Hyundai 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 139138

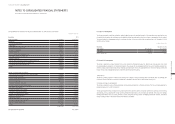

(9) The quantitative information about significant unobservable inputs used in the fair value measurements categorized within

Level 3 of the fair-value hierarchy and the description of relationships of significant unobservable inputs to the fair value

are as follows:

In millions of Korean Won

Description

Fair value at

December 31, 2014

Valuation

Techniques Unobservable inputs Range

Description of

relationship

Unlisted

equity

securities

₩ 247,483 Discounted

cash flow

Sales growth rate 0.5% ~ 8.2% If the sales growth

rate and the pre-tax

operating income ratio

rise or the discount

rate declines, the fair

value increases.

Pre-tax operating income ratio 2.1% ~ 21.8%

Discount rate 7.9% ~ 14.0%

The Group believes that the changes of unobservable inputs to reflect reasonably possible alternative assumptions would not have

significant effects on the fair value measurements.

20. CAPITAL STOCK:

The Company’s number of shares authorized is 600,000,000 shares. Common stock and preferred stock as of December 31, 2014 and

2013, consist of the following:

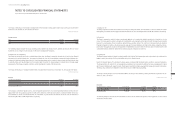

(1) Common stock

In millions of Korean Won, except par value

Description December 31, 2014 December 31, 2013

Issued 220,276,479 shares 220,276,479 shares

Par value ₩ 5,000 ₩ 5,000

Capital stock ₩ 1,157,982 ₩ 1,157,982

The Company completed stock retirement of 10,000,000 common shares and 1,320,000 common shares as of March 5, 2001 and May 4,

2004, respectively. Due to these stock retirements, the total face value of outstanding stock differs from the capital stock amount.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

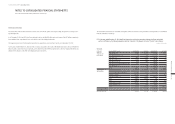

(6) The commission income (financial services revenue) arising from financial assets or liabilities other than financial assets or

liabilities at FVTPL for the years ended December 31, 2014 and 2013, are ₩1,646,656 million and ₩1,646,100 million,

respectively. In addition, the fee expenses (cost of sales from financial services) occurring from financial assets or liabilities

other than financial assets or liabilities at FVTPL for the years ended December 31, 2014 and 2013, are ₩787,994 million and

₩897,756 million, respectively.

(7) The Group recognizes transfers between levels of the fair-value hierarchy at the date of the event or change in

circumstances that caused the transfer. There are no significant transfers between Level 1 and Level 2 for the year ended

December 31, 2014.

(8) Descriptions of the valuation techniques and the inputs used in the fair value measurements categorized within Level 2 and

Level 3 of the fair-value hierarchy are as follows:

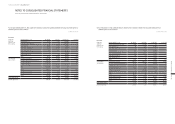

- Currency forwards and options

Fair value of currency forwards and options is measured based on forward exchange rate quoted in the current market at the end

of the reporting period, which has the same remaining period of derivatives to be measured. If the forward exchange rate, which

has the same remaining period of currency forward and option, is not quoted in the current market, fair value is measured using

estimates of similar period of forward exchange rate by applying interpolation method with quoted forward exchange rates.

As the inputs used to measure fair value of currency forwards and options are supported by observable market data, such as for-

ward exchange rates, the Group classified the estimates of fair value measurements of the currency forwards and options as Level

2 of the fair-value hierarchy.

- Debt instruments including corporate bonds

Fair value of debt instruments including corporate bonds is measured applying discounted cash flow method. The rate used to dis-

count cash flows is determined based on swap rate and credit spreads of debt instruments, which have the similar credit rating and

period quoted in the current market with those of debt instruments including corporate bonds that should be measured. The Group

classifies fair value measurements of debt instruments including corporate bonds as Level 2 of the fair-value hierarchy since the

rate, which has significant effects on fair value of debt instruments including corporate bonds, is based on observable market data.

- Unlisted equity securities

Fair value of unlisted equity securities is measured using discounted cash flow projection, and certain assumptions not based on

observable market prices or rate, such as sales growth rate, pre-tax operating income ratio and discount rate based on business

plan and circumstance of industry are used to estimate the future cash flow. The weighted-average cost of capital used to discount

the future cash flows, is calculated by applying the Capital Asset Pricing Model, using the data of similar listed companies. The

Group determines that the effect of estimation and assumptions referred above affecting fair value of unlisted equity securities is

significant and classifies fair value measurements of unlisted securities as Level 3 of the fair-value hierarchy.