Hyundai 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 133132

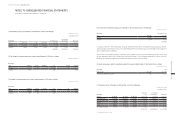

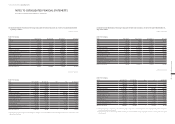

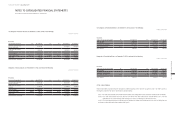

19. FINANCIAL INSTRUMENTS:

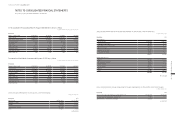

(1) Categories of financial assets as of December 31, 2014, consist of the following:

In millions of Korean Won

Description

Financial

assets at

FVTPL

Loans and

receivables

AFS financial

assets

Derivatives

designated

as hedging

instruments Book value Fair value

Cash and cash equivalents ₩ - ₩ 7,096,513 ₩ - ₩ - ₩ 7,096,513 ₩ 7,096,513

Short-term and long-term

financial instruments -4,101,550 - - 4,101,550 4,101,550

Trade notes and accounts

receivable -3,801,626 - - 3,801,626 3,801,626

Other receivables - 3,143,926 - - 3,143,926 3,143,926

Other financial assets 14,857,723 241,762 2,266,066 39,002 17,404,553 17,404,553

Other assets - 434,481 - - 434,481 434,481

Financial services receivables - 43,994,588 - - 43,994,588 44,292,330

₩ 14,857,723 ₩ 62,814,446 ₩ 2,266,066 ₩ 39,002 ₩ 79,977,237 ₩ 80,274,979

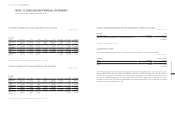

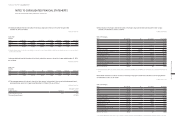

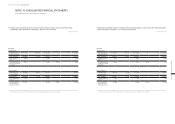

Categories of financial assets as of December 31, 2013, consisted of the following:

In millions of Korean Won

Description

Financial

assets at

FVTPL

Loans and

receivables

AFS financial

assets

Derivatives

designated

as hedging

instruments Book value Fair value

Cash and cash equivalents ₩ - ₩ 6,872,430 ₩ - ₩ - ₩ 6,872,430 ₩ 6,872,430

Short-term and long-term

financial instruments - 14,910,783 - - 14,910,783 14,910,783

Trade notes and accounts

receivable - 3,528,654 - - 3,528,654 3,528,654

Other receivables - 2,845,387 - - 2,845,387 2,845,387

Other financial assets 448,892 248,721 2,515,396 26,696 3,239,705 3,239,705

Other assets - 363,352 - - 363,352 363,352

Financial services receivables - 41,013,607 - - 41,013,607 41,566,247

₩ 448,892 ₩ 69,782,934 ₩ 2,515,396 ₩ 26,696 ₩ 72,773,918 ₩ 73,326,558

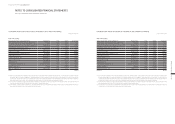

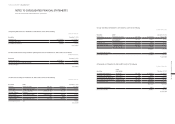

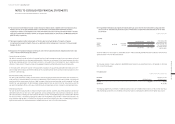

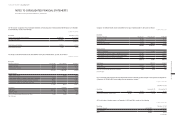

(2) Categories of financial liabilities as of December 31, 2014, consist of the following:

In millions of Korean Won

Description

Financial

liabilities at

FVTPL

Financial

liabilities carried at

amortized cost

Derivatives

designated

as hedging

instruments Book value Fair value

Trade notes and accounts payable ₩ - ₩ 7,041,529 ₩ - ₩ 7,041,529 ₩ 7,041,529

Other payables - 4,688,812 -4,688,812 4,688,812

Borrowings and debentures - 54,257,932 -54,257,932 55,033,485

Other financial liabilities 10,331 9,471 414,029 433,831 433,831

Other liabilities - 1,954,335 -1,954,335 1,954,335

₩ 10,331 ₩ 67,952,079 ₩ 414,029 ₩ 68,376,439 ₩ 69,151,992

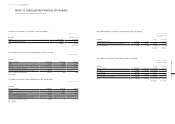

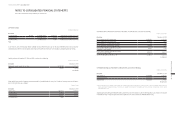

Categories of financial liabilities as of December 31, 2013, consisted of the following:

In millions of Korean Won

Description

Financial

liabilities at

FVTPL

Financial

liabilities carried at

amortized cost

Derivatives

designated

as hedging

instruments Book value Fair value

Trade notes and accounts payable ₩ - ₩ 6,722,740 ₩ - ₩ 6,722,740 ₩ 6,722,740

Other payables - 4,703,454 -4,703,454 4,703,454

Borrowings and debentures - 47,966,862 -47,966,862 48,636,232

Other financial liabilities 3,063 19,711 561,408 584,182 584,182

Other liabilities - 1,664,019 -1,664,019 1,664,019

₩ 3,063 ₩ 61,076,786 ₩ 561,408 ₩ 61,641,257 ₩ 62,310,627

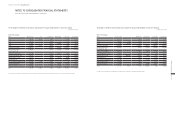

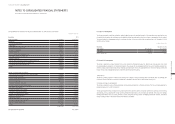

(3) Fair value estimation

Financial instruments that are measured subsequent to initial recognition at fair value are grouped into Level 1 to Level 3, based on

the degree to which the fair value is observable, as described below:

■ Level 1 : Fair value measurements are those derived from quoted prices (unadjusted) in active markets for identical assets or liabilities.

■ Level 2 : Fair value measurements are those derived from inputs other than quoted prices included within Level 1 that are

observable for the asset or liability, either directly (i.e. as prices) or indirectly (i.e. derived from prices).

■

Level 3 : Fair value measurements are those derived from valuation techniques that include inputs for the asset or liability that are

not based on observable market data (unobservable inputs).

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013