Kodak 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

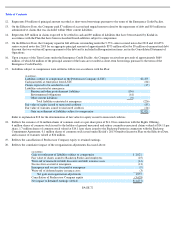

SECTION 363 ASSET SALES

On February 1, 2013, Kodak entered into a series of agreements related to the monetization of certain of its intellectual property assets,

including the sale of its digital imaging patents. Under these agreements, Kodak received approximately $530 million, a portion of which was

paid by twelve licensees that received a license to the digital imaging patent portfolio and other patents owned by Kodak. Another portion was

paid by Intellectual Ventures Fund 83 LLC (“Intellectual Ventures”) and Apple, Inc., each of which acquired a portion of the digital imaging

patent portfolio, subject to the licenses granted to the twelve new licensees, and previously existing licenses. In addition, Kodak retained a

license to the digital imaging patents for its own use. In connection with this transaction, the Company entered into a separate agreement with

FUJIFILM Corporation (“Fuji”) whereby, among other things, Fuji granted Kodak the right to sub-license certain Fuji patents to businesses

Kodak ultimately sold as part of the Plan. The Debtors also agreed to allow Fuji a general unsecured claim against the Debtors in the amount of

$70 million that was discharged pursuant to the terms of the Plan.

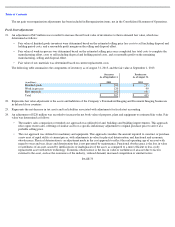

EASTMAN BUSINESS PARK SETTLEMENT AGREEMENT

On June 17, 2013 the Company, the New York State Department of Environmental Conservation and the New York State Urban Development

Corporation, d/b/a Empire State Development entered into a settlement agreement, subsequently amended on August 6, 2013 (the “Amended

EBP Settlement Agreement”), which resolves certain of the Company’s historical environmental liabilities at Eastman Business Park (“EBP”)

through the establishment of a $49 million environmental remediation trust (the “EBP Trust”). Upon implementation of the Amended EBP

Settlement Agreement , (i) the EBP Trust will be responsible for investigation and remediation at EBP arising from the Company’s historical

environmental liabilities in existence prior to the effective date of the EBP Settlement, (ii) the Company will fund the EBP Trust with a $49

million payment and transfer of certain equipment and fixtures used for remediation at EBP, and (iii) in the event the historical liabilities

exceed $99 million, the Company will become liable for 50% of the portion above $99 million.

Approximately $31 million was already held in a separate trust to support the environmental liabilities related to EBP and is recorded within

Restricted cash in Kodak’s Consolidated Statement of Financial Position. An escrow account of $18 million was established on the Effective

Date for the balance of the EBP Trust obligation and is reported within Other current assets in Kodak’s Consolidated Statement of Financial

Position. The Amended EBP Settlement Agreement is not yet effective and is subject to the satisfaction or waiver of certain conditions

including Bankruptcy Court approval of a covenant not to sue from the U.S. Environmental Protection Agency with respect to liabilities that

are addressed in the Amended EBP Settlement Agreement. The deadline for implementation of the Amended EBP Settlement Agreement is

May 15, 2014.

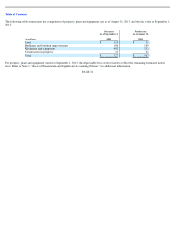

OTHER POSTEMPLOYMENT BENEFITS

On November 7, 2012, the Bankruptcy Court entered an order approving a settlement agreement between the Debtors and the Official

Committee of Retired Employees appointed by the U.S. Trustee under the chapter 11 proceedings (the “Retiree Committee”). Under the

settlement agreement, the Debtors no longer provide retiree medical, dental, life insurance and survivor income benefits to current and future

retirees after December 31, 2012 (other than COBRA continuation coverage of medical and/or dental benefits or conversion coverage as

required by applicable benefit plans or applicable law), and the Retiree Committee established a trust from which some limited benefits for

some retirees may be provided after December 31, 2012. The trust or related account was funded by the following contributions from the

Debtors: $7.5 million in cash paid by the Company in the fourth quarter of 2012, an administrative claim against the Debtors in the amount of

$15 million that was paid on the Effective Date, and a general unsecured claim against the Debtors in the amount of $635 million that was

discharged upon emergence from chapter 11 pursuant to the terms of the Plan.

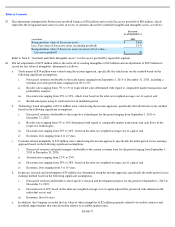

RETIREES

’ SETTLEMENT

The Debtors’ estimated allowed claims for pre-petition obligations for the Kodak Excess Retirement Income Plan (the “KERIP”), the Kodak

Unfunded Retirement Income Plan (the “KURIP”),

the Kodak Company Global Pension Plan for International Employees, and individual letter

agreements with certain current and former employees that provided for supplemental non-qualified pension benefits were reported as

Liabilities subject to compromise in the accompanying Consolidated Statement of Financial Position.

On April 30, 2013, Eastman Kodak Retirees Association Ltd. and certain holders of KERIP and KURIP claims (together with the Debtors, the

“Settlement Parties”) filed a motion (the “Motion”)

requesting that the Bankruptcy Court appoint a committee pursuant to section 1102(a)(2) of

the Bankruptcy Code, to represent the interests of the holders of the KERIP and KURIP claims, and asserted that they and

•

The KPP Note was cancelled after being assigned by the Company to the Subsidiary and subsequently assigned by the Subsidiary to

KPP as settlement, by way of setoff, of an equal amount of outstanding pension liabilities of the Subsidiary to KPP.

•

The cash consideration was comprised of $325 million sourced from assets of the U.K. Pension Plan and $200 million sourced from

a payment by the Subsidiary to KPP as payment for outstanding pension liabilities of the Subsidiary to KPP.

• Up to $35 million in aggregate of the purchase price is subject to repayment to KPP if the Business does not achieve certain annual

adjusted EBITDA targets over the four

-

year period ending December 31, 2018.