Kodak 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

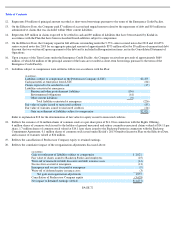

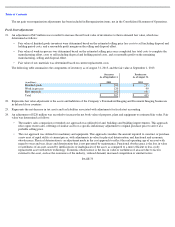

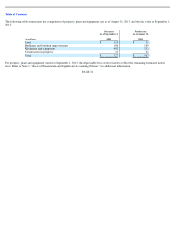

NOTE 2: EMERGENCE FROM VOLUNTARY REORGANIZATION UNDER CHAPTER 11 PROCEEDINGS

PLAN OF REORGANIZATION

On August 23, 2013, the Bankruptcy Court entered an order (the “Confirmation Order”) confirming the revised First Amended Joint Chapter

11 Plan of Reorganization of Eastman Kodak Company and its Debtor Affiliates (the “Plan”). On September 3, 2013 (the “Effective Date”),

the

Plan became effective and the Debtors emerged from the Chapter 11 Cases.

On or following the Effective Date and pursuant to the terms of the Plan, the following occurred:

Backstop Commitment Agreement and Rights Offering

On June 26, 2013, the Bankruptcy Court approved the Company’s entry into a backstop commitment agreement (the “Backstop Commitment

Agreement”) with GSO Capital Partners LP, on behalf of various managed funds, BlueMountain Capital Management, LLC, on behalf of

various managed funds, George Karfunkel, United Equities Commodities Company, Momar Corporation and Contrarian Capital Management,

LLC, on behalf of Contrarian Funds, LLC (collectively, the “Backstop Parties”), associated with rights offerings to offer eligible creditors,

including the Backstop Parties, up to 34 million shares of common stock for the per share purchase price of $11.94, or an aggregate purchase

price of approximately $406 million.

A portion of the shares issued in the rights offerings are restricted securities for purposes of Rule 144 under the Securities Act of 1933 and may

not be offered, sold or otherwise transferred absent registration under the Securities Act of 1933 or an applicable exemption from registration

requirements. The shares issued to participants in the rights offerings were issued in reliance upon the exemption from registration under the

Securities Act of 1933 provided by Regulation D thereunder and/or Section 4(a)(2) thereof; or under Section 1145 of the Bankruptcy Code as

securities of a debtor issued principally in exchange for claims against a debtor and partly in exchange for cash pursuant to a plan of

reorganization.

PAGE 65

• The Debtors’ obligations under the second lien notes indentures, unsecured notes indentures, stock certificates, equity interests,

and / or any other instrument or document directly or indirectly evidencing or creating any indebtedness or obligation of, or

ownership interest in, the Debtors or giving rise to any claim or equity interest were cancelled, except as provided under the Plan;

• The Company’s certificate of incorporation was amended and restated to authorize the issuance of 560 million shares of stock,

consisting of 60 million shares of preferred stock, no par value, and 500 million shares of common stock, par value $0.01 per share;

• The Company entered into a senior secured first lien term loan agreement and senior secured second lien term loan agreement for

an aggregate principal amount of $695 million and a $200 million senior secured asset

-

based revolving credit facility;

•

The Company issued 34 million shares of common stock to unsecured creditors and the Backstop Parties (as defined below) at a per

share price of $11.94, for an aggregate purchase price of approximately $406 million. In addition, the Company issued 1.7 million

shares of common stock to the Backstop Parties in payment of fees pursuant to the Backstop Commitment Agreement (as defined

below);

• The Company issued 6 million shares of common stock and net-share settled warrants to purchase: (i) approximately 2.1 million

shares of new common stock at an exercise price of $14.93 and (ii) approximately 2.1 million shares of new common stock at an

exercise price of $16.12, to the holders of general unsecured and retiree committee unsecured claims;

• The Debtors established a liquidating trust (the “Kodak GUC Trust”) for the benefit of holders of general unsecured and retiree

committee unsecured claims, into which certain avoidance actions of the Debtors were transferred;

•

The Debtors paid approximately $94 million in administrative, priority or secured claims; and

• The Debtors resolved claims held by the Kodak Pension Plan of the United Kingdom (the “U.K. Pension Plan”) pursuant to the

terms of the Global Settlement (as defined below).