Kodak 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

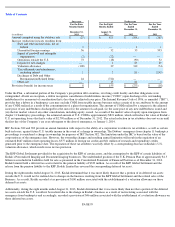

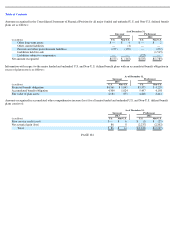

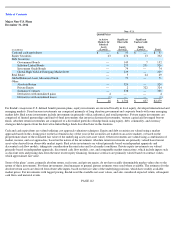

Information regarding the major funded and unfunded U.S. and Non-U.S. defined benefit plans follows:

The transfers of $206 million in the eight months ended August 31, 2013 represent pre-petition obligations related to the U.S. non-qualified

pension plans which were discharged pursuant to the terms of the Plan. The settlement amounts above of $532 million for the U.S. in the

Successor period are a result of lump sum payments from KRIP. The settlement amounts for the Non-U.S. in the eight months ended

August 31, 2013 are primarily a result of the Global Settlement.

PAGE 103

Successor

Predecessor

Four Months Ended

December 31, 2013

Eight Months Ended

August 31, 2013

Year

-

Ended

December 31, 2012

(in millions)

U.S.

Non

-

U.S.

U.S.

Non

-

U.S.

U.S.

Non

-

U.S.

Change in Benefit Obligation

Projected benefit obligation at beginning of period

$

4,970

$

1,073

$

5,575

$

4,264

$

5,259

$

3,652

Transfers

—

—

(

206

)

—

—

—

Service cost

7

2

20

6

48

10

Interest cost

68

11

120

95

206

156

Participant contributions

—

—

—

1

—

2

Plan amendments

—

(

6

)

—

—

—

—

Benefit payments

(124

)

(29

)

(249

)

(139

)

(422

)

(226

)

Actuarial (gain) loss

(28

)

6

(270

)

(103

)

385

560

Curtailments

—

—

(

20

)

(7

)

—

(

34

)

Settlements

(532

)

(3

)

—

(

2,892

)

—

(

8

)

Special termination benefits

—

—

—

—

99

—

Currency adjustments

—

20

—

(

152

)

—

152

Projected benefit obligation at end of period

$

4,361

$

1,074

$

4,970

$

1,073

$

5,575

$

4,264

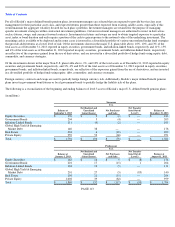

Change in Plan Assets

Fair value of plan assets at beginning of period

$

4,647

$

891

$

4,848

$

2,479

$

4,763

$

2,436

Actual gain on plan assets

192

29

47

79

500

157

Employer contributions

1

5

1

22

7

29

Participant contributions

—

—

—

1

—

2

Settlements

(532

)

(2

)

—

(

1,465

)

—

(

8

)

Benefit payments

(124

)

(29

)

(249

)

(139

)

(422

)

(226

)

Currency adjustments

—

13

—

(

86

)

—

89

Fair value of plan assets at end of period

$

4,184

$

907

$

4,647

$

891

$

4,848

$

2,479

Under Funded Status at end of period

$

(177

)

$

(167

)

$

(323

)

$

(182

)

$

(727

)

$

(1,785

)

Accumulated benefit obligation at end of period

$

4,309

$

1,054

$

5,497

$

4,233