

$

2,719

(14

%)

$

3,585

(24

%)

Cost of sales

687

1,174

2,426

3,095

Gross profit

118

368

21

%

293

11

%

66

%

490

14

%

(40

%)

Selling, general and

administrative expenses

114

297

18

%

637

23

%

(35

%)

859

24

%

(26

%)

Research and development

costs

33

66

4

%

168

6

%

(41

%)

195

5

%

(14

%)

Restructuring costs and other

17

43

3

%

215

8

%

(72

%)

108

3

%

99

%

Other operating expense

(income), net

2

(495

)

21

%

(85

)

3

%

480

%

(56

)

2

%

52

%

(Loss) earnings from

continuing operations

before interest expense,

loss on early

extinguishment of debt,

net, other income

(charges), net,

reorganization items, net

and income taxes

(48

)

457

17

%

(642

)

(24

%)

164

%

(616

)

(17

%)

(4

%)

Interest expense

22

106

5

%

139

5

%

(8

%)

138

4

%

1

%

Loss on early extinguishment

of debt, net

—

8

—

7

—

14

%

—

—

—

Other income (charges), net

12

(13

)

—

21

1

%

(105

%)

(3

)

—

800

%

Reorganization items, net

16

(2,026

)

86

%

843

31

%

(338

%)

—

—

—

(Loss) earnings from

continuing operations

before income taxes

(74

)

2,356

97

%

(1,610

)

(59

%)

242

%

(757

)

(21

%)

(113

%)

Provision (benefit) for income

taxes

8

155

7

%

(273

)

(10

%)

(160

%)

(18

)

(1

%)

1,417

%

(Loss) earnings from

continuing operations

(82

)

2,201

90

%

(1,337

)

(49

%)

258

%

(739

)

(21

%)

(81

%)

Earnings (loss) from

discontinued operations,

net of income taxes

4

(135

)

(6

%)

(42

)

(2

%)

212

%

(25

)

(1

%)

(68

%)

NET (LOSS) EARNINGS

(78

)

2,066

85

%

(1,379

)

(51

%)

244

%

(764

)

(21

%)

(80

%)

Less: Net loss attributable to

noncontrolling interests

3

—

—

—

—

—

—

—

—

NET (LOSS) EARNINGS

ATTRIBUTABLE TO

EASTMAN KODAK

COMPANY

$

(81

)

$

2,066

85

%

$

(1,379

)

(51

%)

244

%

$

(764

)

(21

%)

(80

%)

Year Ended December 31,

Percent Change vs. 2012 (Combined)

(in millions)

2013

(Combined)

Amount

Change vs.

2012

(Predecessor)

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other

Costs

Net Sales

$

2,347

-

14

%

-

17

%

4

%

-

1

%

n/a

Gross profit margin

21

%

10pp

n/a

8pp

-

1pp

3pp

Year Ended December 31,

Percent Change vs. 2011

(in millions)

2012 Amount

(Predecessor)

Change vs.

2011

(Predecessor)

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other

Costs

Net Sales

$

2,719

-

24

%

-

15

%

-

7

%

-

2

%

n/a

Gross profit margin

11

%

-

3pp

n/a

-

2pp

-

1pp

0pp