Hyundai 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 9392

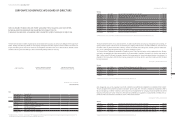

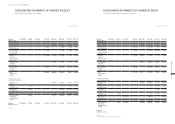

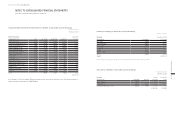

2) Risks associated with interests in an unconsolidated structured entity, which belongs to Group as of

December 31, 2014, are as follows:

In millions of Korean Won

Financial support provided to the structured entity Maximum amount of

exposure to loss of the

structured entity

Description

Book value in the

structured entity (*) Method Purpose

Asset securitization SPC ₩ 31,209 Mezzanine debt Credit facility ₩ 31,209

Investment fund 210,023 Beneficiary certificates Invest agreement 210,023

Investment trust 26,491 Investment trust ˝26,491

(*) Interest in structured entities is recognized as AFS financial assets and others according to K-IFRS 1039.

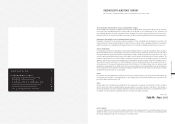

Risks associated with interests in an unconsolidated structured entity, which belongs to Group as of

December 31, 2013, were as follows:

In millions of Korean Won

Financial support provided to the structured entity Maximum amount of

exposure to loss of the

structured entity

Description

Book value in the

structured entity (*) Method Purpose

Asset securitization SPC ₩ 30,223 Mezzanine debt Credit facility ₩ 30,223

(*) Interest in structured entities was recognized as AFS financial assets and others according to K-IFRS 1039.

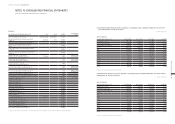

(8) Significant restrictions of the subsidiaries

1) As of December 31, 2014, Hyundai Card Co., Ltd. and Hyundai Capital Services, Inc., subsidiaries of the Company have signifi-

cant restrictions that require them to obtain consent from directors appointed by non-controlling shareholders in the event of

merger, investment in stocks, transfer of the whole or a significant part of assets, borrowing, guarantee or disposal of assets

beyond a certain amount, acquirement of treasury stock, payment of dividend and so on.

2) As of December 31, 2014, Hyundai Rotem Company, subsidiary of the Company, is required to obtain consent from directors

appointed by non-controlling shareholders in the event of significant change in the capital structure of the entity, excluding

transactions according to the business plan or the regulation of the Board of Directors, such as issue, disposal, repurchase or

retirement of stocks or options, increase or decrease of capital, and so on.

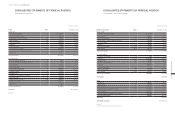

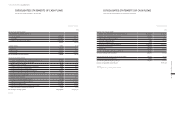

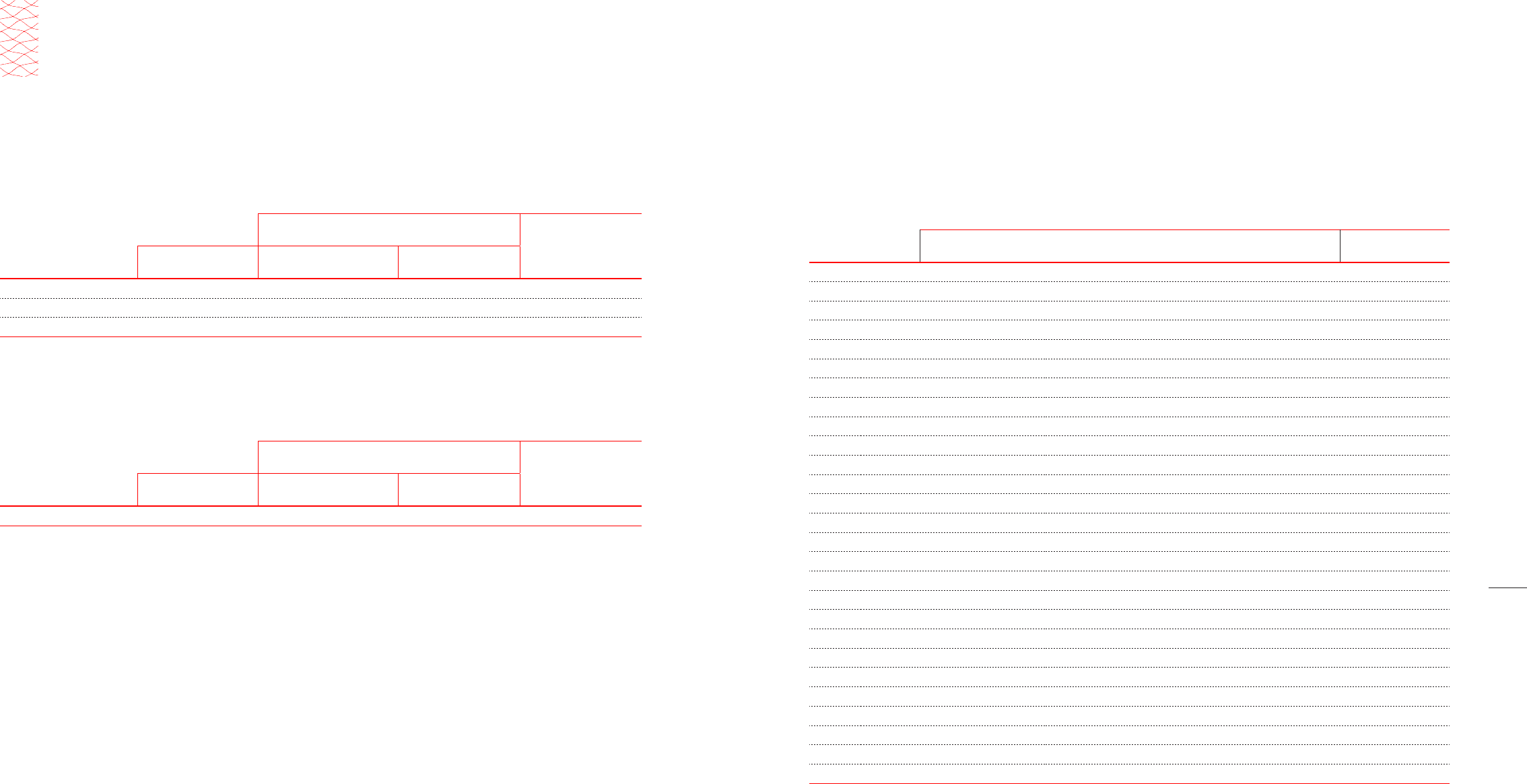

(9) Changes in consolidated subsidiaries

Subsidiaries newly included in and excluded from consolidation for the year ended December 31, 2014, are as follows:

Changes Name of subsidiaries Description

Included Hyundai Capital Canada Inc. (HCCA) Establishment

˝Hyundai Capital Lease Inc. ˝

˝Hyundai Motor Netherlands B.V. (HMNL) ˝

˝Hyundai Rotem Brasil Engineering Services LTD ˝

˝KyoboAXA Private Tomorrow Securities Investment Trust No.12 ˝

˝Shinyoung Private Securities Investment Trust WB-1 ˝

˝UBS Hana Dynamic Balance Private Investment Trust 1 ˝

˝Shinhan BNPP Private Corporate Security Investment Trust No.34 ˝

˝Miraeasset Triumph Private Equity Security Investment Trust No.15

˝Autopia Fifty-Fourth Asset Securitization Specialty Company ˝

˝Autopia Fifty-Fifth Asset Securitization Specialty Company ˝

˝Privia the Fourth Securitization Specialty Co., Ltd. ˝

˝Privia the Fifth Securitization Specialty Co., Ltd. ˝

˝Hyundai HK Funding Three, LLC ˝

˝Power Protect Extended Services, Inc. ˝

˝Power Protect Extended Services Florida, Inc. ˝

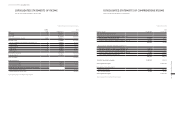

Excluded Hyundai Motor Norway AS (HMN) Merger (*)

˝Hyundai Motor Hungary (HMH) Liquidation

˝IBK Panorama Private Equity Security Investment Trust No.50 ˝

˝Woori Frontier Private Equity Security Investment Trust No.5 ˝

˝KTB Safe Private Equity Security Investment Trust No.78 ˝

˝Macquarie Lion Private Equity Security Investment Trust Security No.45 ˝

˝Shinhan BNPP Private Corporate Security Investment Trust No.27 ˝

˝Miraeasset Triumph Private Equity Security Investment Trust No.13 ˝

˝Autopia Thirty-Sixth Asset Securitization Specialty Company ˝

˝Autopia Fourty-Second Asset Securitization Specialty Company ˝

˝Privia the Second Securitization Specialty Co., Ltd. ˝

(*) HMN has been merged with HMUK, a subsidiary of the Company, during the year ended December 31, 2014.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013