Kodak 2013 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2013 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Reorganization Items, Net

For details, refer to Note 4, “Reorganization Items, Net.”

Income Tax Provision (Benefit)

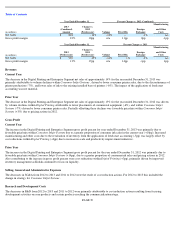

Current Year

The change in Kodak’

s effective tax rate from continuing operations for 2013 as compared to 2012 is primarily attributable to: (1) a decrease as

a result of income generated in the U.S., for which no provision was recognized, partially offset by an increase as a result of losses in certain

jurisdictions outside the U.S. for which no benefit was recognized due to management

’s conclusion that it was more likely than not that the tax

benefits would not be realized, (2) a benefit as a result of Kodak reaching a settlement with a taxing authority in a location outside the U.S. in

the twelve months ended December 31, 2012, (3) an increase as a result of the establishment of a deferred tax asset valuation allowance in

certain jurisdictions outside the U.S., (4) a benefit associated with the tax impact of the impairment of goodwill and intangibles recognized in

the twelve months ended December 31, 2013, (5) a decrease as a result of a legislative tax rate change in a jurisdiction outside the U.S., (6) a

provision as a result of withholding taxes on foreign dividends in the twelve months ended December 31, 2013, (7) an increase as a result of tax

accounting impacts related to items reported in Accumulated other comprehensive loss in the Consolidated Statement of Financial Position,

(8) a provision as a result of withholding taxes on the sale of intellectual property in the twelve months ended December 31, 2013, (9) a

decrease associated with foreign withholding taxes on undistributed earnings, and (10) a benefit as a result of Kodak reaching a settlement with

taxing authorities outside the U.S. in the twelve months ended December 31, 2012.

Prior Year

The change in Kodak’s effective tax rate from continuing operations for 2012 as compared with 2011 is primarily attributable to: (1) a benefit

as a result of tax accounting impacts related to items reported in Accumulated other comprehensive loss in the Consolidated Statement of

Financial Position as of December 31, 2012, (2) a benefit as a result of Kodak reaching a settlement with a taxing authority in a location outside

the U.S. during the year ended December 31, 2012, (3) a benefit as a result of the U.S Internal Revenue Service federal audit settlement for

calendar years 2001 through 2005 during the year ended December 31, 2011, (4) a decrease as a result of foreign withholding taxes on

undistributed earnings, (5) an increase as a result of Kodak reaching a settlement with taxing authorities outside the U.S., (6) an increase as a

result of losses generated in the U.S. and certain jurisdictions outside the U.S. for which no benefit was recognized due to management’s

conclusion that it was more likely than not that the tax benefits would not be realized, (7) a decrease as a result of the establishment of a

deferred tax asset valuation allowance in certain jurisdictions outside the U.S., and (8) a benefit as a result of the release of a deferred tax asset

valuation allowance in a certain jurisdiction outside the U.S. during the year ended December 31, 2011.

PAGE 35

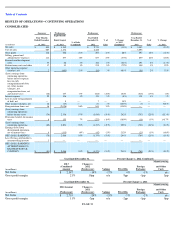

(in millions)

Successor

Predecessor

Four Months Ended

December 31, 2013

Eight Months

Ended August 31, 2013

Year Ended

December 31, 2012

Year Ended

December 31, 2011

(Loss) earnings from

continuing

operations before

income taxes

$

(74

)

$

2,356

$

(1,610

)

$

(757

)

Provision (benefit) for

income taxes

8

155

(273

)

(18

)

Effective tax rate

(11

%)

7

%

17

%

2

%

(Benefit) provision)

for income taxes @

35%

(26

)

825

(564

)

(265

)

Difference between

tax @ effective vs

statutory rate

34

(670

)

291

247

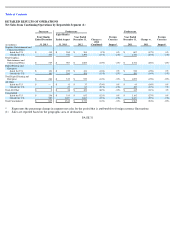

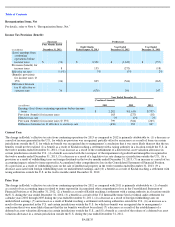

Year Ended December 31,

(in millions)

(Combined Amount)

2013

2012

2011

Earnings (loss) from continuing operations before income

taxes

$

2,282

$

(1,610

)

$

(757

)

Provision (benefit) for income taxes

163

(273

)

(18

)

Effective tax rate

7

%

17

%

2

%

Provision (benefit) for income taxes @ 35%

799

(564

)

(265

)

Difference between tax @ effective vs statutory rate

(636

)

291

247