Kodak 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

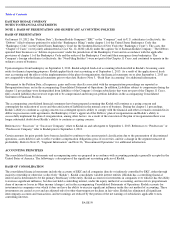

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are recorded at cost, net of accumulated depreciation with the exception of property, plant and equipment owned

as of the application of fresh start accounting. Kodak capitalizes additions and improvements while maintenance and repairs are charged to

expense as incurred. Upon sale or other disposition, the applicable amounts of asset cost and accumulated depreciation are removed from the

accounts and the net amount, less proceeds from disposal, is charged or credited to net (loss) earnings. In connection with fresh start

accounting, property, plant and equipment were adjusted to their estimated fair value and depreciable lives were revised as of September 1,

2013. Refer to Note 3, “Fresh Start Accounting.”

Kodak calculates depreciation expense using the straight-line method over the assets’ estimated useful lives, which are as follows:

Kodak depreciates leasehold improvements over the shorter of the lease term or the asset’s estimated useful life.

GOODWILL

Goodwill reported in the Successor period represents the reorganizational value of assets in excess of amounts allocated to identified tangible

and intangible assets. Goodwill reported in the Predecessor period represents the excess of purchase price of an acquisition over the fair value

of net assets acquired. Goodwill is not amortized, but is required to be assessed for impairment at least annually. Kodak has historically

performed its annual goodwill impairment assessment as of September 30. Upon application of fresh start accounting, Kodak elected October 1

as the annual goodwill impairment assessment date and will perform additional impairment tests when events or changes in circumstances

occur that would more likely than not reduce the fair value of the reporting unit below its carrying amount.

Kodak tests goodwill for impairment at a level of reporting referred to as a reporting unit. A reporting unit is defined as an operating segment

or one level below an operating segment (referred to as a component). A component of an operating segment is a reporting unit if the

component constitutes a business for which discrete financial information is available and segment management regularly reviews the

operating results of that component. When two or more components of an operating segment have similar economic characteristics, the

components are aggregated and deemed a single reporting unit. An operating segment is deemed to be a reporting unit if all of its components

are similar, if none of its components is a reporting unit, or if the segment comprises only a single component.

Kodak estimates the fair value of its reporting units using the guideline public company method and discounted cash flow method. When

testing goodwill for impairment, Kodak may assess qualitative factors for some or all of its reporting units to determine whether it is more

likely than not (that is, a likelihood of more than 50 percent) that the fair value of a reporting unit is less than its carrying amount, including

goodwill. If Kodak determines based on this qualitative test of impairment that it is more likely than not that a reporting unit’s fair value is less

than its carrying amount, or elects to bypass the qualitative assessment for some or all of its reporting units, then a two-step goodwill

impairment test is performed to test for a potential impairment of goodwill (step 1) and if potential losses are identified, to measure the

impairment loss (step 2). Determining the fair value of a reporting unit involves the use of significant estimates and assumptions. Refer to Note

3, “Fresh Start Accounting” and Note 8, “Goodwill and Other Intangible Assets.”

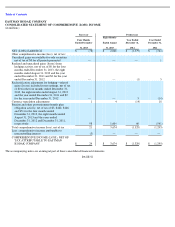

REVENUE

Kodak’s revenue transactions include sales of products (such as components and consumables for use in Kodak and other manufacturers’

equipment and film based products); equipment; software; services; integrated solutions; and intellectual property licensing. Kodak recognizes

revenue when realized or realizable and earned, which is when the following criteria are met: (1)

PAGE 61

Successor

As of

Company

September 1, 2013

Buildings and building improvements

5

-

40

1

-

38

Land improvements

20

1

-

20

Leasehold improvements

3

-

20

1

-

10

Equipment

3

-

15

1

-

20

Tooling

1

-

3

1

-

3

Furniture and fixtures

5

-

10

1

-

10