Kodak 2013 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

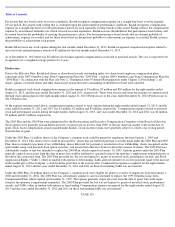

Table of Contents

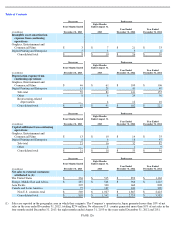

Depreciation and amortization of long-lived assets of the Personalized Imaging and Document Imaging businesses included in discontinued

operations ceased as of July 1, 2013.

Direct operating expenses of the discontinued operations are included in the results of discontinued operations. Indirect expenses that were

historically allocated to the discontinued operations have been included in the results of continuing operations. Prior period results have been

reclassified to conform to the current period presentation.

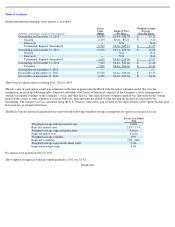

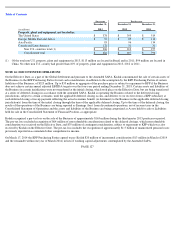

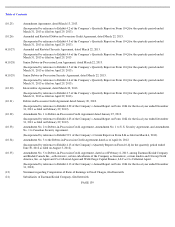

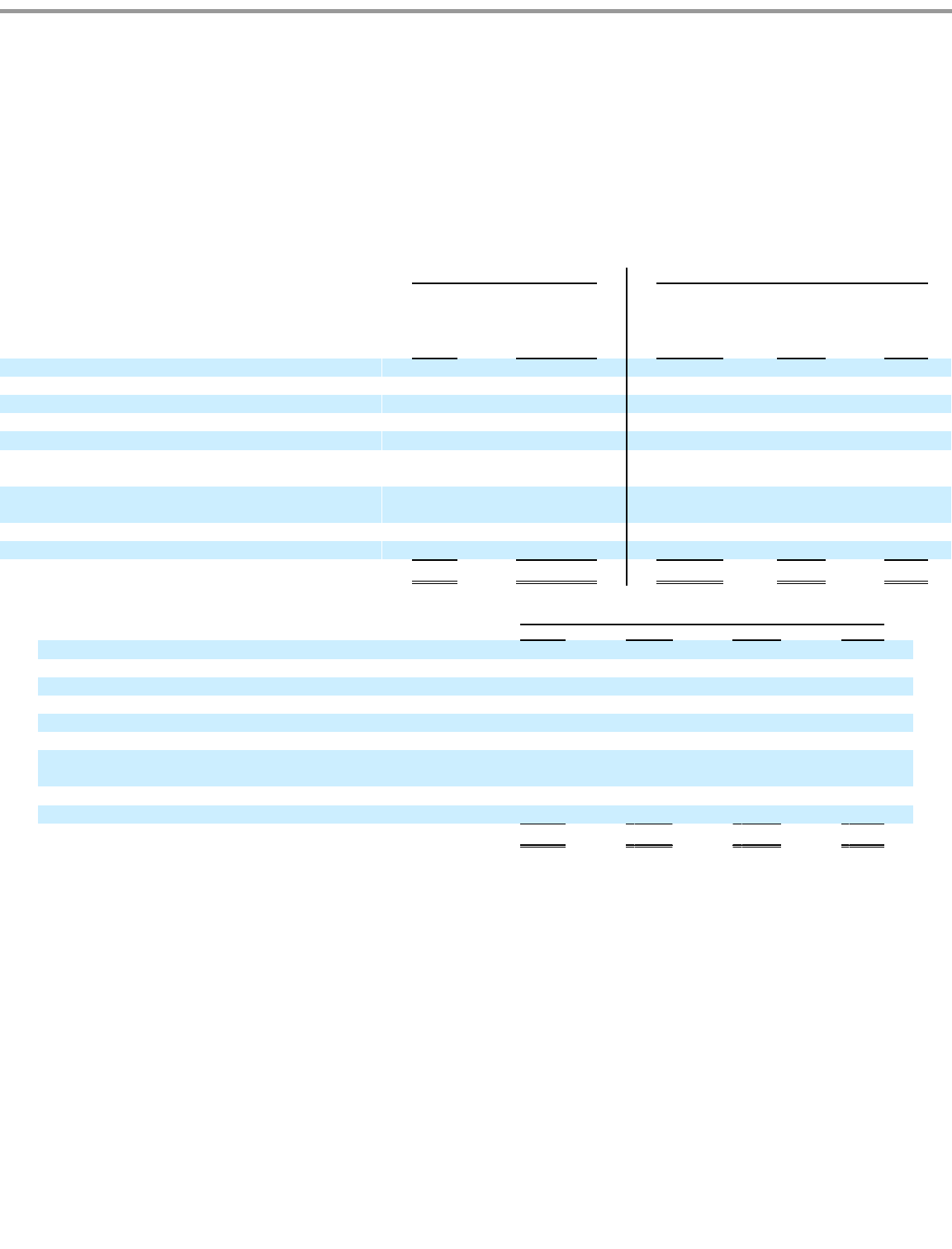

NOTE 27: QUARTERLY SALES AND EARNINGS DATA – UNAUDITED

PAGE 129

Successor

Predecessor

(in millions, except per share data)

4th Qtr.

September 1,

2013 through

September 30,

2013

July 1, 2013

through

August 31,

2013

2nd Qtr.

1st Qtr.

2013

Net sales from continuing operations

$

607

$

198

$

365

$

583

$

594

Gross profit from continuing operations

96

22

85

133

150

(Loss) earnings from continuing operations

(51

)(5)

(31

)(4)

2,085

(3)

(208

)(2)

324

(1)

(Loss) earnings from discontinued operations (10)

(6

)

10

(78

)

(16

)

(41

)

Net (loss) earnings attributable to Eastman Kodak

Company

(63

)

(18

)

2,007

(224

)

283

Basic and diluted net (loss) earnings per share

attributable to Eastman Kodak Company

Continuing operations

$

(1.37

)

$

(0.67

)

$

7.65

$

(0.76

)

$

1.19

Discontinued

operations

(0.14

)

0.24

(0.29

)

(0.06

)

(0.15

)

Total

$

(1.51

)

$

(0.43

)

$

7.36

$

(0.82

)

$

1.04

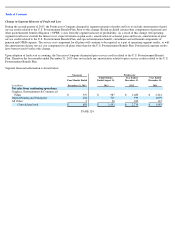

Predecessor

4th Qtr.

3rd Qtr.

2nd Qtr.

1st Qtr.

2012

Net sales from continuing operations

$

739

$

660

$

699

$

621

Gross profit from continuing operations

103

75

101

14

(Loss) earnings from continuing operations

(420

)(9)

(322

)(8)

(297

)(7)

(298

)(6)

(Loss) earnings from discontinued operations (10)

18

10

(2

)

(68

)

Net (loss) earnings attributable to Eastman Kodak Company

(402

)

(312

)

(299

)

(366

)

Basic and diluted net (loss) earnings per share attributable to

Eastman Kodak Company

Continuing operations

$

(1.54

)

$

(1.19

)

$

(1.09

)

$

(1.10

)

Discontinued operations

0.07

0.04

(0.01

)

(0.25

)

Total

$

(1.47

)

$

(1.15

)

$

(1.10

)

$

(1.35

)

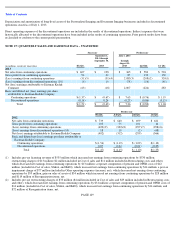

(1) Includes pre-tax licensing revenue of $535 million which increased net earnings from continuing operations by $530 million;

restructuring charges of $13 million ($2 million included in Cost of sales and $11 million included in Restructuring costs and other),

which decreased net earnings from continuing operations by $13 million; corporate components of pension and OPEB costs of $12

million (included in Cost of sales, SG&A, and R&D), which increased net earnings from continuing operations by $14 million; a pre-tax

impairment charge of $77 million (included in Other operating expenses (income), net), which decreased net earnings from continuing

operations by $55 million, gain on sales of assets of $34 million which increased net earnings from continuing operations by $28 million

and $119 million of Reorganization items, net.

(2) Includes pre-

tax restructuring charges of $33 million ($4 million included in Cost of sales and $29 million included in Restructuring costs

and other), which decreased net earnings from continuing operations by $31 million; corporate components of pension and OPEB costs of

$14 million (included in Cost of sales, SG&A, and R&D), which increased net earnings from continuing operations by $14 million; and

$72 million of Reorganization items, net.