Kodak 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

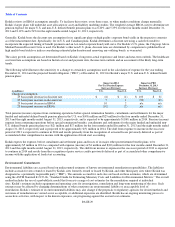

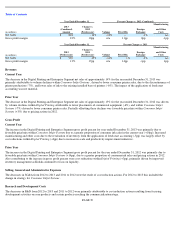

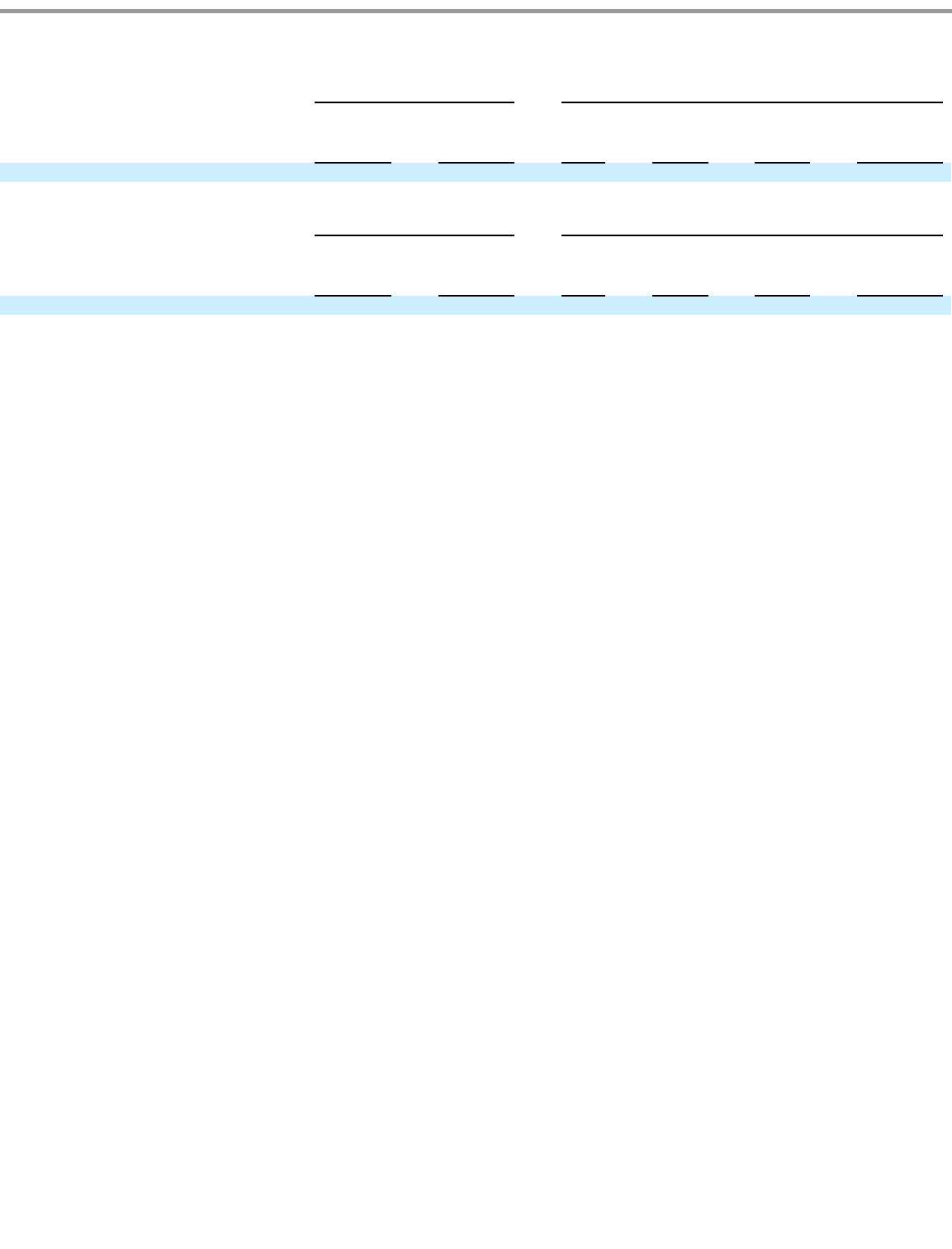

Revenues

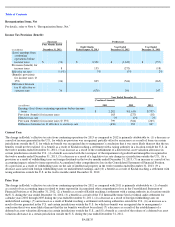

Current Year

The decrease in the Digital Printing and Enterprise Segment net sales of approximately 14% for the year ended December 31, 2013 was

primarily attributable to volume declines within Consumer Inkjet Systems

, driven by lower consumer printer sales, due to the discontinuance of

printer production (-7%), and lower sales of ink to the existing installed base of printers (-6%). The impact of the application of fresh start

accounting was not material.

Prior Year

The decrease in the Digital Printing and Enterprise Segment net sales of approximately 15% for the year ended December 31, 2012 was driven

by volume declines within Digital Printing attributable to lower placements of commercial equipment (-6%), and within Consumer Inkjet

Systems (-7%) driven by lower consumer printer sales. Partially offsetting these declines was favorable price/mix within Consumer Inkjet

Systems (+3%) due to pricing actions in 2012.

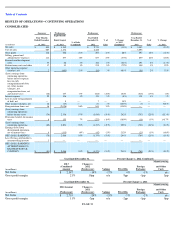

Gross Profit

Current Year

The increase in the Digital Printing and Enterprise Segment gross profit percent for year ended December 31, 2013 was primarily due to

favorable price/mix within Consumer Inkjet Systems due to a greater proportion of consumer ink sales in the current year (+10pp). Increased

manufacturing and other costs due to the revaluation of inventory from the application of fresh start accounting (-5pp) was largely offset by

cost reductions within Digital Printing (+3pp) due to increase in scale and productivity improvement initiatives.

Prior Year

The increase in the Digital Printing and Enterprise Segment gross profit percent for the year ended December 31, 2012 was primarily due to

favorable price/mix within Consumer Inkjet Systems (+14pp), due to a greater proportion of consumer ink sales and pricing actions in 2012.

Also contributing to the increase in gross profit percent were cost reductions within Digital Printing (+3pp), primarily driven by improved

inventory management as Kodak continued to focus on liquidity.

Selling, General and Administrative Expenses

The decreases in SG&A from 2012 to 2013 and 2011 to 2012 were the result of cost reduction actions. For 2012 to 2013 this included the

change in strategy for Consumer Inkjet Systems .

Research and Development Costs

The decreases in R&D from 2012 to 2013 and 2011 to 2012 were primarily attributable to cost reduction actions resulting from focusing

development activities on core products and certain products reaching the commercialization stage.

PAGE 39

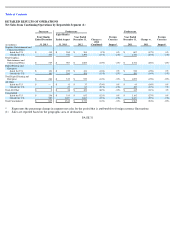

Year Ended December 31,

Percent Change vs. 2012 (Combined)

(in millions)

2013

(Combined)

Amount

Change vs.

2012

(Predecessor)

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other

Costs

Net Sales

$

803

-

14

%

-

13

%

—

-

1

%

n/a

Gross profit margin

23

%

10pp

n/a

11pp

0pp

-

1pp

Year Ended December 31,

Percent Change vs. 2011

(in millions)

2012

(Predecessor)

Change vs.

2011

(Predecessor)

Volume

Price/Mix

Foreign

Exchange

Manufacturing

and Other

Costs

Net Sales

$

939

-

15

%

-

14

%

1

%

-

2

%

n/a

Gross profit margin

13

%

17pp

n/a

14pp

-

1pp

4pp