Kodak 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

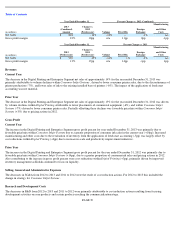

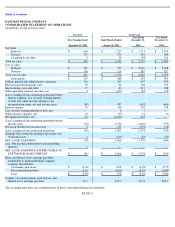

Sources of Liquidity

Available liquidity includes cash balances and the unused portion of the ABL Credit Agreement. The ABL Credit Agreement had $49 million

of net availability as of December 31, 2013. The amount of available liquidity is subject to fluctuations and includes cash balances held by

various entities worldwide. At December 31, 2013 and December 31, 2012, approximately $307 million and $324 million, respectively, of cash

and cash equivalents were held within the U.S. and approximately $537 million and $811 million, respectively, of cash and cash equivalents

were held outside the U.S. Cash balances held outside of the U.S. are generally required to support local country operations, may have high tax

costs, or other limitations that delay the ability to repatriate, and therefore may not be readily available for transfer to other jurisdictions.

Additionally, in China, where approximately $254 million of cash and cash equivalents were held as of December 31, 2013, there are

limitations related to net asset balances that impact the ability to make cash available to other jurisdictions in the world. Under the terms of the

Company’s Credit Agreements, the Company is permitted to invest up to $100 million at any time in subsidiaries that are not party to the loan

agreement.

As defined in each of the Company’s Term Credit Agreements, the Company is required to prepay loans with net proceeds from asset sales,

recovery events or issuance of indebtedness, subject to, in the case of net proceeds received from asset sales or recovery events, reinvestment

rights by the Company in assets used or usable by the business within certain time limits. On an annual basis, starting with the fiscal year

ending on December 31, 2014, the Company will prepay on June 30 of the following fiscal year loans in an amount equal to a percentage of

Excess Cash Flow (“ECF”) as defined in each of the Term Credit Agreements, provided no such prepayment is required if such prepayment

would cause U.S. liquidity (as defined in each of the Term Credit Agreements) to be less than $100 million. Any mandatory prepayments as

described above shall be reduced by any mandatory prepayments of the first lien loan.

The Company’s Credit Agreements limit, among other things, the Company’s and its subsidiary guarantors’ ability to (i) incur indebtedness,

(ii) incur or create liens, (iii) dispose of assets, (iv) make restricted payments and (v) make investments. Under the Company’s Term Credit

Agreements, the Company is required to maintain minimum U.S. Liquidity (as defined therein) through 2014 and starting December 31, 2014,

tested on a quarterly basis, Net Secured Leverage (as defined therein) not to exceed specified levels. Under the ABL Credit Agreement, if

Excess Availability (as defined therein) is less than 15% of commitments available, the Company would be required to maintain a minimum

Fixed Charge Coverage Ratio (as defined therein). Kodak was in compliance with all covenants under the Company’

s Term Credit Agreements

and the ABL Credit Agreement as of December 31, 2013.

During 2013 and 2012, Kodak made contributions (funded plans) or paid benefits (unfunded plans) of $34 million and $153 million,

respectively, relating to its major defined benefit pension and other postretirement benefit plans. The decline in contributions in 2013 from

2012 is primarily due to the discontinuation of U.S. retiree medical, dental, life insurance, and survivor income benefits (other than COBRA

continuation coverage or conversion rights as required by the applicable benefit plans or applicable law) in 2013. Kodak estimates

contributions and benefit payments relating to its major defined benefit pension and other postretirement benefit plans in 2014 of $26 million.

Cash flows from investing activities included $21 million and $18 million for capital expenditures for the four months ended December 31,

2013 and the eight months ended August 31, 2013, respectively. Kodak expects approximately $50 million of cash flows for investing activities

from capital expenditures for the year ended December 31, 2014. Additionally, Kodak intends to utilize a variety of methods to finance

customer equipment purchases in the future, including expansion of third party finance programs and internal financing through both leasing

and installment loans.

Kodak believes that its liquidity position is adequate to fund its operating and investing needs and to provide the flexibility to respond to further

changes in the business environment. See “Item 1A. Risk Factors” for a discussion of potential challenges to liquidity.

Refer to Note 11, “Short-Term Borrowings and Long-Term Debt,” in the Notes to Financial Statements for further discussion of long-term

debt, related maturities and interest rates as of December 31, 2013 and December 31, 2012.

PAGE 43