Kodak 2013 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEASONALITY OF BUSINESS

Equipment sales for the DP&E Segment and Graphics, within the GECF Segment, generally exhibit higher levels in the fourth quarter due to

the seasonal nature of placements, resulting from customer or industry budgeting practices. Sales of entertainment imaging film within the

GECF Segment are typically strongest in the second quarter reflecting increased demand due to the summer motion picture season.

RESEARCH AND DEVELOPMENT

Through the years, Kodak has engaged in extensive and productive efforts in research and development.

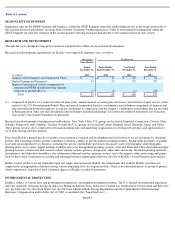

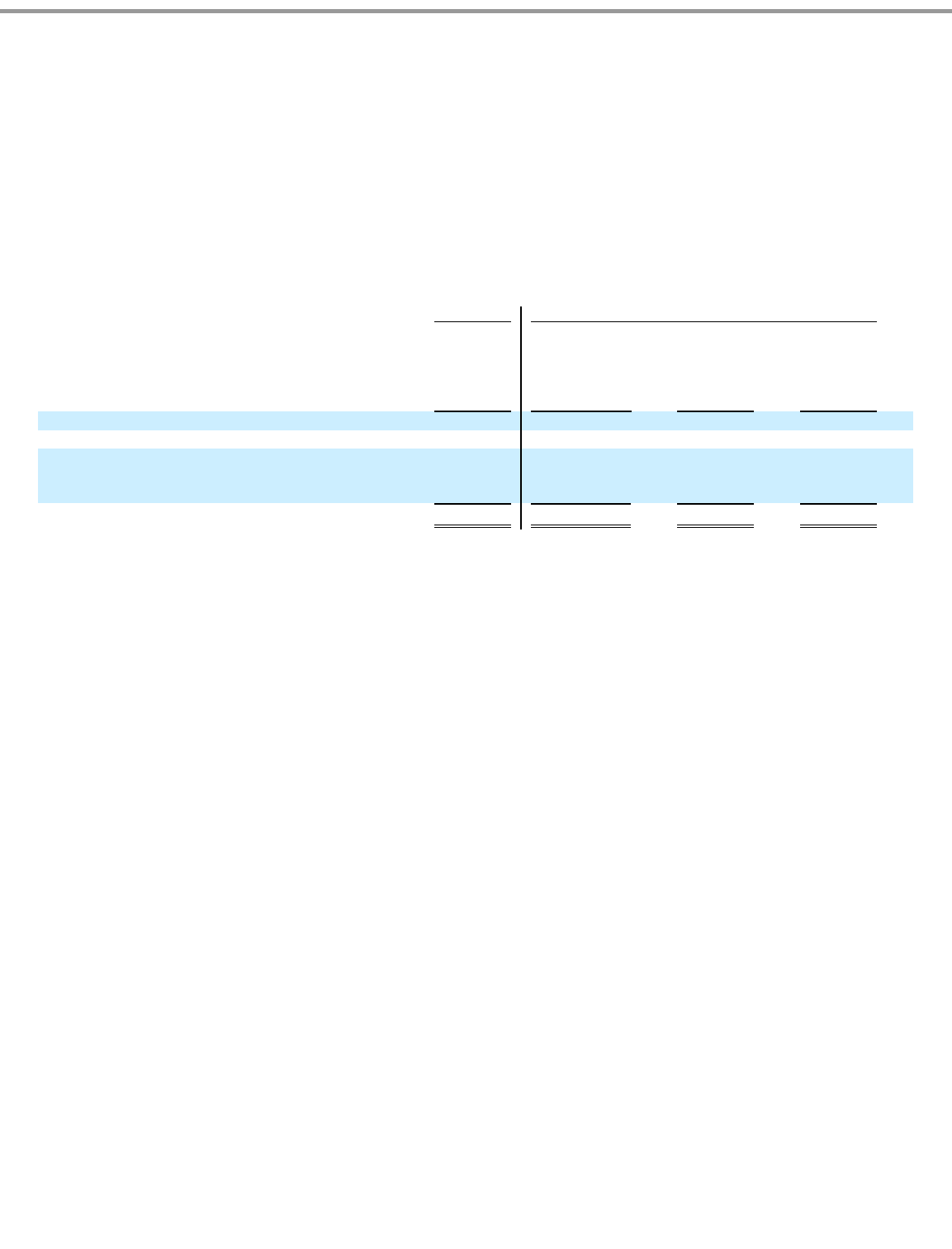

Research and development expenditures for Kodak’s two reportable segments were as follows:

Research and development is headquartered in Rochester, New York. Other U.S. groups are located in Stamford, Connecticut; Dayton, Ohio;

Oakdale, Minnesota; and Columbus, Georgia. Outside the U.S., groups are located in Canada, England, Israel, Germany, Japan, and China.

These groups work in close cooperation with manufacturing units and marketing organizations to develop new products and applications to

serve both existing and new markets.

It has been Kodak’s general practice to protect its investment in research and development and its freedom to use its inventions by obtaining

patents. The ownership of these patents contributes to Kodak’s ability to provide industry-leading products. Kodak holds portfolios of patents

in several areas important to its business, including the specific technologies previously discussed, such as flexographic and lithographic

printing plates and systems; digital printing workflow and color management proofing systems; color and black-and-white electrophotographic

printing systems; commercial and consumer inkjet writing systems, printers, and presses; inkjet inks and media; functional printing materials,

formulations, and deposition modalities; dye sublimation (thermal transfer) printing systems; and color negative films, processing and papers.

Each of these areas is important to existing and emerging business opportunities that bear directly on Kodak’s overall business performance.

Kodak’s major products are not dependent upon one single, material patent. Rather, the technologies that underlie Kodak’s products are

supported by an aggregation of patents having various remaining lives and expiration dates. There is no individual patent, or group of patents,

whose expiration is expected to have a material impact on Kodak’s results of operations.

ENVIRONMENTAL PROTECTION

Kodak is subject to various laws and governmental regulations concerning environmental matters. The U.S. federal environmental legislation

and state regulatory programs having an impact on Kodak include the Toxic Substances Control Act, the Resource Conservation and Recovery

Act, the Clean Air Act, the Clean Water Act, the NY State Chemical Bulk Storage Regulations and the Comprehensive Environmental

Response, Compensation and Liability Act of 1980, as amended (the “Superfund Law”).

PAGE 6

(in millions)

Successor

Predecessor

Four Months

Ended

December 31,

2013

Eight Months

Ended August 31,

2013

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Graphics, Entertainment and Commercial Films

$

7

$

13

$

40

$

54

Digital Printing and Enterprise

33

55

132

159

Impact of exclusion of certain components of

pension and OPEB income from the segment

measure of profitability (1)

(7

)

(2

)

(4

)

(18

)

Total

$

33

$

66

$

168

$

195

(1) Composed of interest cost, expected return on plan assets, amortization of actuarial gains and losses, amortization of prior service credits

related to the U.S. Postretirement Benefit Plan and special termination benefits, curtailments and settlement components of pension and

other postretirement benefit expenses, except for settlements in connection with the chapter 11 bankruptcy proceedings that are recorded

in Reorganization items, net and curtailments and settlements included in Earnings (loss) from discontinued operations, net of income

taxes in the Consolidated Statement of Operations.