Kodak 2013 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

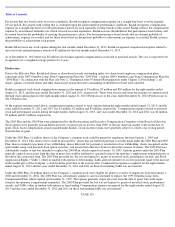

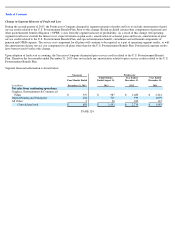

NOTE 26: DISCONTINUED OPERATIONS

On the Effective Date, as a part of the Global Settlement and pursuant to the Amended SAPA, Kodak consummated the sale of certain assets of

the Business to the KPP Purchasing Parties for net cash consideration, in addition to the assumption by the KPP Purchasing Parties of certain

liabilities of the Business, of $325 million. Up to $35 million in aggregate of the purchase price is subject to repayment to KPP if the Business

does not achieve certain annual adjusted EBITDA targets over the four-year period ending December 31, 2018. Certain assets and liabilities of

the Business in certain jurisdictions were not transferred at the initial closing, which took place on the Effective Date, but are being transferred

at a series of deferred closings in accordance with the Amended SAPA. Kodak is operating the Business related to the deferred closing

jurisdictions, subject to certain covenants, until the applicable deferred closing occurs, and delivers to (or receives from) a KPP subsidiary at

each deferred closing a true-up payment reflecting the actual economic benefit (or detriment) to the Business in the applicable deferred closing

jurisdiction(s) from the time of the initial closing through the time of the applicable deferred closing. Up to the time of the deferred closing, the

results of the operations of the Business are being reported as Earnings (loss) from discontinued operations, net of income taxes in the

Consolidated Statement of Operations and the assets and liabilities of the Business are being categorized as Assets held for sale or Liabilities

held for sale in the Consolidated Statement of Financial Position, as appropriate.

Kodak recognized a pre-tax loss on the sale of the Business of approximately $163 million during the third quarter 2013 predecessor period.

The pre-tax loss excluded recognition of $64 million of non-refundable consideration related to the delayed closings, which non-refundable

consideration was received on the Effective Date, and $35 million of contingent consideration, subject to repayment to KPP which was also

received by Kodak on the Effective Date. The pre-

tax loss includes the recognition of approximately $1.5 billion of unamortized pension losses

previously reported in accumulated other comprehensive income.

On March 17, 2014 the KPP Purchasing Parties agreed to pay Kodak $20 million of incremental consideration ($13 million in March of 2014

and the remainder within one year of March 2014) in lieu of working capital adjustments contemplated by the Amended SAPA.

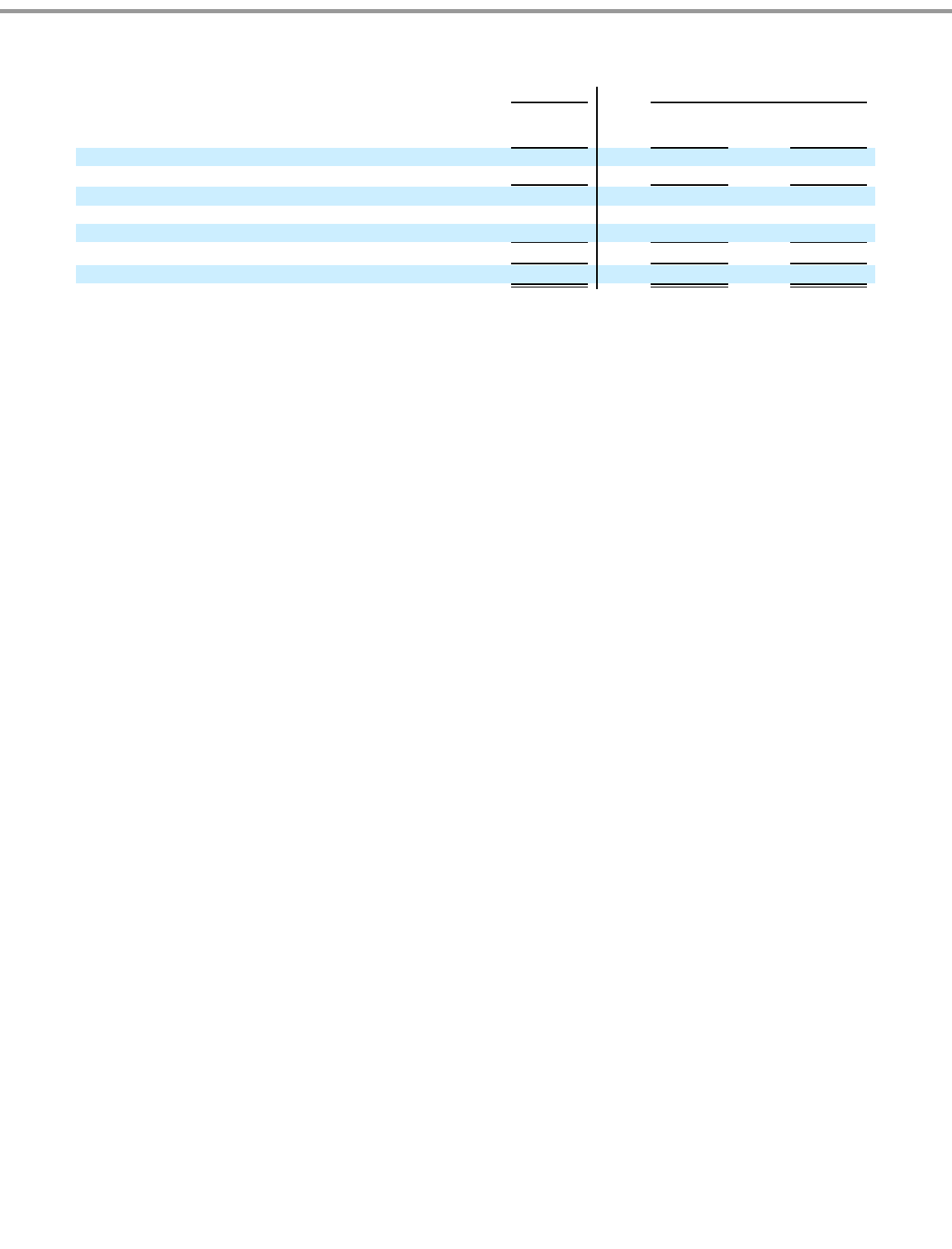

PAGE 127

Successor

Predecessor

December 31,

2013

December 31,

2012

December 31,

2011

(in millions)

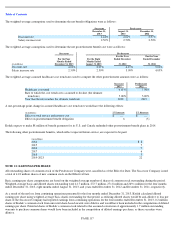

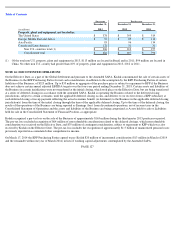

Property, plant and equipment, net located in:

The United States

$

378

$

395

$

519

Europe, Middle East and Africa

$

91

$

85

$

112

Asia Pacific

83

96

134

Canada and Latin America

132

31

31

Non U.S. countries total (1)

$

306

$

212

$

277

Consolidated total

$

684

$

607

$

796

(1) Of the total non U.S. property, plant and equipment in 2013, $113 million are located in Brazil and in 2011; $94 million are located in

China. No other non U.S. country had greater than 10% of property, plant and equipment in 2013, 2012 or 2011.