Kodak 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

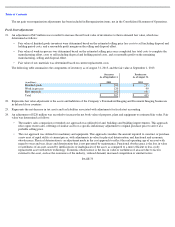

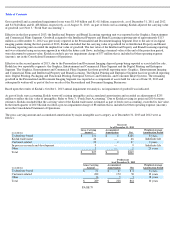

The net gain on fresh start adjustments has been included in Reorganization items, net in the Consolidated Statement of Operations.

PAGE 76

27.

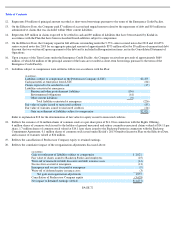

Represents the write

-

off of deferred costs under various licensing transactions now being reflected in intangible assets.

28.

Represents the write

-

off of unamortized debt issuance costs related to the Emergence Credit Facilities.

29. Represents the revaluation of pension and other postretirement obligations. Refer to Note 19, “Retirement plans “and Note 20, “Other

postretirement benefits

”

for additional information.

30.

Represents the revaluation of deferred revenues to the fair value of Kodak

’

s related future performance obligations.

31.

Represents the write

-

off of unamortized debt discounts related to the Emergence Credit Facilities based on the fair value of debt.

32. Represents $38 million decrease in capitalized lease obligations determined based on market rents, $19 million decrease related to the

remeasurement of employee benefit obligations offset by net $4 million increase in fair value adjustment related to asset retirement

obligations and other miscellaneous liabilities.

33. Reflects the increase in fair value of the 34 million shares of common stock issued in connection with the Rights Offering from $11.94 to

$14.11 per share.

34. Reflects the cumulative impact of fresh start adjustments as discussed above and the elimination of the Predecessor Company’s

accumulated other comprehensive loss.

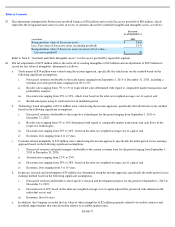

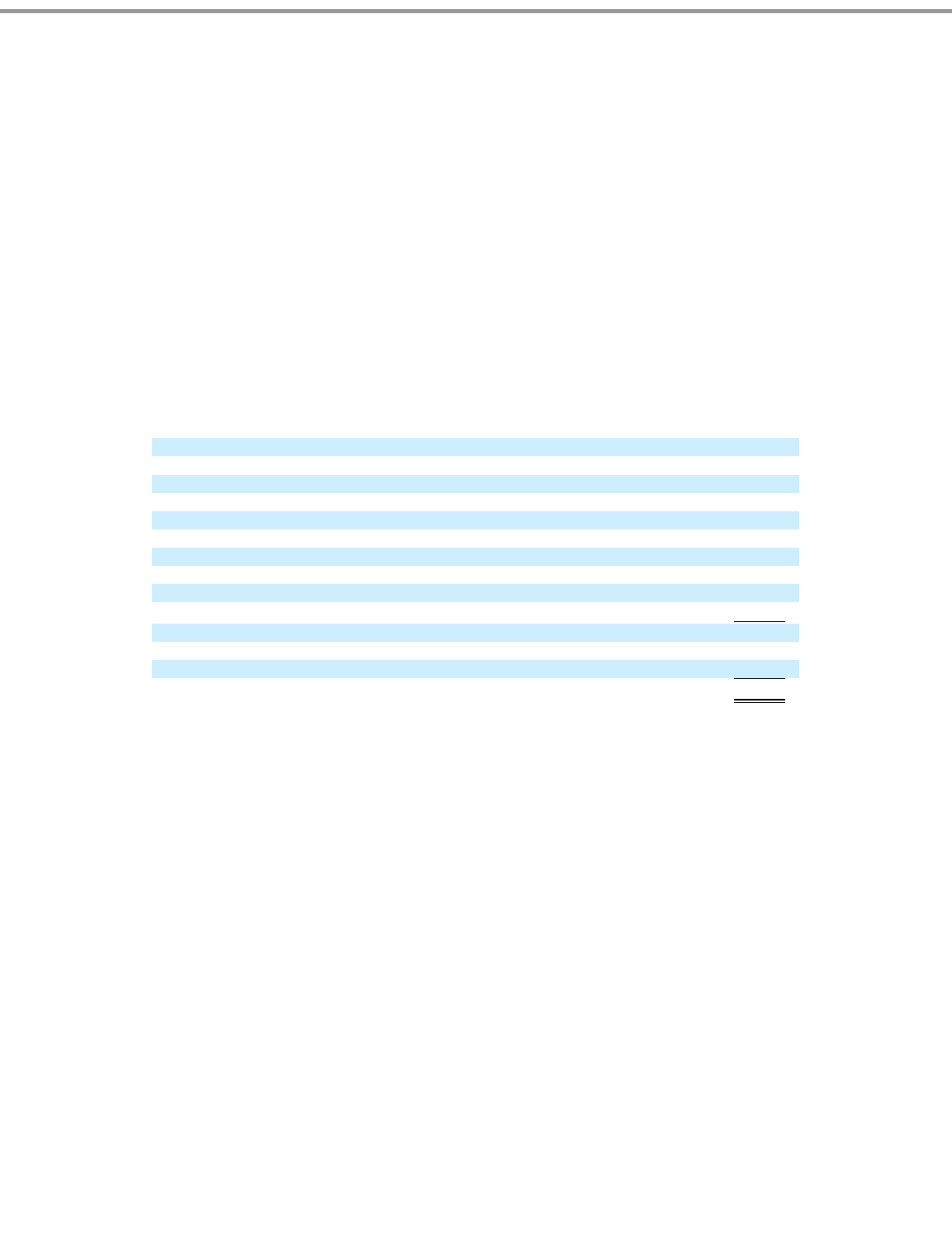

(in millions)

Establishment of Successor goodwill

$

88

Elimination of Predecessor goodwill

(56

)

Establishment of Successor intangibles

235

Elimination of Predecessor intangibles

(43

)

Inventory fair value adjustment

67

Property, plant & equipment fair value adjustment

220

Pension and other postretirement obligations fair value adjustment

(178

)

Rights offering fair value adjustment

(73

)

Long

-

term debt fair value adjustment

(11

)

Other assets and liabilities fair value adjustments

53

Net gain on fresh start adjustments

302

Tax impact on fresh start adjustments

(69

)

Elimination of Predecessor accumulated other comprehensive loss

(1,008

)

Net impact on Retained earnings (deficit)

$

(775

)