Kodak 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

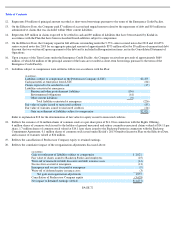

Refer to explanation #18 for the determination of fair value for equity issued to unsecured creditors.

PAGE 72

12.

Represents $4 million of principal amount recorded as short

-

term borrowings pursuant to the terms of the Emergence Credit Facility.

13. On the Effective Date, the Company paid $7 million of accrued and unpaid interest related to the repayment of debt and $10 million in

administrative claims that was included within Other current liabilities.

14. Represents $29 million in claims expected to be settled in cash and $9 million of liabilities that have been retained by Kodak in

accordance with the Plan that have been reclassified from Liabilities subject to compromise.

15. On the Effective Date, the Company repaid in full all loans outstanding under the 9.75% senior secured notes due 2018 and 10.625%

senior secured notes due 2019 for an aggregate principal amount of approximately $375 million offset by $5 million of unamortized debt

discount that was written off upon repayment of the debt and is included in Reorganization items, net in the Consolidated Statement of

Operations.

16. Upon issuance of the Term Loans under the Emergence Credit Facility, the Company received net proceeds of approximately $669

million, of which $4 million of the principal amount of the loans are recorded as short-term borrowings pursuant to the terms of the

Emergence Credit Facility.

17.

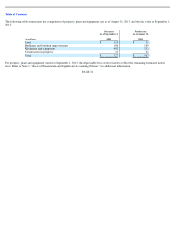

Liabilities subject to compromise were settled as follows in accordance with the Plan:

(in millions)

Liabilities subject to compromise of the Predecessor Company (LSTC)

$

2,475

Cash payments at emergence from LSTC

(84

)

Claims expected to be satisfied in cash

(35

)

Liabilities reinstated at emergence:

Pension and other postretirement liabilities

(156

)

Environmental obligations

(61

)

Other current liabilities

(9

)

Total liabilities reinstated at emergence

(226

)

Fair value of equity issued to unsecured creditors

(85

)

Fair value of warrants issued to unsecured creditors

(24

)

Gain on settlement of liabilities subject to compromise

$

2,021

18. Reflects the issuance of 34 million shares of common stock at a per share price of $11.94 in connection with the Rights Offering,

6 million shares of common stock issued to the holders of general unsecured and retiree committee unsecured claims valued at $14.11 per

share, 1.7 million shares of common stock valued at $14.11 per share issued to the Backstop Parties in connection with the Backstop

Commitment Agreement, 0.1 million shares of common stock issued under Kodak’s 2013 Omnibus Incentive Plan on the Effective Date,

and issuance of warrants valued at $24 million.

19.

Reflects the cancellation of Predecessor Company equity to retained earnings.

20.

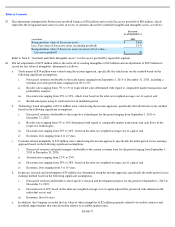

Reflects the cumulative impact of the reorganization adjustments discussed above:

(in millions)

Gain on settlement of liabilities subject to compromise

$

2,021

Fair value of shares issued to Backstop Parties and employees

(25

)

Write

-

off of unamortized debt discounts and debt issuance costs

(14

)

Success fees accrued at emergence

(13

)

Emergence and success fees paid at emergence

(9

)

Write

-

off of deferred equity issuance costs

(3

)

Net gain on reoganization adjustments

1,957

Cancellation of Predecessor Company equity

(3,628

)

Net impact to Retained earnings (deficit)

$

(1,671

)