Hyundai 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 109108

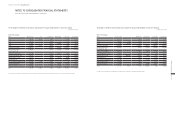

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

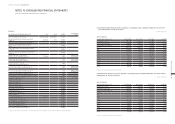

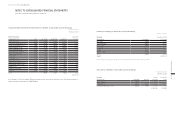

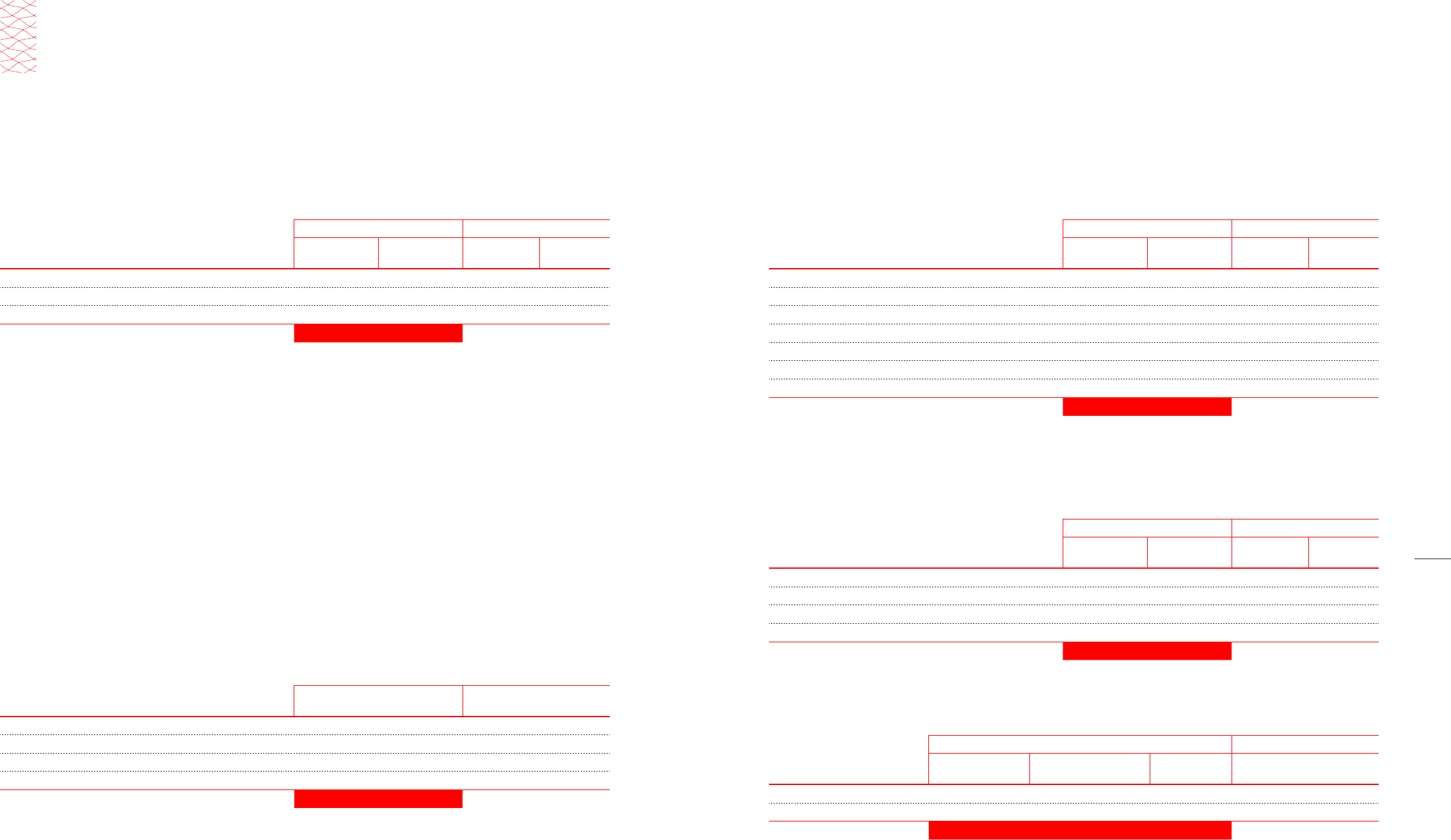

3. TRADE NOTES AND ACCOUNTS RECEIVABLE:

(1) Trade notes and accounts receivable as of December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

December 31, 2014 December 31, 2013

Description Current Non-current Current Non-current

Trade notes and accounts receivable ₩ 3,808,798 ₩ 57,100 ₩ 3,531,279 ₩ 47,969

Allowance for doubtful accounts (58,706) -(45,934) -

Present value discount accounts - (5,566) -(4,660)

₩ 3,750,092 ₩ 51,534 ₩ 3,485,345 ₩ 43,309

(2) Aging analysis of trade notes and accounts receivables

As of December 31, 2014 and 2013, total trade notes and accounts receivable that are past due, but not impaired, amount to ₩311,979

million and ₩310,984 million, respectively; of which ₩282,969 million and ₩264,159 million, respectively, are past due less than 90

days, but not impaired. As of December 31, 2014 and 2013, the impaired trade notes and accounts receivable amount to ₩58,706 mil-

lion and ₩45,934 million, respectively.

(3) Transferred trade notes and accounts receivable that are not derecognized

As of December 31, 2014 and 2013, total trade notes and accounts receivable which the Group transferred to financial institutions but

did not qualify for derecognition, amount to ₩1,100,610 million and ₩997,519 million, respectively. The Group recognize the carrying

amount of the trade notes and accounts receivable continuously due to the fact that the risks and rewards were not transferred sub-

stantially, and cash and cash equivalents received as consideration for the transfer are recognized as short-term borrowings.

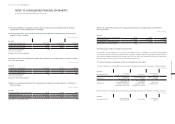

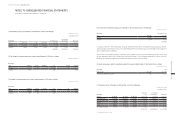

(4) The changes in allowance for doubtful accounts for the years ended December 31, 2014 and 2013, are as follows:

In millions of Korean Won

Description 2014 2013

Beginning of the year ₩ 45,934 ₩ 29,543

Impairment loss 16,548 14,959

Write-off (2,757) (539)

Effect of foreign exchange differences (1,019) 1,971

End of the year ₩ 58,706 ₩ 45,934

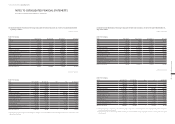

4. OTHER RECEIVABLES:

Other receivables as of December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

December 31, 2014 December 31, 2013

Description Current Non-current Current Non-current

Accounts receivable-others ₩ 2,083,571 ₩ 719,888 ₩ 1,672,402 ₩ 827,510

Due from customers for contract work 1,617,221 -1,393,555 -

Lease and rental deposits 28,119 298,401 42,784 274,832

Deposits 2,820 23,998 13,699 23,154

Others 93 119 2,549 7,283

Allowance for doubtful accounts (9,715) -(6,603) -

Present value discount accounts - (3,249) -(4,940)

₩ 3,722,109 ₩ 1,039,157 ₩ 3,118,386 ₩ 1,127,839

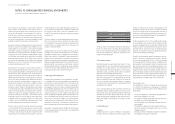

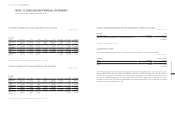

5. OTHER FINANCIAL ASSETS:

(1) Other financial assets as of December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

December 31, 2014 December 31, 2013

Description Current Non-current Current Non-current

Financial assets at fair value through profit or loss (“FVTPL”) ₩ 14,853,071 ₩ 4,652 ₩ 447,300 ₩ 1,592

Derivative assets that are effective hedging instruments 13,373 25,629 7,558 19,138

AFS financial assets 1,950 2,264,116 21,363 2,494,033

Loans 16,040 225,722 31,600 217,121

₩ 14,884,434 ₩ 2,520,119 ₩ 507,821 ₩ 2,731,884

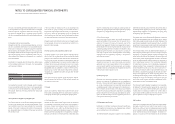

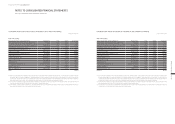

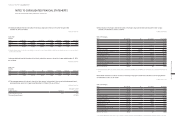

(2) AFS financial assets that are measured at fair value as of December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

December 31, 2014 December 31, 2013

Description Acquisition cost Valuation difference Book value Book value

Debt instruments ₩ 154,945 ₩ 4,402 ₩ 159,347 ₩ 124,240

Equity instruments 1,460,735 645,984 2,106,719 2,391,156

₩ 1,615,680 ₩ 650,386 ₩ 2,266,066 ₩ 2,515,396