Kodak 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

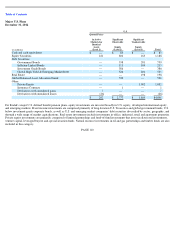

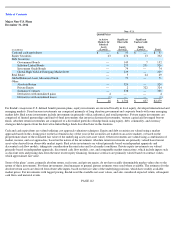

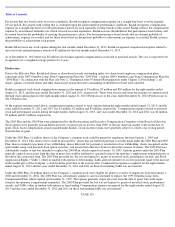

For all of Kodak’s major defined benefit pension plans, investment managers are selected that are expected to provide best-in-class asset

management for their particular asset class, and expected returns greater than those expected from existing salable assets, especially if this

would maintain the aggregate volatility desired for each plan’s portfolio. Investment managers are retained for the purpose of managing

specific investment strategies within contractual investment guidelines. Certain investment managers are authorized to invest in derivatives

such as futures, swaps, and currency forward contracts. Investments in futures and swaps are used to obtain targeted exposure to a particular

asset, index or bond duration and only require a portion of the cash to gain exposure to the notional value of the underlying investment. The

remaining cash is available to be deployed and in some cases is invested in a diversified portfolio of various uncorrelated hedge fund strategies

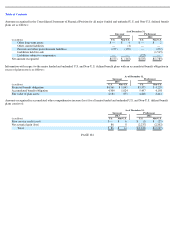

that provide added returns at a lower level of risk. Of the investments shown in the major U.S. plans table above, 10%, 10%, and 3% of the

total assets as of December 31, 2013 reported in equity securities, government bonds, and inflation-linked bonds, respectively and 11%, 15%

and 4% of the total assets as of December 31, 2012 reported in equity securities, government bonds, and inflation-linked bonds, respectively

are reflective of the exposures gained from the use of derivatives, and are invested in a diversified portfolio of hedge funds using equity, debt,

commodity, and currency strategies.

Of the investments shown in the major Non-

U.S. plans table above, 1%, and 10% of the total assets as of December 31, 2013 reported in equity

securities and government bonds, respectively, and 3%, 4% and 20% of the total assets as of December 31, 2012 reported in equity securities,

government bonds, and inflation-linked bonds, respectively, are reflective of the exposures gained from the use of derivatives, and are invested

in a diversified portfolio of hedge funds using equity, debt, commodity, and currency strategies.

Foreign currency contracts and swaps are used to partially hedge foreign currency risk. Additionally, Kodak’s major defined benefit pension

plans invest in government bond futures or local government bonds to partially hedge the liability risk of the plans.

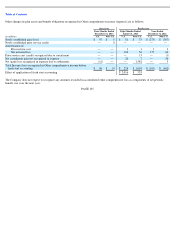

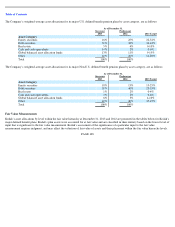

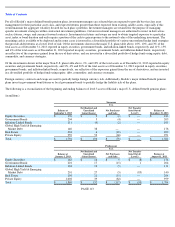

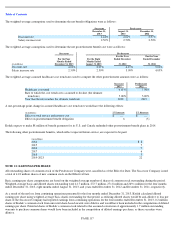

The following is a reconciliation of the beginning and ending balances of level 3 assets of Kodak’s major U.S. defined benefit pension plans:

(in millions)

PAGE 113

Successor

U.S.

Balance at

September 1, 2013

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

December 31, 2013

Equity Securities

$

176

$

9

$

(2

)

$

—

$

183

Government Bonds

204

5

(4

)

—

205

Inflation

-

Linked Bonds

111

(4

)

(2

)

—

105

Global High Yield & Emerging

Market Debt

140

38

—

—

178

Real Estate

204

6

(10

)

—

200

Private Equity

959

52

(60

)

—

951

Total

$

1,794

$

106

$

(78

)

$

—

$

1,822

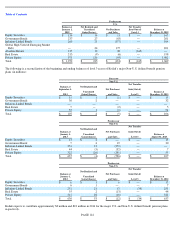

Predecessor

U.S.

Balance at

January 1, 2013

Net Realized and

Unrealized

Gains/(Losses)

Net Purchases

and Sales

Net Transfer

Into/(Out of)

Level 3

Balance at

August 31, 2013

Equity Securities

$

163

$

16

$

5

$

(8

)

$

176

Government Bonds

201

17

(15

)

1

204

Inflation

-

Linked Bonds

104

12

(5

)

—

111

Global High Yield & Emerging

Market Debt

201

27

(5

)

(83

)

140

Real Estate

198

21

(15

)

—

204

Private Equity

1,002

39

(82

)

—

959

Total

$

1,869

$

132

$

(117

)

$

(90

)

$

1,794