Kodak 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

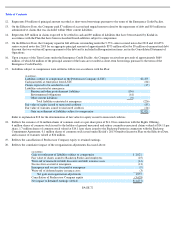

The net gain on reorganization adjustments has been included in Reorganization items, net in the Consolidated Statement of Operations.

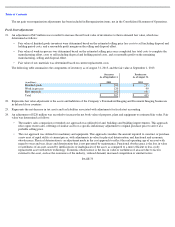

Fresh Start adjustments

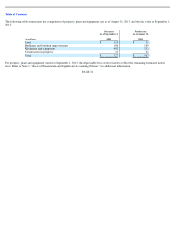

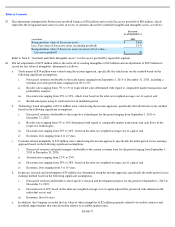

The following table summarizes the components of inventory as of August 31, 2013, and the fair value at September 1, 2013:

PAGE 73

21. An adjustment of $67 million was recorded to increase the net book value of inventories to their estimated fair value, which was

determined as follows:

• Fair value of finished goods inventory were determined based on the estimated selling price less costs to sell including disposal and

holding period costs, and a reasonable profit margin on the selling and disposal effort.

• Fair value of work-in-process was determined based on the estimated selling price once completed less total costs to complete the

manufacturing effort, costs to sell including disposal and holding period costs, and a reasonable profit on the remaining

manufacturing, selling and disposal effort.

•

Fair value of raw materials was determined based on current replacement costs.

Successor

Predecessor

(in millions)

As of September 1,

2013

As of August 31,

2013

Finished goods

$

280

$

235

Work in process

120

99

Raw materials

102

101

Total

$

502

$

435

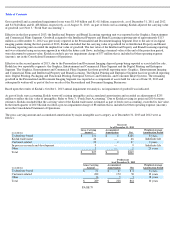

22. Represents fair value adjustment to the assets and liabilities of the Company’s Personalized Imaging and Document Imaging businesses

in delayed close countries.

23.

Represents the net decrease in tax assets and tax liabilities associated with adjustments for fresh start accounting.

24. An adjustment of $220 million was recorded to increase the net book value of property, plant and equipment to estimated fair value. Fair

value was determined as follows:

• The market, sales comparison or trended cost approach was utilized for land, buildings and building improvements. This approach

relies upon recent sales, offerings of similar assets or a specific inflationary adjustment to original purchase price to arrive at a

probable selling price.

•

The cost approach was utilized for machinery and equipment. This approach considers the amount required to construct or purchase

a new asset of equal utility at current prices, with adjustments in value for physical deterioration, and functional and economic

obsolescence. Physical deterioration is an adjustment made in the cost approach to reflect the real operating age of an asset with

regard to wear and tear, decay and deterioration that is not prevented by maintenance. Functional obsolescence is the loss in value

or usefulness of an asset caused by inefficiencies or inadequacies of the asset, as compared to a more efficient or less costly

replacement asset with newer technology. Economic obsolescence is the loss in value or usefulness of an asset due to factors

external to the asset, such as the economics of the industry, reduced demand, increased competition or similar factors.