Hyundai 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 9190

(3) The financial statements of all subsidiaries, which are used in the preparation of the consolidated financial statements,

are prepared for the same reporting periods as the Company’s.

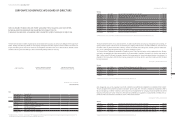

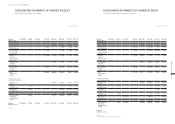

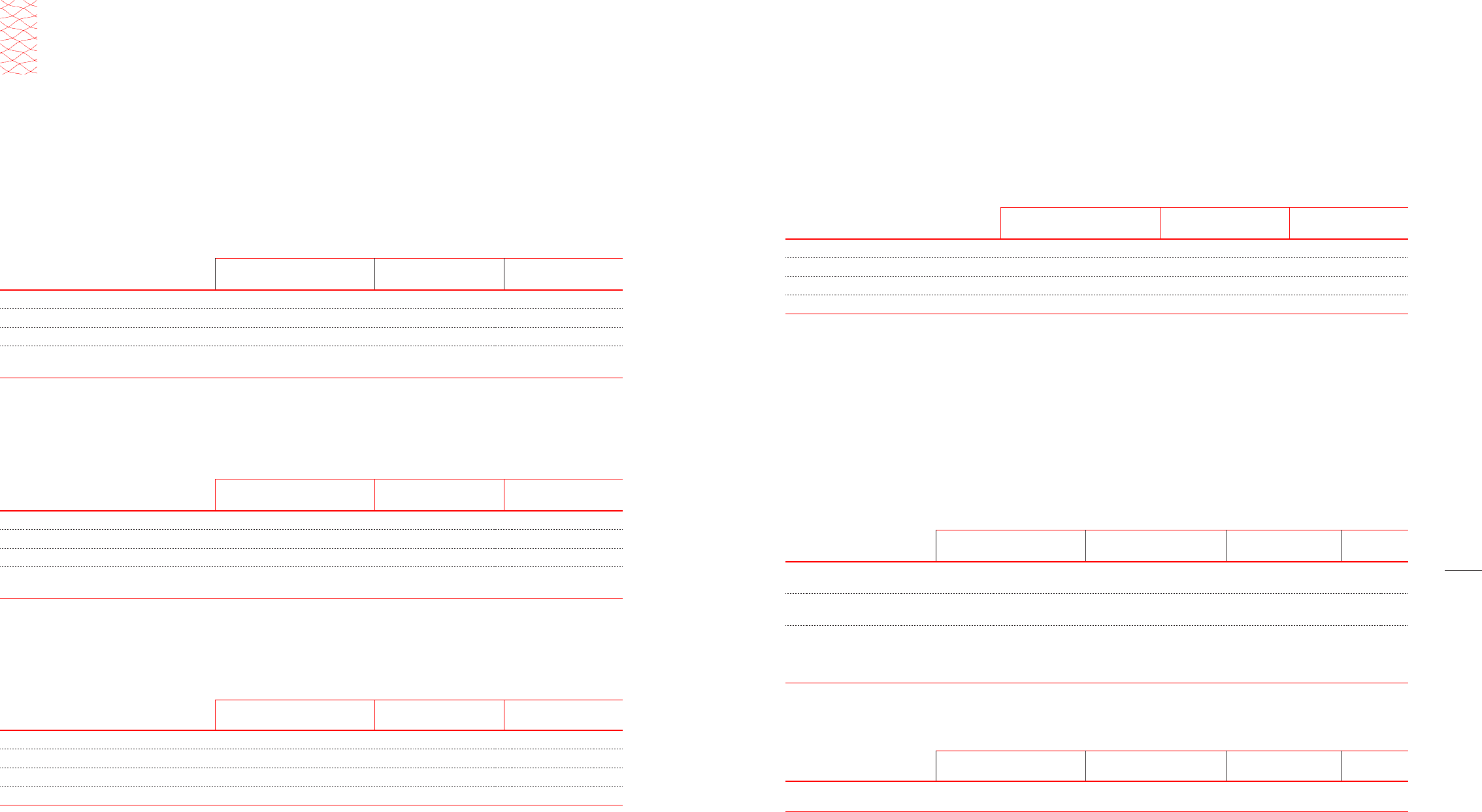

(4) Summarized cash flows of non-wholly owned subsidiaries that have material non-controlling interests to the Group as of

December 31, 2014, are as follows:

In millions of Korean Won

Description Hyundai Capital Services, Inc. Hyundai Card Co., Ltd. Hyundai Rotem Company

Cash flows from operating activities ₩ (976,758) ₩ (1,351,845) ₩ (188,798)

Cash flows from investing activities (64,890) (141,427) (57,753)

Cash flows from financing activities 147,298 695,513 245,511

Effect of exchange rate changes

on cash and cash equivalents

(44) -119

Net decrease in cash and cash equivalents ₩ (894,393) ₩ (797,758) ₩ (921)

Summarized cash flows of non-wholly owned subsidiaries that had material non-controlling interests to the Group as of Decem-

ber 31, 2013, were as follows:

In millions of Korean Won

Description Hyundai Capital Services, Inc. Hyundai Card Co., Ltd. Hyundai Rotem Company

Cash flows from operating activities ₩ (140,669) ₩ 103,169 ₩ (408,594)

Cash flows from investing activities 69,086 (105,453) (24,474)

Cash flows from financing activities 272,041 176,192 440,503

Effect of exchange rate changes

on cash and cash equivalents

(20) - (4,183)

Net increase in cash and cash equivalents ₩ 200,438 ₩ 173,908 ₩ 3,252

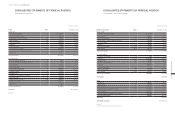

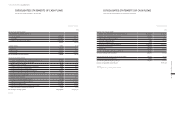

(5) Details of non-wholly owned subsidiaries of the Company that have material non-controlling interests as of December 31,

2014, are as follows:

In millions of Korean Won

Description Hyundai Capital Services, Inc. Hyundai Card Co., Ltd. Hyundai Rotem Company

Ownership percentage of non-controlling interests 43.53% 63.04% 56.64%

Non-controlling interests ₩ 1,496,716 ₩ 1,611,007 ₩ 1,056,862

Profit attributable to non-controlling interests 104,053 140,912 (11,870)

Dividends paid to non-controlling interests - - 6,984

Details of non-wholly owned subsidiaries of the Company that had material non-controlling interests as of December 31,

2013, were as follows:

In millions of Korean Won

Description Hyundai Capital Services, Inc. Hyundai Card Co., Ltd. Hyundai Rotem Company

Ownership percentage of non-controlling interests 43.53% 63.04% 56.64%

Non-controlling interests ₩ 1,415,812 ₩ 1,491,715 ₩ 1,088,548

Profit attributable to non-controlling interests 170,307 105,461 62,686

Dividends paid to non-controlling interests 78,365 - 155

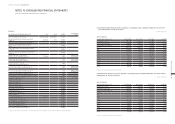

(6) Financial support provided to consolidated structured entities

As of December 31, 2014, Hyundai Card Co., Ltd. and Hyundai Capital Services, Inc., subsidiaries of the Company, have agreements

which provide counterparties with rights to claim themselves in the event of default on the derivatives relating to asset-backed secu-

rities issued by consolidated structured entities, Autopia Forty-Fifth, Forty-Sixth, Forty-Ninth and Fifty-Second Asset Securitization

Specialty Company, Privia the third and the Fourth Securitization Specialty Co., Ltd.

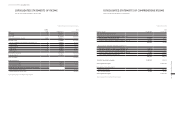

(7) The nature and the risks associated with interests in unconsolidated structured entities

1) Nature of interests in an unconsolidated structured entity, which belongs to the Group as of December 31, 2014, is as follows:

In millions of Korean Won

Description Purpose Nature of business Method of funding Total assets

Asset securitization SPC Fund raising

through asset-securitization Fund collection Corporaten Bond

and others ₩ 305,457

Investment fund Investment in

beneficiary certificate

Fund management and

operation

Sales of beneficiary

certificates 13,207,887

Investment trust

Development trust,

Unspecified monetary trust,

Principal unsecured trust,

Operation of trust investment

Trust management

and operation,

Payment of trust fee,

Distribution of trust benefit

Sales of trust

investment product 34,442

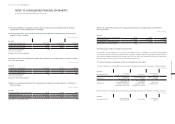

Nature of interests in an unconsolidated structured entity, which belongs to the Group as of December 31, 2013, was as follows:

In millions of Korean Won

Description Purpose Nature of business Method of funding Total assets

Asset securitization SPC Fund raising through

asset-securitization Fund collection Corporate Bond

and others ₩ 396,497

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013