Kodak 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

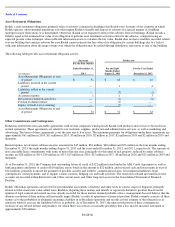

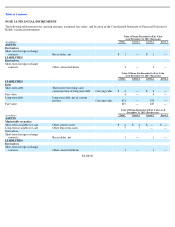

Asset Retirement Obligations

Kodak’s asset retirement obligations primarily relate to asbestos contained in buildings that Kodak owns. In many of the countries in which

Kodak operates, environmental regulations exist that require Kodak to handle and dispose of asbestos in a special manner if a building

undergoes major renovations or is demolished. Otherwise, Kodak is not required to remove the asbestos from its buildings. Kodak records a

liability equal to the estimated fair value of its obligation to perform asset retirement activities related to the asbestos, computed using an

expected present value technique, when sufficient information exists to calculate the fair value. Kodak does not have a liability recorded related

to every building that contains asbestos because Kodak cannot estimate the fair value of its obligation for certain buildings due to a lack of

sufficient information about the range of time over which the obligation may be settled through demolition, renovation or sale of the building.

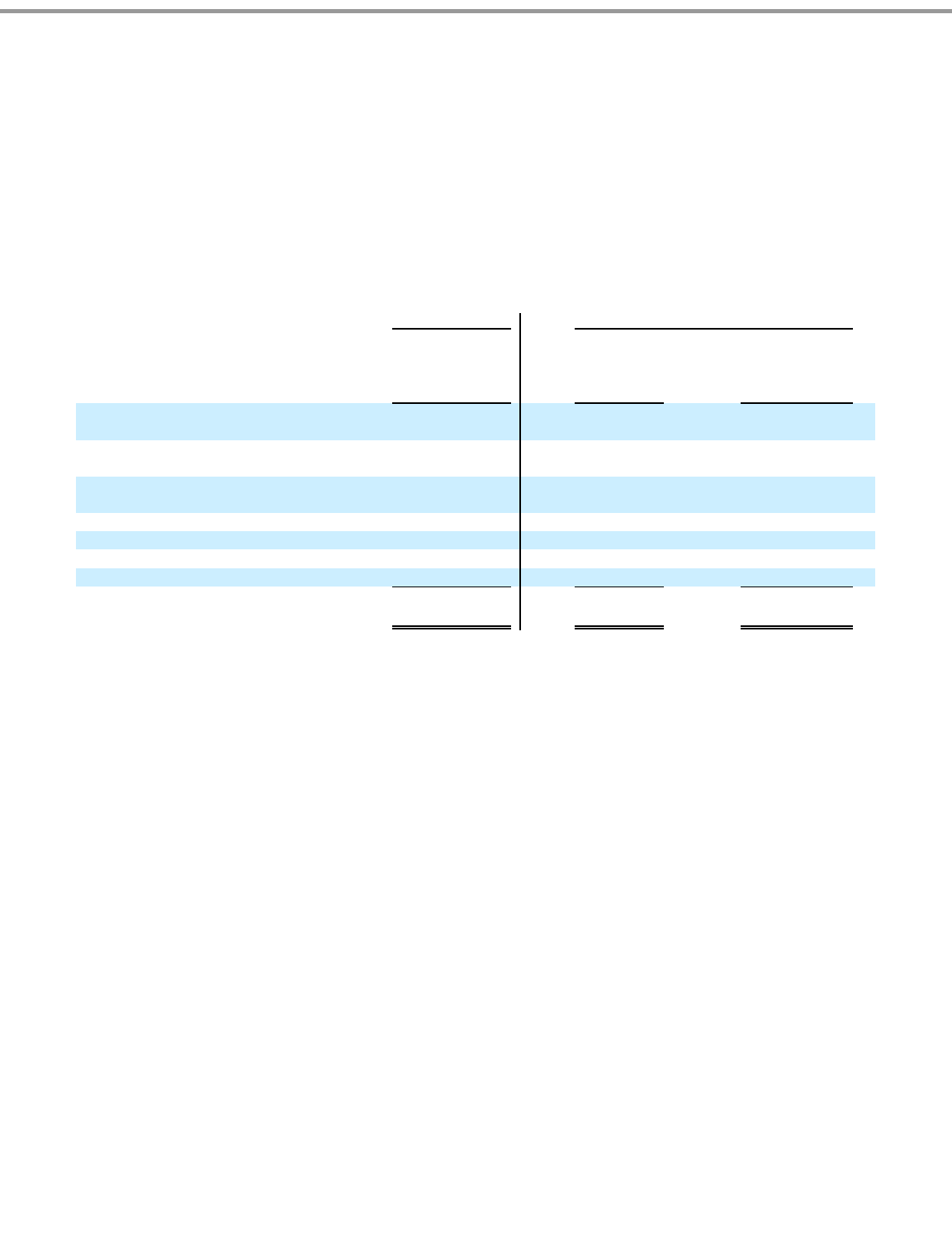

The following table provides asset retirement obligation activity:

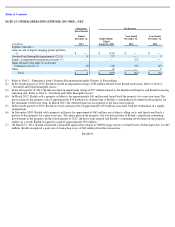

Other Commitments and Contingencies

Kodak has entered into non-cancelable agreements with several companies which provide Kodak with products and services to be used in its

normal operations. These agreements are related to raw materials, supplies, production and administrative services, as well as marketing and

advertising. The terms of these agreements cover the next one to five years. The minimum payments for obligations under these agreements are

approximately $61 million in 2014, $11 million in 2015, $3 million in 2016, $2 million in 2017, $2 million in 2018 and $2 million in 2019 and

thereafter.

Rental expense, net of minor sublease income, amounted to $15 million, $36 million, $60 million and $76 million in the four months ending

December 31, 2013, the eight months ending August 31, 2013 and the years ended December 31, 2012, and 2011, respectively. The amounts of

non-cancelable lease commitments with terms of more than one year, principally for the rental of real property, reduced by minor sublease

income, are $28 million in 2014, $20 million in 2015, $15 million in 2016, $12 million in 2017, $8 million in 2018 and $12 million in 2019 and

thereafter.

As of December 31, 2013, the Company had outstanding letters of credit of $122 million issued under the ABL Credit Agreement as well as

bank guarantees and letters of credit of $10 million, surety bonds in the amount of $22 million, and restricted cash and investments in trust of

$121 million, primarily to ensure the payment of possible casualty and workers’ compensation claims, environmental liabilities, legal

contingencies, rental payments, and to support various customs, hedging, tax and trade activities. The restricted cash and investments in trust

accounts are recorded within Restricted cash, Other current assets and Other long-term assets in the Consolidated Statement of Financial

Position.

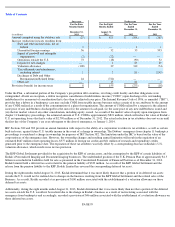

Kodak’s Brazilian operations are involved in governmental assessments of indirect and other taxes in various stages of litigation, primarily

related to federal and state value-added taxes. Kodak is disputing these matters and intends to vigorously defend its position. Based on the

opinion of legal counsel and current reserves already recorded for those matters deemed probable of loss, management does not believe that the

ultimate resolution of these matters will materially impact Kodak’

s results of operations or financial position. Kodak routinely assesses all these

matters as to the probability of ultimately incurring a liability in its Brazilian operations and records its best estimate of the ultimate loss in

situations where it assesses the likelihood of loss as probable. As of December 31, 2013, the unreserved portion of these contingencies,

inclusive of any related interest and penalties, for which there was at least a reasonable possibility that a loss may be incurred, amounted to

approximately $38 million.

PAGE 86

Successor

Predecessor

(in millions)

For the Four Months

Ended December 31,

2013

For the Eight

Months Ended

August 31, 2013

For the Year Ended

December 31, 2012

Asset Retirement Obligations at start

of period

$

51

$

63

$

61

Liabilities incurred in the current

period

—

1

4

Liabilities settled in the current

period

—

(

5

)

(1

)

Accretion expense

1

1

3

Revision in estimated cash flows

—

(

1

)

(4

)

Foreign exchange impact

—

(

1

)

—

Impact of fresh start accounting

—

(

7

)

—

Asset Retirement Obligations at end

of period

$

52

$

51

$

63