Hyundai 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 157156

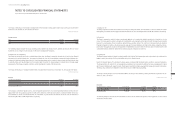

(3) Derivative instrument

The Group enters into derivative instrument contracts such as forwards, options and swaps to hedge its exposure to changes in for-

eign exchange rate.

As of December 31, 2014 and 2013, the Group deferred a net loss of ₩30,363 million and a net income of ₩1,207 million, respectively,

in accumulated other comprehensive loss, on its effective cash flow hedging instruments.

The longest period in which the forecasted transactions are expected to occur is within 51 months as of December 31, 2014.

For the years ended December 31, 2014 and 2013, the Group recognized a net income of ₩178,547 million and a net loss of ₩230,974

million in profit or loss (before tax), respectively, which resulted from the ineffective portion of its cash flow hedging instruments and

changes in the valuation of its other non-hedging derivative instruments.

36. RELATED-PARTY TRANSACTIONS:

The transactions and balances of receivables and payables within the Group are wholly eliminated in the preparation of consolidated

financial statements of the Group.

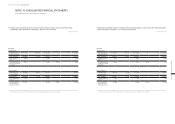

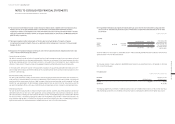

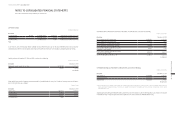

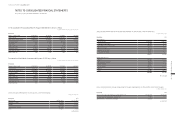

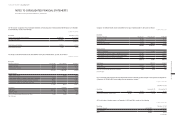

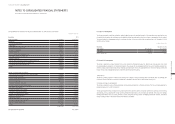

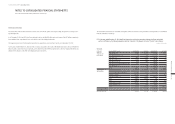

(1) For the year ended December 31, 2014, significant transactions arising from operations between the Group and related

parties or affiliates by the Monopoly Regulation And Fair Trade Act of the Republic of Korea (“the Act”) are as follows:

In millions of Korean Won

Description

Sales/proceeds Purchases/expenses

Sales Others Purchases Others

Entity with

significant

influence over

the Company

Hyundai MOBIS Co., Ltd. ₩ 855,186 ₩ 9,962 ₩ 4,834,975 ₩ 39,486

Mobis Alabama, LLC 21,484 16,792 1,321,444 23,419

Mobis Automotive Czech s.r.o. 48 438 1,177,753 578

Mobis India, Ltd. 18,040 17,402 746,382 650

Mobis Parts America, LLC 25,720 5,561 529,788 1,616

Mobis Parts Europe N.V. 4,628 1,889 244,800 -

Mobis Brasil Fabricacao De Auto Pecas Ltda 2,561 -307,535 -

Mobis Module CIS, LLC - 448 216,528 28

Others 20,272 731 445,031 17,424

Joint ventures

and associates

Kia Motors Corporation 941,875 476,662 154,410 224,568

Kia Motors Manufacturing Georgia, Inc. 637,885 1,609 2,419,402 943

Kia Motors Russia LLC 885,546 156 -4,714

Kia Motors Slovakia s.r.o. 120,347 19,896 576,617 655

BHMC 956,691 44,452 404 -

HMGC 368,616 146 2,389 6,193

Hyundai WIA Corporation 200,301 520 856,907 14,985

Hyundai HYSCO Co., Ltd. 12,528 1,804 13,912 15

Others 456,964 35,133 2,870,138 1,803,768

Other related parties 3,073 6,258 408,969 454,203

Affiliates by the Act 780,543 69,118 4,756,881 1,380,518

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013