Kodak 2013 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

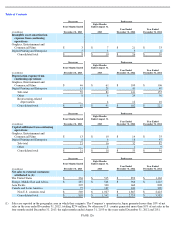

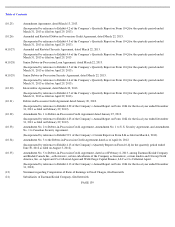

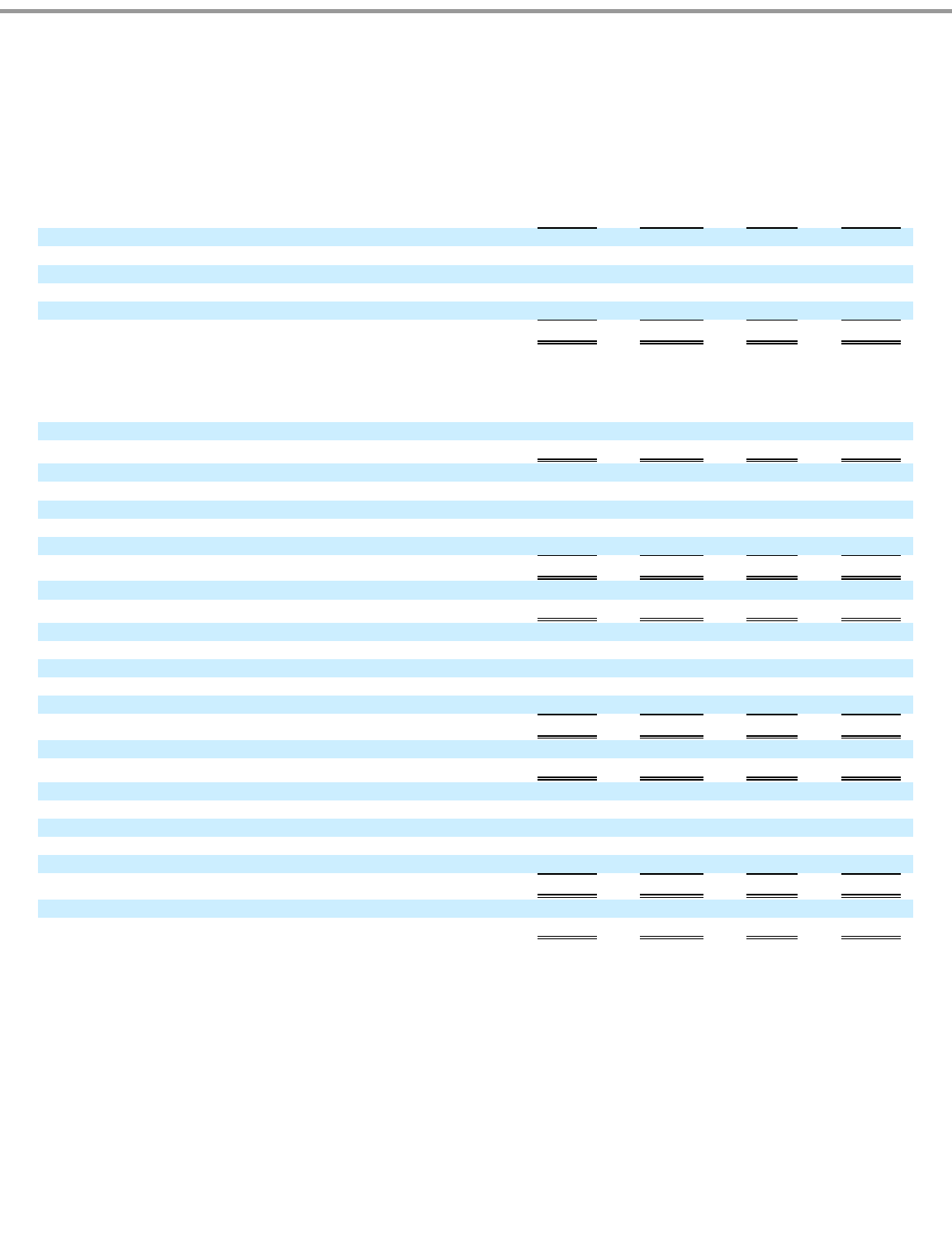

Schedule II

Eastman Kodak Company

Valuation and Qualifying Accounts

PAGE 135

Balance at

Charges to

Amounts

Balance at

Beginning

Earnings

Written

End of

(in millions)

Of Period

and Equity

Off

Period

Four Months ended December 31, 2013 (Successor)

Deducted in the Statement of Financial Position:

From Current Receivables:

Reserve for doubtful accounts

$

—

$

6

$

—

$

6

Reserve for loss on returns and allowances

3

2

2

3

Total

$

3

$

8

$

2

$

9

In connection with the application of fresh start accounting on September 1, 2013, the carrying value of trade receivables was

adjusted to fair value, eliminating the reserve for doubtful accounts.

From Deferred Tax Assets:

Valuation allowance

$

1,273

$

157

$

477

$

953

Eight Months ended August 31, 2013 (Predecessor)

Deducted in the Statement of Financial Position:

From Current Receivables:

Reserve for doubtful accounts

$

30

$

—

$

8

$

22

Reserve for loss on returns and allowances

5

3

5

3

Total

$

35

$

3

$

13

$

25

From Deferred Tax Assets:

Valuation allowance

$

2,838

$

180

$

1,745

$

1,273

Year ended December 31, 2012 (Predecessor)

Deducted in the Statement of Financial Position:

From Current Receivables:

Reserve for doubtful accounts

$

27

$

12

$

9

$

30

Reserve for loss on returns and allowances

11

10

16

5

Total

$

38

$

22

$

25

$

35

From Deferred Tax Assets:

Valuation allowance

$

2,560

$

807

$

529

$

2,838

Year ended December 31, 2011 (Predecessor)

Deducted in the Statement of Financial Position:

From Current Receivables:

Reserve for doubtful accounts

$

44

$

7

$

24

$

27

Reserve for loss on returns and allowances

12

21

22

11

Total

$

56

$

28

$

46

$

38

From Deferred Tax Assets:

Valuation allowance

$

2,335

$

505

$

280

$

2,560