Kodak 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

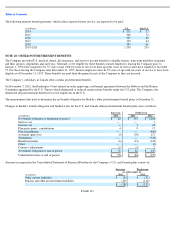

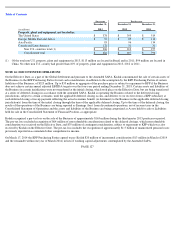

For awards that vest based solely on service conditions, Kodak recognizes compensation expense on a straight-line basis over the requisite

service period. For awards with vesting that is contingent upon the achievement of performance conditions, Kodak recognizes compensation

expense on a straight-line basis over the performance period for each separately vesting tranche of the award. Kodak reduces the compensation

expense by an estimated forfeiture rate which is based on actual experience. Kodak assesses the likelihood that performance-based shares will

be earned based on the probability of meeting the performance criteria. For those performance-based awards that are deemed probable of

achievement, expense is recorded, and for those awards that are deemed not probable of achievement, no expense is recorded. Kodak assesses

the probability of achievement each quarter.

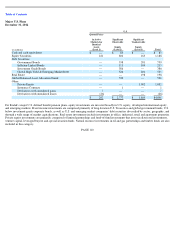

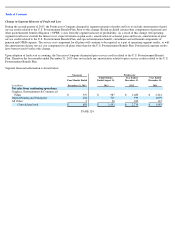

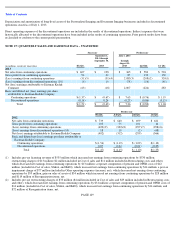

Kodak did not issue any stock options during the four months ended December 31, 2013. Kodak recognized compensation expense related to

unvested stock and performance awards of $1 million for the four months ended December 31, 2013.

As of December 31, 2013 there was $5 million of total unrecognized compensation cost related to unvested awards. The cost is expected to be

recognized over a weighted-average period of 1.4 years.

Predecessor

Prior to the Effective Date, Kodak had shares or share-based awards outstanding under two share-based employee compensation plans

consisting of the 2005 Omnibus Long-Term Compensation Plan (the “2005 Plan”), and the 2000 Omnibus Long-Term Compensation Plan (the

“2000 Plan”). In conjunction with the Plan (see Note 2, “Emergence from Voluntary Reorganization under Chapter 11 Proceedings”), all

shares, options, restricted shares and other share-based awards that were outstanding on the Effective Date were canceled.

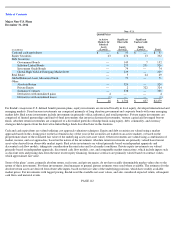

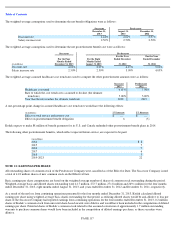

Kodak recognized stock-based compensation expense in the amount of $3 million, $7 million and $20 million for the eight months ended

August 31, 2013, and the years ended December 31, 2012 and 2011, respectively. There were no proceeds from the issuance of common stock

through stock option plans for the eight months ended August 31, 2013 (Predecessor) or the years ended December 31, 2012 (Predecessor) or

2011 (Predecessor).

Of the expense amounts noted above, compensation expense related to stock options during the eight months ended August 31, 2013, and the

years ended December 31, 2012 and 2011 was $1 million, $2 million and $3 million, respectively. Compensation expense related to unvested

stock and performance awards during the eight months ended August 31, 2013, and years ended December 31, 2012 and 2011 was $2 million,

$5 million and $17 million, respectively.

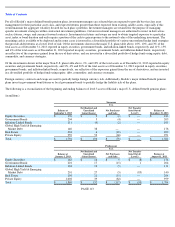

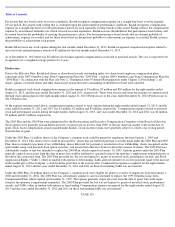

The 2005 Plan and the 2000 Plan were administered by the Restructuring and Executive Compensation Committee of the Board of Directors.

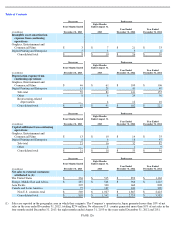

Stock options were generally non-qualified and were at exercise prices not less than 100% of the per share fair market value on the date of

grant. Stock-based compensation awards granted under Kodak’s stock incentive plans were generally subject to a three-year vesting period

from the date of grant.

Under the 2005 Plan, 11 million shares of the Company’s common stock could be granted to employees between January 1, 2005 and

December 31, 2014. This share reserve could be increased by: shares that are forfeited pursuant to awards made under the 2000 Plan and 2005

Plan; shares retained for payment of tax withholding; shares delivered for payment or satisfaction of tax withholding; shares reacquired on the

open market using cash proceeds from option exercises; and awards that otherwise do not result in the issuance of shares. The 2005 Plan was

substantially similar to and was intended to replace the 2000 Plan, which expired on January 18, 2005. Options granted under the 2005 Plan

generally expired seven years from the date of grant, but could be forfeited or canceled earlier if the optionee’s employment terminated prior to

the end of the contractual term. The 2005 Plan provided for, but was not limited to, grants of unvested stock, performance awards, and Stock

Appreciation Rights (“SARs”), either in tandem with options or freestanding. SARs allowed optionees to receive payment equal to the increase

in the market price of the Company’s stock from the grant date to the exercise date. Compensation expense recognized for the eight months

ended August 31, 2013 and the years ended December 31, 2012 and 2011 on those freestanding SARs was not material.

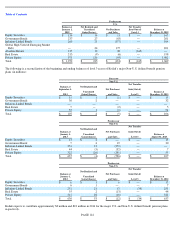

Under the 2000 Plan, 22 million shares of the Company’s common stock were eligible for grant to a variety of employees between January 1,

2000 and December 31, 2004. The 2000 Plan was substantially similar to, and was intended to replace, the 1995 Omnibus Long-Term

Compensation Plan, which expired on December 31, 1999. The options generally expire ten years from the date of grant, but could expire

sooner if the optionee’s employment terminated. The 2000 Plan provided for, but was not limited to, grants of unvested stock, performance

awards, and SARs, either in tandem with options or freestanding. Compensation expense recognized for the eight months ended August 31,

2013 and the years ended December 31, 2012 and 2011 on those freestanding SARs was not material.

PAGE 119