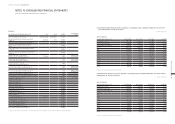

Hyundai 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 8988

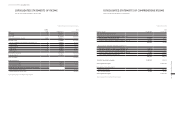

Subsidiaries

Nature of

the business Location

Ownership

percentage

Indirect

ownership

Hyundai Rotem Brasil Engineering Services LTD Sales Brazil 100.00% Hyundai Rotem

100.00%

China Millennium Corporations (CMEs) Holding company Cayman Islands 59.60%

KyoboAXA Private Tomorrow Securities Investment

Trust No.12 Investment Korea 100.00%

Shinyoung Private Securities Investment Trust WB-1 ˝ ˝ 100.00%

UBS Hana Dynamic Balance Private Investment

Trust 1 ˝ ˝ 100.00%

Shinhan BNPP Private Corporate Security Investment

Trust No.34 ˝ ˝ 100.00%

Miraeasset Triumph Private Equity Security Investment

Trust No.15 ˝ ˝ 100.00%

Autopia Forty-Third ~ Forty-Seventh

Asset Securitization Specialty Company (*) Financing ˝0.90% Hyundai Capital

Services 0.90%

Autopia Forty-Ninth ~ Fifty-Second

Asset Securitization Specialty Company (*) ˝ ˝ 0.50% Hyundai Capital

Services 0.50%

Autopia Fifty-Fourth ~ Fifty-five

Asset Securitization Specialty Company (*) ˝ ˝ 0.50% ˝

HB the Third Securitization Specialty Company (*) ˝ ˝ 0.90% Hyundai Capital

Services 0.90%

HB the Fourth Securitization Specialty Company (*) ˝ ˝ 0.31% Hyundai Capital

Services 0.31%

Privia the Third Securitization Specialty Co., Ltd. (*) ˝ ˝ 0.90% Hyundai Card 0.90%

Privia the Fourth ~ Fifth Securitization Specialty Co., Ltd. (*) ˝ ˝ 0.50% Hyundai Card 0.50%

Hyundai CHA Funding Corporation ˝USA 100.00% HCA 100.00%

Hyundai Lease Titling Trust ˝ ˝ 100.00% ˝

Hyundai HK Funding, LLC ˝ ˝ 100.00% ˝

Hyundai HK Funding Two, LLC ˝ ˝ 100.00% ˝

Hyundai HK Funding Three, LLC ˝ ˝ 100.00% ˝

Hyundai ABS Funding Corporation ˝ ˝ 100.00% ˝

HK Real Properties, LLC ˝ ˝ 100.00% ˝

Hyundai Auto Lease Offering, LLC ˝ ˝ 100.00% ˝

Hyundai HK Lease, LLC ˝ ˝ 100.00% ˝

Hyundai Protection Plan, Inc. Insurance ˝100.00% ˝

Hyundai Protection Plan Florida, Inc. ˝ ˝ 100.00% ˝

Hyundai Capital Insurance Services, LLC ˝ ˝ 100.00% ˝

Hyundai Capital Insurance Company ˝ ˝ 100.00% ˝

Power Protect Extended Services, Inc. ˝ ˝ 100.00% ˝

Power Protect Extended Services Florida, Inc. ˝ ˝ 100.00% ˝

(*) The Group is considered to have substantial control over the entities by virtue of an agreement with other investors or relationship with structured entities.

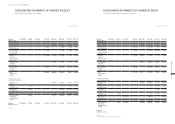

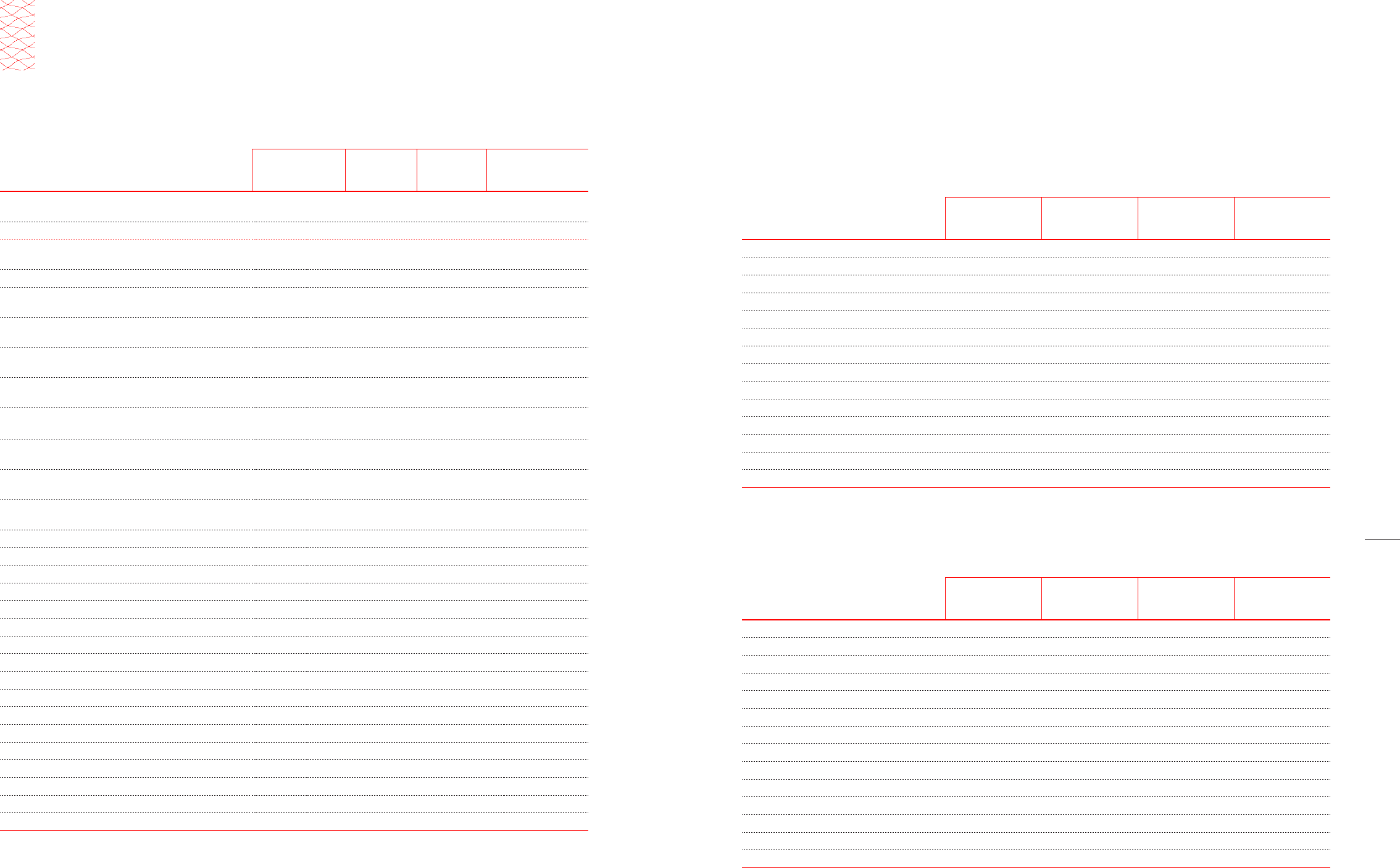

(2) Condensed financial position and results of operations of the Company’s major consolidated subsidiaries as of and for the

year ended December 31, 2014, are as follows:

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

Name of subsidiaries Assets Liabilities Sales

Profit (loss)

for the year

Hyundai Capital Services, Inc. (*) ₩ 22,538,708 ₩ 19,101,141 ₩ 3,011,804 ₩ 237,705

Hyundai Card Co., Ltd. (*) 12,397,420 9,842,039 2,617,995 223,514

Hyundai Rotem Company (*) 4,400,828 2,662,157 3,191,088 (15,109)

Hyundai KEFICO Corporation (*) 1,054,525 557,785 1,741,520 81,572

HCA (*) 30,361,736 27,835,212 5,342,308 266,867

HMA 6,516,465 3,795,729 16,812,738 378,405

HMMA 3,306,417 1,394,335 7,436,941 362,485

HMMC 3,241,318 1,646,741 5,397,857 440,955

HMI (*) 2,115,173 1,029,825 4,636,707 200,999

HME (*) 1,298,995 1,292,923 6,734,387 (38,666)

HAC (*) 998,306 538,314 2,939,635 67,576

HMMR 884,601 550,768 2,384,202 22,464

HMCA 696,189 498,732 1,972,615 61,715

HMCIS 641,565 396,810 3,353,943 49,902

(*) Based on the subsidiary’s consolidated financial statements.

In millions of Korean Won

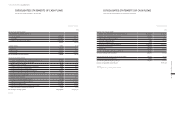

Name of subsidiaries Assets Liabilities Sales

Profit (loss)

for the year

Hyundai Capital Services, Inc. (*) ₩ 22,389,046 ₩ 19,136,092 ₩ 3,222,235 ₩ 391,427

Hyundai Card Co., Ltd. (*) 11,520,878 9,154,730 2,527,479 163,210

Hyundai Rotem Company (*) 4,274,897 2,485,374 3,299,370 126,076

Hyundai KEFICO Corporation (*) 894,606 481,021 1,666,971 98,432

HCA (*) 24,787,736 22,762,022 4,403,250 285,406

HMA 6,382,182 3,756,767 16,592,560 490,250

HMMA 3,031,145 1,294,805 7,385,302 479,606

HMMC 3,050,239 1,480,611 5,450,412 374,303

HMI (*) 1,904,660 968,802 4,736,902 220,593

HME (*) 1,130,991 1,084,122 5,531,337 4,164

HAC (*) 908,415 497,106 3,145,661 73,997

HMMR 1,285,326 606,948 2,750,925 209,710

HMCA 687,001 541,674 2,272,191 40,010

HMCIS 923,966 583,367 3,742,285 96,107

(*) Based on the subsidiary’s consolidated financial statements.

In millions of Korean Won

Condensed financial position and results of operations of the Company’s major consolidated subsidiaries as of and for the year

ended December 31, 2013, were as follows: