Kodak 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

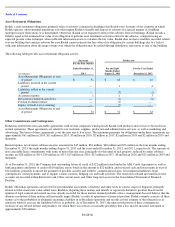

During 2012 and 2011, Kodak determined that it was more likely than not that a portion of the deferred tax assets outside the U.S. would not be

realized due to reduced manufacturing volumes negatively impacting profitability in a location outside the U.S. and accordingly, recorded a

provision of $30 million and $53 million, respectively, associated with the establishment of a valuation allowance on those deferred tax assets.

In March 2011, Kodak filed a Request for Competent Authority Assistance with the United States Internal Revenue Service (“IRS”). The

request related to a potential double taxation issue with respect to certain patent licensing royalty payments received by Kodak in 2012 and

2011. In the twelve months ended December 31, 2012, Kodak received notification that the IRS had reached agreement with the Korean

National Tax Service (

“NTS”) with regards to Kodak’s March 2011 request. As a result of the agreement reached by the IRS and NTS, Kodak

was due a partial refund of Korean withholding taxes in the amount of $123 million. Kodak had previously agreed with the licensees that made

the royalty payments that any refunds of the related Korean withholding taxes would be shared equally between Kodak and the licensees. The

licensees’

share ($61 million) of the Korean withholding tax refund has therefore been reported as a licensing revenue reduction in Licensing &

royalties in the Consolidated Statement of Operations.

PAGE 96

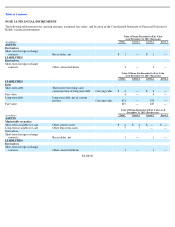

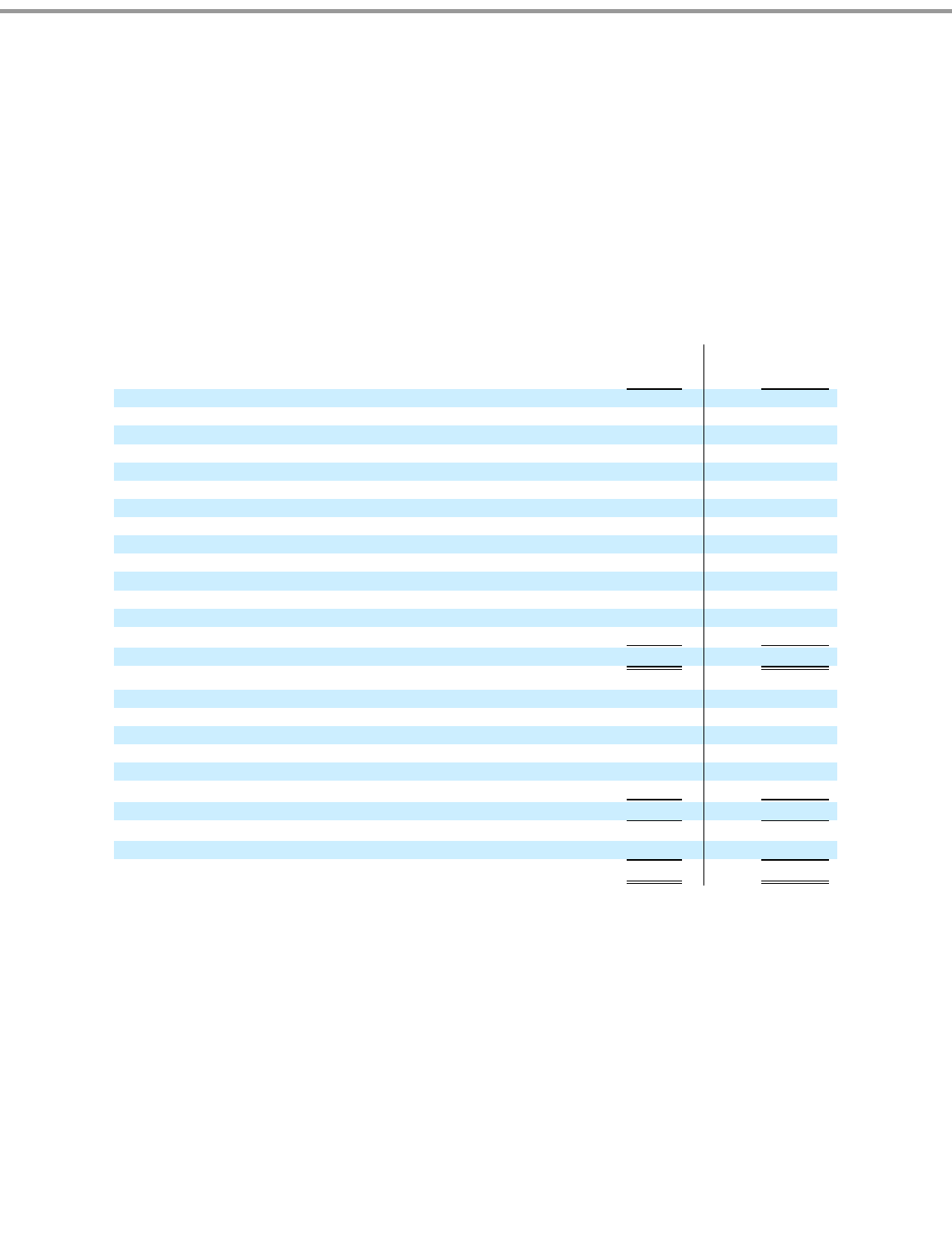

As of December 31,

(in millions)

Successor

2013

Predecessor

2012

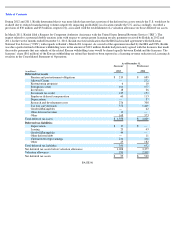

Deferred tax assets

Pension and postretirement obligations

$

219

$

689

Allowed Claims

—

272

Restructuring programs

6

10

Foreign tax credit

101

577

Inventories

18

26

Investment tax credit

125

153

Employee deferred compensation

60

113

Depreciation

—

57

Research and development costs

276

308

Tax loss carryforwards

372

1,409

Goodwill/Intangibles

—

42

Other deferred revenue

13

—

Other

168

373

Total deferred tax assets

$

1,358

$

4,029

Deferred tax liabilities

Depreciation

$

17

$

—

Leasing

23

43

Goodwill/Intangibles

49

—

Other deferred debt

—

11

Unremitted foreign earnings

236

416

Other

25

182

Total deferred tax liabilities

350

652

Net deferred tax assets before valuation allowance

1,008

3,377

Valuation allowance

953

2,838

Net deferred tax assets

$

55

$

539