Hyundai 2014 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 149148

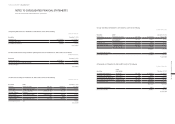

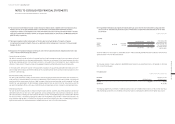

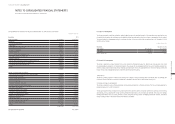

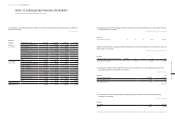

(3) The changes in deferred tax assets (liabilities) for the year ended December 31, 2014, are as follows:

In millions of Korean Won

Description Beginning of the year Changes End of the year

Provisions ₩ 1,737,352 ₩ 107,182 ₩ 1,844,534

AFS financial assets (247,363) (60,212) (307,575)

Subsidiaries, associates and joint ventures (1,172,789) (156,805) (1,329,594)

Reserve for research and manpower development (290,481) 57,172 (233,309)

Derivatives (52,121) 74,216 22,095

PP&E (3,962,231) (788,151) (4,750,382)

Accrued income (7,509) 4,489 (3,020)

Gain on foreign currency translation 992 (3,539) (2,547)

Others 178,374 (52,628) 125,746

(3,815,776) (818,276) (4,634,052)

Accumulated deficit and tax credit carryforward 984,823 247,876 1,232,699

₩ (2,830,953) ₩ (570,400) ₩ (3,401,353)

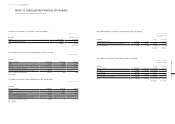

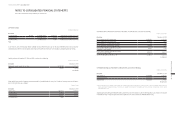

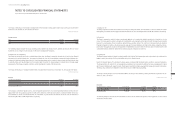

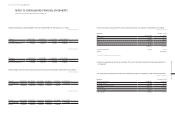

The changes in deferred tax assets (liabilities) for the year ended December 31, 2013, were as follows:

In millions of Korean Won

Description Beginning of the year Changes End of the year

Provisions ₩ 1,672,540 ₩ 64,812 ₩ 1,737,352

AFS financial assets (229,971) (17,392) (247,363)

Subsidiaries, associates and joint ventures (854,175) (318,614) (1,172,789)

Reserve for research and manpower development (240,177) (50,304) (290,481)

Derivatives (56,428) 4,307 (52,121)

PP&E (3,232,024) (730,207) (3,962,231)

Accrued income (32,434) 24,925 (7,509)

Gain on foreign currency translation 615 377 992

Others 294,834 (116,460) 178,374

(2,677,220) (1,138,556) (3,815,776)

Accumulated deficit and tax credit carryforward 804,237 180,586 984,823

₩ (1,872,983) ₩ (957,970) ₩ (2,830,953)

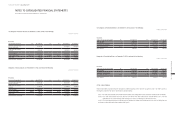

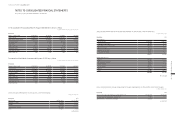

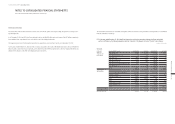

(4) The components of items charged to equity for the years ended December 31, 2014 and 2013, are as follows:

In millions of Korean Won

Description 2014 2013

Deferred tax charged or credited to:

Loss (gain) on valuation of AFS financial assets, net ₩ 72,227 ₩ (17,411)

Loss (gain) on valuation of cash flow hedge derivatives, net 19,982 (2,216)

Remeasurements of defined benefit plans 128,118 (91,818)

Changes in retained earnings of equity-accounted investees 11,192 (1,985)

₩ 231,519 ₩ (113,430)

(5) The temporary differences not recognized as deferred tax liabilities related to subsidiaries, associates and joint ventures are

₩7,000,120 million and ₩6,248,359 million as of December 31, 2014 and 2013, respectively.

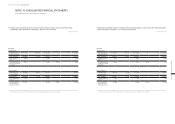

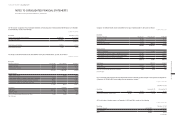

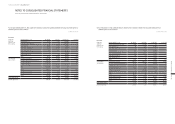

33. RETIREMENT BENEFIT PLAN:

(1) Expenses recognized in relation to defined contribution plans for the years ended December 31, 2014 and 2013, are as fol-

lows:

In millions of Korean Won

Description 2014 2013

Paid in cash ₩ 6,426 ₩ 6,315

Recognized liability 508 416

₩ 6,934 ₩ 6,731

(2) The significant actuarial assumptions used by the Group as of December 31, 2014 and 2013, are as follows:

Description December 31, 2014 December 31, 2013

Discount rate 3.62% 4.45%

Rate of expected future salary increase 5.01% 4.97%

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013