Hyundai 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 9594

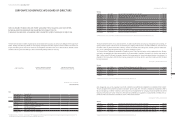

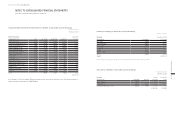

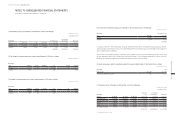

(10) Decrease in the Group's ownership interests in one of its subsidiary and the consequent effects on the equity attributable to

the owners of the Company for the year ended December 31, 2014, is as follows:

In millions of Korean Won

Description HCA (*1) HAOSVT (*2)

Ownership percentage before transaction 85.00% 89.29%

Ownership percentage after transaction 80.00% 83.91%

Increase in paid-in capital and proceeds on disposal ₩ 132,263 ₩ 23,678

Changes in non-controlling interests 133,215 16,909

Changes in capital surplus (952) 4,834

(*1) The ownership percentage of the Group decreased as a result of not participating in the paid-in capital increase that occurred during the year ended December 31, 2014.

(*2) The ownership percentage of the Group decreased as the Group disposed its shares partially during the year ended December 31, 2014.

- K-IFRS interpretation 2121 (Enactment): ‘Levies’

The enactment to K-IFRS 2121 clarifies that the obligating

event giving rise to the recognition of a liability to pay a levy

is the activity that triggers the payment of the levy in accor-

dance with the related legislation.

The above mentioned changes in accounting policies did not

have any significant effect on the Group’s consolidated financial

statements.

2) New and revised standards that have been issued but are

not yet effective as of the authorization date for issue of

financial statements, and that have not been applied earlier

by the Group are as follows:

- K-IFRS 1019 (Amendment): ‘Employee Benefits’

The amendments to K-IFRS 1019 permit to recognize amount

of contributions as a reduction in the service cost in which

the related service is rendered if the amount of the contribu-

tions are independent of the number of years of service. The

amendments are effective for the annual periods beginning on

or after July 1, 2014.

- K-IFRS 1016 (Amendment): ‘Property, Plant and Equipment’

The amendments to K-IFRS 1016 prohibit from using a reve-

nue-based depreciation method for items of property, plant

and equipments. The amendments are effective for the annual

periods beginning on or after January 1, 2016.

- K-IFRS 1038 (Amendment): ‘Intangible Assets’

The amendments to K-IFRS 1038 rebut presumption that rev-

enue is not an appropriate basis for the amortization of intan-

gible assets, which the presumption can only be rebutted when

the intangible asset expressed as a measure of revenue or

when it can be demonstrated that revenue and consumption of

the economic benefits of the intangible asset are highly cor-

related. The amendments to K-IFRS 1038 apply prospectively

for annual periods beginning on or after January 1, 2016.

- K-IFRS 1111 (Amendment): ‘Joint Arrangements’

The amendments to K-IFRS 1111 provide guidance on how to

account for the acquisition of joint operation that constitues a

business as defined in K-IFRS 1103 ‘Business Combintations’. A

joint operator is also required to disclose the relevant informa-

tion required by K-IFRS 1103 and other standards for business

combinations. The amendments to K-IFRS 1111 are effective

for the annual periods beginning on or after January 1, 2016.

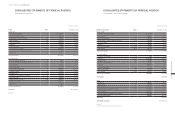

- Annual Improvements to K-IFRS 2010-2012 Cycle

The amendments to K-IFRS 1002 (i) change the definitions of

‘vesting condition’ and ‘market condition’; and (ii) add definition

for ‘performance condition’ and ‘service condition’ which were

previously included within the definition of ‘vesting condition’.

The amendments to K-IFRS 1103 clarify the classification and

measurement of the contingent consideration in business com-

bination. The amendments to K-IFRS 1108 clarify that a recon-

ciliation of the total of the reportable segments’ assets should

only be provided if the segment assets are regularly provided to

the chief operating decision maker. The amendments are effec-

tive for the annual periods beginning on or after July 1, 2014.

- Annual Improvements to K-IFRS 2011-2013 Cycle

The amendments to K-IFRS 1103 clarify the scope of the

portfolio exception for measuring the fair values of the group

of financial assets and financial liabilities on a net basis in-

cludes all contracts that are within the scope the standard

does not apply to the accounting for the formation of all types

of joint arrangement in the financial statements of the joint

arrangement itself. The amendments to K-IFRS 1113 ‘Fair Val-

ue Measurement’ and K-IFRS 1040 ‘Investment Property’ exist

and these amendments are effective to the annual periods

beginning on or after July 1, 2014.

The Group does not anticipate that the above mentioned enact-

ments and amendments will have any significant effect on the

Group’s consolidated financial statements.

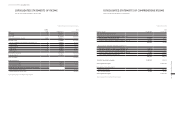

(2) Basis of measurement

The consolidated financial statements have been prepared on

the historical cost basis except as otherwise stated in the ac-

counting policies below. Historical cost is usually measured at

the fair value of the consideration given to acquire the assets.

(3) Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities (including structured

entities) controlled by the Company (or its subsidiaries). Control

2. SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES:

The Company maintains its official accounting records in Korean

Won and prepares its consolidated financial statements in con-

formity with Korean International Financial Reporting Standards

(“K-IFRS”), in Korean language (Hangul). Accordingly, these con-

solidated financial statements are intended for use by those who

are informed about K-IFRS and Korean practices. The accompa-

nying consolidated financial statements have been condensed,

restructured and translated into English with certain expanded de-

scriptions from Korean language consolidated financial statements.

Certain information included in Korean language consolidated

financial statements, but not required for a fair presentation of

the Group’s consolidated statements of financial position, income,

comprehensive income, changes in equity or cash flows, is not

presented in the accompanying consolidated financial statements.

(1) Basis of consolidated financial statements preparation

The Group has prepared the consolidated financial statements in

accordance with K-IFRS.

The consolidated financial statements as of and for the year

ended on December 31, 2014, to be submitted at the ordinary

shareholders’ meeting were authorized for issuance at the

board of directors’ meeting on February 12, 2015.

The significant accounting policies used for the preparation of

the consolidated financial statements are summarized below.

These accounting policies are consistent with those applied to

the consolidated financial statements for the year ended De-

cember 31, 2013, except for the adoption effect of the new ac-

counting standards and interpretations described below.

1) New and revised standards that have been applied from the

year beginning on January 1, 2014, are as follows:

- K-IFRS 1032 (Amendment): ‘Financial Instruments: Presentation’

The amendments to K-IFRS 1032 clarify the requirement to

offset financial assets and financial liabilities within the pre-

sentation of the statements of financial position: the right to

offset must not be conditional upon the occurrence of future

events and can be exercised anytime during the contract pe-

riods. The right to offset is executable even in the case of de-

fault or insolvency.

- K-IFRS 1036 (Amendment): ‘Impairment of Assets’

The amendments to K-IFRS 1036 require disclosure of the re-

coverable amounts of cash generating units or individual assets

only when there has been impairment or reversal of impairment.

- K-IFRS 1039 (Amendment): ‘Financial Instruments: Recognition

and Measurement’

The amendments to K-IFRS 1039 permit the use of hedge ac-

counting when, as a consequence of the introduction of laws

or regulations, the original counterparty to the hedging instru-

ment is replaced by a central counterparty or an entity which is

acting as counterparty in order to effect clearing by a central

counterparty.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013