Hyundai 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 127126

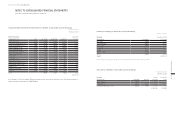

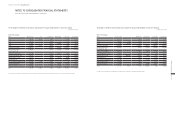

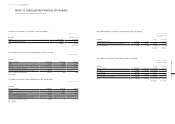

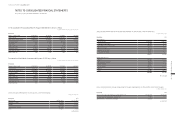

(7) The market price of listed equity securities as of December 31, 2014, is as follows:

In millions of Korean Won, except price per share

Name of the company Price per share Total number of shares Market value

Kia Motors Corporation ₩ 52,300 ₩ 137,318,251 ₩ 7,181,745

Hyundai Engineering & Construction Co., Ltd. 42,100 23,327,400 982,084

Hyundai WIA Corporation 176,000 6,893,596 1,213,273

Hyundai HYSCO Co., Ltd. 72,700 6,698,537 486,984

HMC Investment Securities Co., Ltd. 10,150 8,065,595 81,866

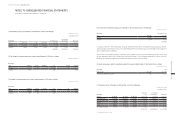

13. FINANCIAL SERVICES RECEIVABLES:

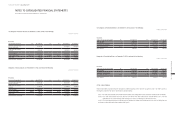

(1) Financial services receivables as of December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Loans ₩ 31,464,943 ₩ 29,078,336

Card receivables 10,601,341 9,806,136

Financial lease receivables 2,730,188 3,038,540

Others 16,755 11,348

44,813,227 41,934,360

Allowance for doubtful accounts (845,566) (823,408)

Loan origination fee 35,682 (89,881)

Present value discount accounts (8,755) (7,464)

₩ 43,994,588 ₩ 41,013,607

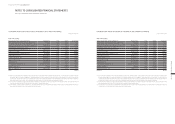

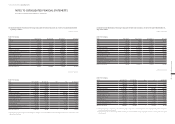

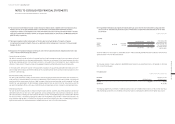

(2) Aging analysis of financial services receivables

As of December 31, 2014 and 2013, total financial services receivables that are past due but not impaired are ₩1,751,712 million and

₩1,288,443 million, respectively; all of them are past due less than 90 days. As of December 31, 2014 and 2013, the impaired financial

services receivables amount to ₩513,128 million and ₩530,638 million, respectively.

(3) Transferred financial services receivables that are not derecognized

As of December 31, 2014 and 2013, the Group issued asset backed securities, which have recourse to the underlying assets, based

on loans, card receivables and others. As of December 31, 2014, the carrying amounts and fair values of the transferred financial

assets that are not derecognized are ₩15,046,062 million and ₩15,220,978 million, respectively, the carrying amounts and fair values

of the associated liabilities are ₩10,962,648 million and ₩10,927,013 million, respectively, and the net position is ₩4,293,965 million.

As of December 31, 2013, the carrying amounts and fair values of the transferred financial assets that were not derecognized were

₩14,802,187 million and ₩14,709,639 million, respectively, the carrying amounts and fair values of the associated liabilities were

₩10,934,023 million and ₩11,101,945 million, respectively, and the net position was ₩3,607,694 million.

(4) The changes in allowance for doubtful accounts of financial services receivables for the years ended December 31, 2014 and

2013, are as follows:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Beginning of the year ₩ 823,408 ₩ 749,166

Impairment loss 629,261 669,339

Write-off (527,556) (474,001)

Effect of foreign exchange differences 6,706 (2,761)

Disposals and others (86,253) (118,335)

End of the year ₩ 845,566 ₩ 823,408

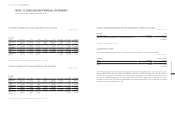

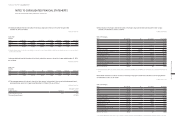

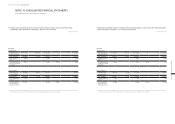

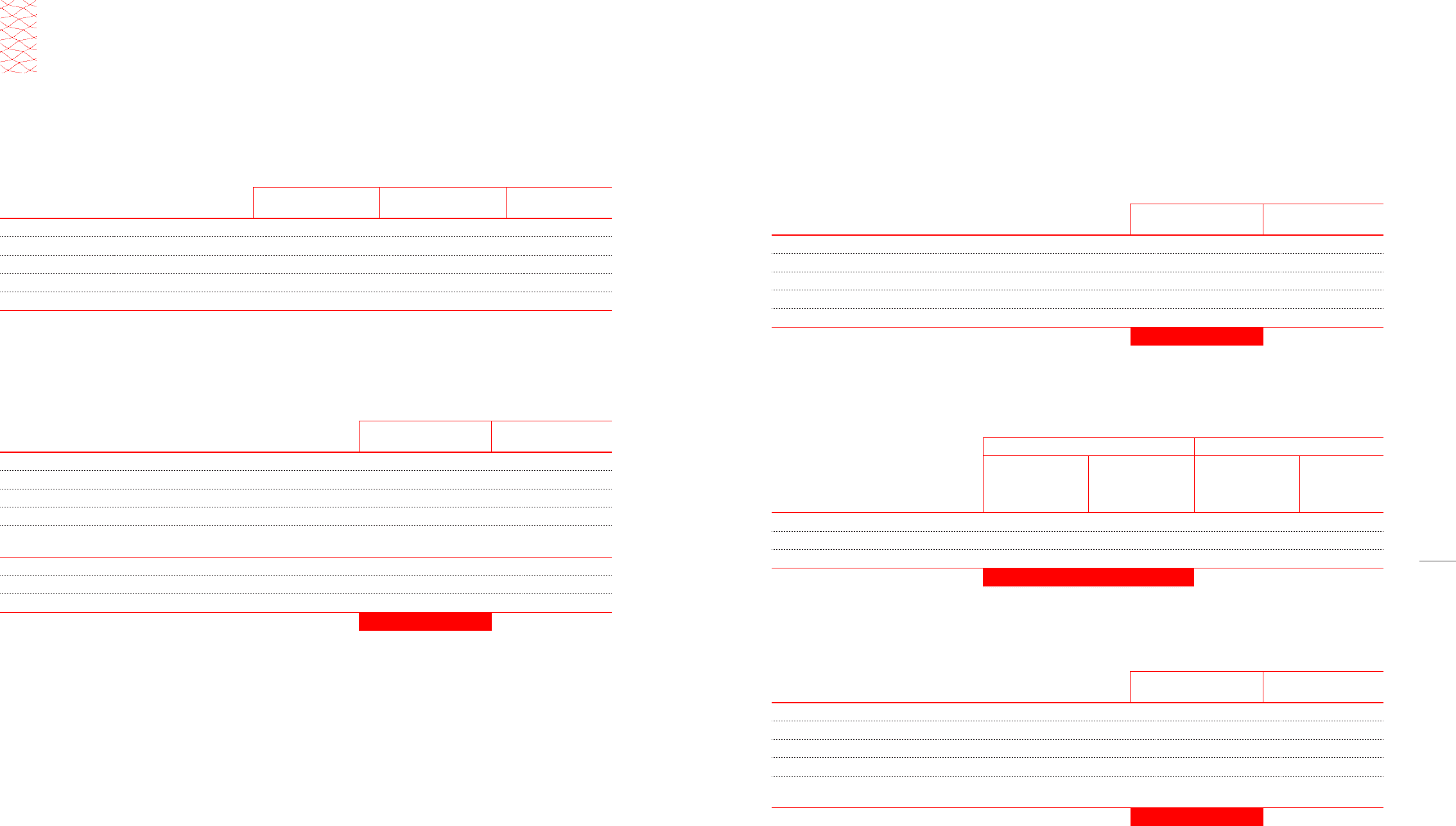

(5) Gross investments in financial leases and their present value of minimum lease receipts as of December 31, 2014 and 2013,

are as follows:

In millions of Korean Won

December 31, 2014 December 31, 2013

Description

Gross

investments

in financial leases

Present value

of minimum

lease receipts

Gross

investments

in financial leases

Present value

of minimum

lease receipts

Not later than one year ₩ 1,284,279 ₩ 1,117,016 ₩ 1,453,668 ₩ 1,257,942

Later than one year and not later than five years 1,743,890 1,609,391 1,944,394 1,776,643

Later than five years 229 227 172 171

₩ 3,028,398 ₩ 2,726,634 ₩ 3,398,234 ₩ 3,034,756

(6) Unearned interest income of financial leases as of December 31, 2014 and 2013, is as follows:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Gross investments in financial lease ₩ 3,028,398 ₩ 3,398,234

Net lease investments:

Present value of minimum lease receipts 2,726,634 3,034,756

Present value of unguaranteed residual value 3,554 3,784

2,730,188 3,038,540

Unearned interest income ₩ 298,210 ₩ 359,694

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013