Hyundai 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 141140

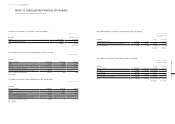

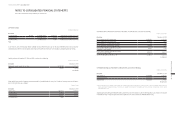

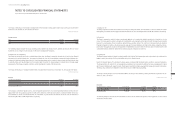

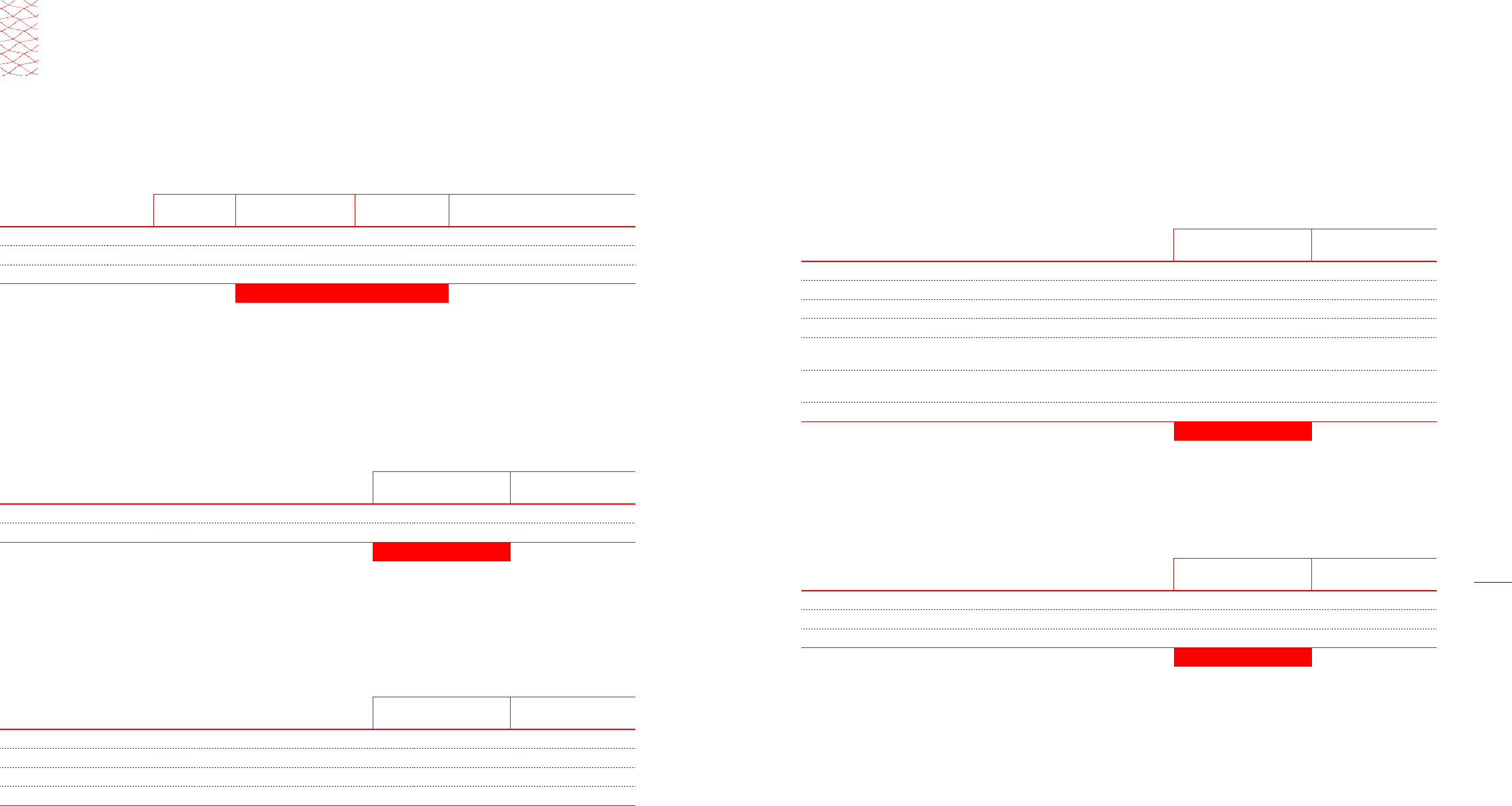

(2) Preferred stock

In millions of Korean Won

Description Par value Issued Korean Won Dividend rate

1st preferred stock ₩ 5,000 25,109,982 shares ₩ 125,550 Dividend rate of common stock + 1%

2nd preferred stock ˝37,613,865 shares 193,069 Dividend rate of common stock + 2%

3rd preferred stock ˝2,478,299 shares 12,392 Dividend rate of common stock + 1%

Total 65,202,146 shares ₩ 331,011

As of March 5, 2001, the Company retired 1,000,000 second preferred shares. Due to this stock retirement, the total face value of

outstanding stock differs from the capital stock amount. The preferred shares are non-cumulative, participating and non-voting.

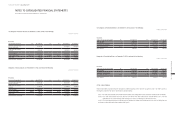

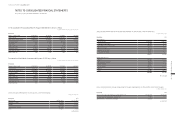

21. CAPITAL SURPLUS:

Capital surplus as of December 31, 2014 and 2013, consists of the following:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Stock paid-in capital in excess of par value ₩ 3,321,334 ₩ 3,321,334

Others 813,216 809,334

₩ 4,134,550 ₩ 4,130,668

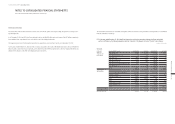

22. OTHER CAPITAL ITEMS:

Other capital items consist of treasury stocks purchased for the stabilization of stock price. Number of treasury stocks as of Decem-

ber 31, 2014 and 2013, are as follows:

Number of shares

Description December 31, 2014 December 31, 2013

Common stock 11,632,277 11,006,710

1st preferred stock 1,993,081 1,950,960

2nd preferred stock 1,053,727 1,000,000

3rd preferred stock 5,660 -

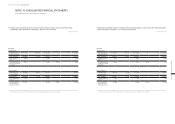

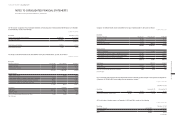

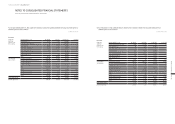

23. ACCUMULATED OTHER COMPREHENSIVE INCOME:

Accumulated other comprehensive income as of December 31, 2014 and 2013, consists of the following:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Gain on valuation of AFS financial assets ₩ 670,781 ₩ 737,234

Loss on valuation of AFS financial assets (163,791) (2,850)

Gain on valuation of cash flow hedge derivatives 15 2,589

Loss on valuation of cash flow hedge derivatives (30,378) (1,382)

Gain on share of the other comprehensive income

of equity-accounted investees 148,672 59,833

Loss on share of the other comprehensive income

of equity-accounted investees (395,272) (386,557)

Loss on foreign operations translation, net (1,574,853) (1,242,903)

₩ (1,344,826) ₩ (834,036)

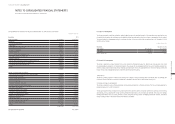

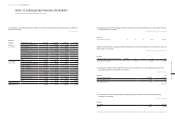

24. RETAINED EARNINGS AND DIVIDENDS:

(1) Retained earnings as of December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Legal reserve (*) ₩ 528,648 ₩ 475,707

Discretionary reserve 35,826,647 31,021,647

Unappropriated 18,294,568 16,776,885

₩ 54,649,863 ₩ 48,274,239

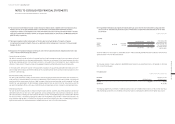

(*) The Commercial Code of the Republic of Korea requires the Company to appropriate as a legal reserve, a minimum of 10% of annual cash dividends declared, until such

reserve equals 50% of its capital stock issued. The reserve is not available for the payment of cash dividends, but may be transferred to capital stock or used to reduce

accumulated deficit, if any.

Appraisal gains, amounting to ₩1,852,871 million, derived from asset revaluation by the Asset Revaluation Law of Korea are included

in retained earnings. It may be only transferred to capital stock or used to reduce accumulated deficit, if any.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013