Kodak 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

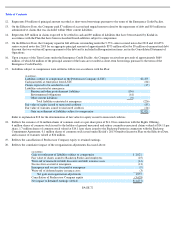

certain other holders of the KERIP and KURIP claims disagreed with the underlying discount rates and mortality tables used by the Debtors to

calculate the KERIP and KURIP estimated allowed claim amounts. Subsequent to the filing of the Motion, the Settlement Parties entered into a

stipulation (the “Stipulation”) approved by an order of the Bankruptcy Court, which became effective on July 18, 2013, for a total allowed

claim of approximately $244 million. During August 2013 a provision for expected allowed claims of approximately $27 million was reflected

in Reorganization Items, net in the accompanying Consolidated Statement of Operations to increase the recorded liability to what was

ultimately agreed to in the Stipulation.

On the Effective Date, the claim was discharged upon emergence pursuant to the terms of the Plan.

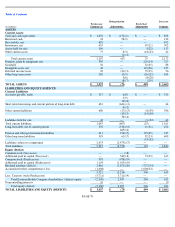

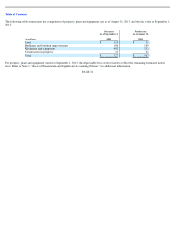

NOTE 3: FRESH START ACCOUNTING

In connection with the Company’s emergence from chapter 11, Kodak applied the provisions of fresh start accounting to its financial

statements as (i) the holders of existing voting shares of the Predecessor Company received less than 50% of the voting shares of the emerging

entity and (ii) the reorganization value of Kodak’s assets immediately prior to confirmation was less than the post-petition liabilities and

allowed claims. Kodak applied fresh start accounting as of September 1, 2013.

Upon the application of fresh start accounting, Kodak allocated the reorganization value to its individual assets based on their estimated fair

values. Reorganization value represents the fair value of the Successor Company’s assets before considering liabilities. The excess

reorganization value over the fair value of identified tangible and intangible assets is reported as goodwill.

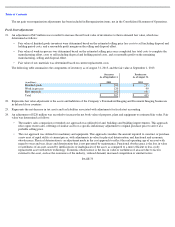

Reorganization Value

In support of the Plan, the enterprise value of the Successor Company was estimated to be in the range of $875 million to $1.4 billion. As part

of determining the reorganization value, Kodak estimated the enterprise value of the Successor Company to be $1 billion utilizing the guideline

public company method and discounted cash flow method.

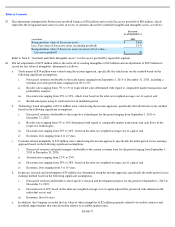

To estimate fair value utilizing the guideline public company method, Kodak applied valuation multiples, derived from the operating data of

publicly-traded benchmark companies, to the same operating data of Kodak. The comparable public company analysis identified a group of

comparable companies giving consideration to lines of business and markets served, size and geography. The valuation multiples were derived

based on projected financial measures of revenue and earnings before interest, taxes, depreciation and amortization (“EBITDA”)

and applied to

projected operating data of Kodak. The range of multiples for the comparable companies was between .2x-.9x of revenue and 2.5x-8.0x of

EBITDA.

To estimate fair value utilizing the discounted cash flow method, Kodak established an estimate of future cash flows for the period ranging

from September 1, 2013 to December 31, 2022 and discounted the estimated future cash flows to present value. The expected cash flows for

the period September 1, 2013 to December 31, 2017 were based on the financial projections and assumptions utilized in the disclosure

statement. The expected cash flows for the period January 1, 2018 to December 31, 2022 were derived from earnings forecasts and assumptions

regarding growth and margin projections, as applicable. A terminal value was included, calculated using the constant growth method, based on

the cash flows of the final year of the forecast period.

The discount rate of 29% was estimated based on an after-tax weighted average cost of capital (“WACC”) reflecting the rate of return that

would be expected by a market participant. The WACC also takes into consideration a company specific risk premium reflecting the risk

associated with the overall uncertainty of the financial projections used to estimate future cash flows.

As the valuation approaches produced comparable ranges of enterprise value, Kodak selected equal weighting of the guideline public company

method and discounted cash flow method to estimate the enterprise value.

PAGE 68