Kodak 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

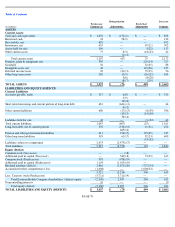

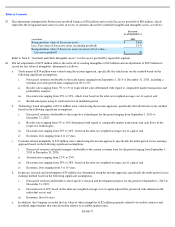

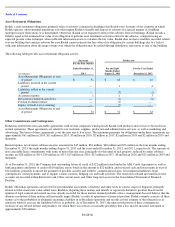

NOTE 6: INVENTORIES, NET

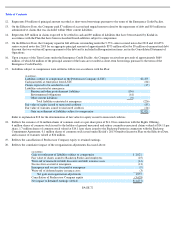

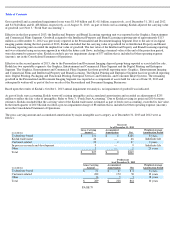

NOTE 7: PROPERTY, PLANT AND EQUIPMENT, NET

In connection with the application of fresh start accounting as of September 1, 2013, Kodak recorded fair value adjustments disclosed in Note

3, “Fresh Start Accounting”. Accumulated depreciation was therefore eliminated as of that date.

Depreciation expense was $67 million, $91 million, $182 million, and $221 million for the four months ended December 31, 2013, eight

months ended August 31, 2013 and the years 2012, and 2011 respectively, of which approximately $0 million, $4 million, $13 million, and $10

million, respectively, represented accelerated depreciation in connection with restructuring actions.

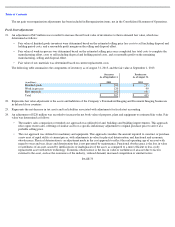

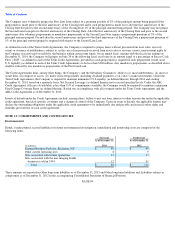

NOTE 8: GOODWILL AND OTHER INTANGIBLE ASSETS

The following table presents the changes in the carrying value of goodwill by reportable segment:

PAGE 78

Successor

Predecessor

(in millions)

As of December 31,

2013

As of December 31,

2012

Finished goods

$

185

$

236

Work in process

94

87

Raw materials

79

97

Total

$

358

$

420

Successor

Predecessor

(in millions)

As of December 31,

2013

As of December 31,

2012

Land

$

117

$

39

Buildings and building improvements

178

1,156

Machinery and equipment

414

3,138

Construction in progress

42

28

751

4,361

Accumulated depreciation

(67

)

(3,754

)

Property, plant and equipment, net

$

684

$

607

(in millions)

Graphics, Entertainment

and Commercial Films

Segment

Digital Printing and

Enterprise Segment

Consolidated

Total

Balance as of December 31, 2011 and 2012 (Predecessor):

$

115

$

17

$

132

Impairment

(77

)

—

(

77

)

Currency translation adjustments

1

—

1

Balance as of August 31, 2013 (Predecessor):

$

39

$

17

$

56

Impact of fresh start accounting

$

22

$

10

$

32

Balance as of December 31, 2013 (Successor):

$

61

$

27

$

88