Hyundai 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 117116

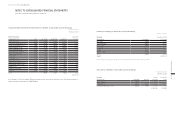

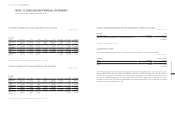

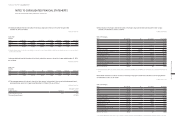

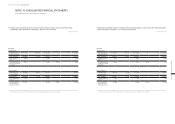

(2) The changes in intangible assets for the year ended December 31, 2014, are as follows:

In millions of Korean Won

Description

Beginning of

the year

Internal

developments

and separate

acquisitions

Transfers

within

intangible

assets Disposals Amortization

Impairment

loss Others (*)

End of

the year

Goodwill ₩ 299,352 ₩ - ₩ - ₩ - ₩ - ₩ (1,429) ₩ (11,445) ₩ 286,478

Development

costs 1,945,557 1,117,115 33,377 (4,386) (564,905) (9,391) 37,616 2,554,983

Industrial

property rights 44,367 40,605 16,141 - (9,571) - (1,580) 89,962

Software 273,421 14,811 45,800 (124) (103,560) - 84,633 314,981

Others 291,903 6,977 27,749 (3,305) (28,059) (358) 18,978 313,885

Construction in

progress 274,490 173,962 (123,067) - - (17,418) (46,600) 261,367

₩ 3,129,090 ₩ 1,353,470 ₩ - ₩ (7,815) ₩ (706,095) ₩ (28,596) ₩ 81,602 ₩ 3,821,656

(*) Others include the effect of foreign exchange differences and transfer from or to other accounts.

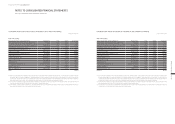

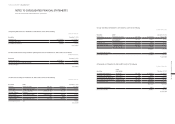

The changes in intangible assets for the year ended December 31, 2013, were as follows:

In millions of Korean Won

Description

Beginning of

the year

Internal

developments

and separate

acquisitions

Transfers

within

intangible

assets Disposals Amortization

Impairment

loss Others (*)

End of

the year

Goodwill ₩ 301,011 ₩ - ₩ - ₩ - ₩ - ₩ - ₩ (1,659) ₩ 299,352

Development

costs 1,854,606 781,694 5,060 (15,198) (658,684) (27,250) 5,329 1,945,557

Industrial

property rights 32,441 5,553 12,696 - (7,220) - 897 44,367

Software 230,673 34,650 30,826 (319) (84,814) - 62,405 273,421

Others 315,867 1,518 12,522 (2,282) (31,635) (911) (3,176) 291,903

Construction in

progress 148,620 196,495 (61,104) - - - (9,521) 274,490

₩ 2,883,218 ₩ 1,019,910 ₩ - ₩ (17,799) ₩ (782,353) ₩ (28,161) ₩ 54,275 ₩ 3,129,090

(*) Others include the effect of foreign exchange differences and transfer from or to other accounts.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

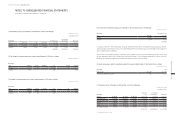

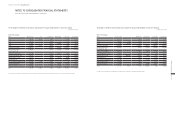

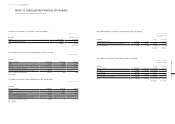

(3) Research and development expenditures for the years ended December 31, 2014 and 2013, are as follows:

In millions of Korean Won

Description 2014 2013

Development costs (*) ₩ 1,117,115 ₩ 781,694

Research and development (manufacturing cost and administrative expenses) 1,011,789 1,067,350

₩ 2,128,904 ₩ 1,849,044

(*) Amortization of development costs is not included.

(4) Impairment test of goodwill

The allocation of goodwill amongst the Group’s cash-generating units as of December 31, 2014 and 2013, is as follows:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Vehicle ₩ 186,026 ₩ 197,471

Finance 482 1,911

Others 99,970 99,970

₩ 286,478 ₩ 299,352

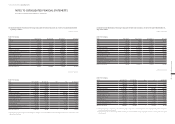

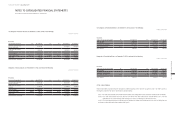

The recoverable amounts of the Group’s CGUs are measured at their value-in-use calculated based on cash flow projections of fi-

nancial budgets for the next five years approved by management and the pre-tax discount rate applied to the cash flow projections

is 14.0%. Cash flow projections beyond the next five-year period are extrapolated by using the estimated growth rate which does

not exceed the long-term average growth rate of the region and industry to which the CGU belongs. An impairment loss has been

recognized for the Finance CGU in the amount of ₩1,429 million for the year ended December 31, 2014. No impairment loss had been

recognized for the year ended December 31, 2013.