Kodak 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

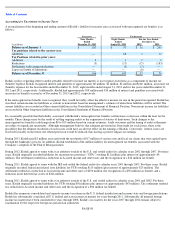

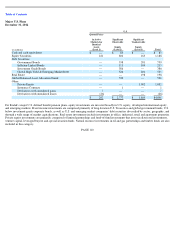

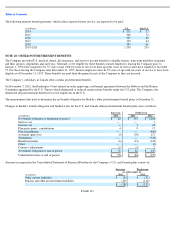

The weighted-average assumptions used to determine net pension (income) expense for all the major funded and unfunded U.S. and Non-U.S.

defined benefit plans were as follows:

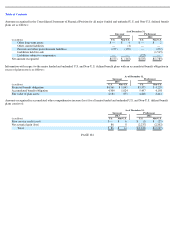

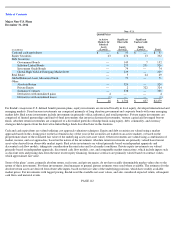

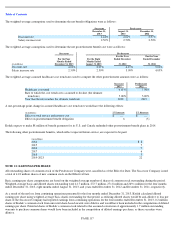

Plan Asset Investment Strategy

The investment strategy underlying the asset allocation for the pension assets is to achieve an optimal return on assets with an acceptable level

of risk while providing for the long-

term liabilities, and maintaining sufficient liquidity to pay current benefits and other cash obligations of the

plans. This is primarily achieved by investing in a broad portfolio constructed of various asset classes including equity and equity-like

investments, debt and debt-like investments, real estate, private equity and other assets and instruments. Long duration bonds and Treasury

bond futures are used to partially match the long-term nature of plan liabilities. Other investment objectives include maintaining broad

diversification between and within asset classes and fund managers, and managing asset volatility relative to plan liabilities.

Every three years, or when market conditions have changed materially, each of Kodak’s major pension plans will undertake an asset allocation

or asset and liability modeling study. The asset allocation and expected return on the plans’ assets are individually set to provide for benefits

and other cash obligations within each country’s legal investment constraints.

Actual allocations may vary from the target asset allocations due to market value fluctuations, the length of time it takes to implement changes

in strategy, and the timing of cash contributions and cash requirements of the plans. The asset allocations are monitored, and are rebalanced in

accordance with the policy set forth for each plan.

The total plan assets attributable to the major U.S. defined benefit plans at December 31, 2013 relate to KRIP. The expected long-term rate of

return on plan assets assumption (“EROA”) is based on a combination of formal asset and liability studies that include forward-looking return

expectations given the current asset allocation. A review of the EROA as of December 31, 2013, based upon the current asset allocation and

forward-looking expected returns for the various asset classes in which KRIP invests, resulted in an EROA of 7.8%.

As with KRIP, the EROA assumptions for certain of Kodak’s other pension plans were reassessed as of December 31, 2013. The annual

expected return on plan assets for the major non-U.S. pension plans range from 2.4% to 7.2% based on the plans’

respective asset allocations as

of December 31, 2013.

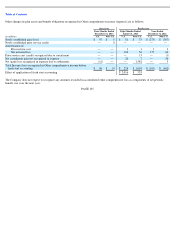

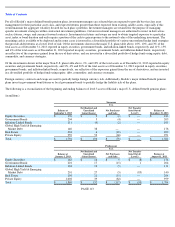

Plan Asset Risk Management

Kodak evaluates its defined benefit plans’ asset portfolios for the existence of significant concentrations of risk. Types of concentrations that

are evaluated include, but are not limited to, investment concentrations in a single entity, type of industry, foreign country, and individual fund.

As of December 31, 2013 and 2012, there were no significant concentrations (defined as greater than 10 percent of plan assets) of risk in

Kodak’s defined benefit plan assets.

PAGE 107

Successor

Predecessor

Four Months Ended

Eight Months Ended

Year Ended December 31,

December 31, 2013

August 31, 2013

2012

2011

U.S.

Non

-

U.S.

U.S.

Non

-

U.S.

U.S.

Non

-

U.S.

U.S.

Non

-

U.S.

Discount rate

4.25

%

3.14

%

4.25

%

3.14

%

4.25

%

4.41

%

5.24

%

4.95

%

Salary increase rate

3.39

%

2.69

%

3.39

%

2.69

%

3.45

%

2.98

%

3.99

%

3.89

%

Expected long-term rate of return on plan

assets

8.20

%

5.35

%

8.12

%

6.54

%

8.52

%

7.02

%

8.43

%

7.64

%