Hyundai 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 129128

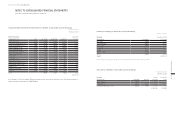

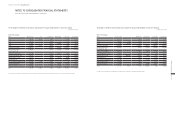

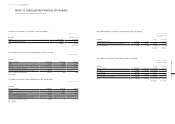

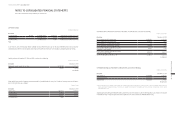

14. OPERATING LEASE ASSETS:

(1) Operating lease assets as of December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Acquisition cost ₩ 15,136,720 ₩ 12,030,614

Accumulated depreciation (1,804,291) (1,388,421)

Accumulated impairment loss (66,813) (77,317)

₩ 13,265,616 ₩ 10,564,876

(2) Future minimum lease receipts related to operating lease assets as of December 31, 2014 and 2013, are as follows:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Not later than one year ₩ 2,474,411 ₩ 2,018,610

Later than one year and not later than five years 2,674,220 2,270,798

Later than five years - 1

₩ 5,148,631 ₩ 4,289,409

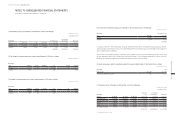

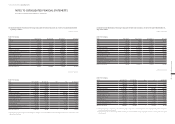

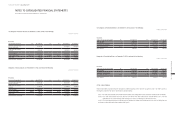

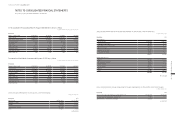

15. BORROWINGS AND DEBENTURES:

(1) Short-term borrowings as of December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

Description Lender

Annual interest rate (%)

December 31, 2014 December 31, 2014 December 31, 2013

Overdrafts Citi Bank and others 0.40~3.63 ₩ 189,121 ₩ 211,603

General loans Kookmin Bank and others 0.34~9.54 3,274,955 2,468,175

Loans on trade

receivables collateral

Korea Exchange Bank

and others

LIBOR+0.23~0.40 1,100,610 997,519

Banker’s Usance Kookmin Bank and others LIBOR+0.31~0.40 433,510 439,579

Short-term debentures 2.27 19,997 -

Commercial paper Shinhan Bank and others 0.27~2.64 1,827,727 747,375

Asset-backed securities HSBC - 428,547

₩ 6,845,920 ₩ 5,292,798

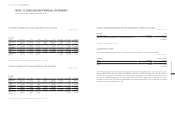

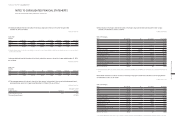

(2) Long-term debt as of December 31, 2014 and 2013, consists of the following:

In millions of Korean Won

Description Lender

Annual interest rate (%)

December 31, 2014 December 31, 2014 December 31, 2013

General loans Shinhan Bank and others 0.37~9.54 ₩ 3,283,340 ₩ 3,127,981

Facility loan Korea Development

Bank and others

1.00~5.85 383,072 524,530

Commercial paper Hana Daetoo Security 3.13~3.17 73,000 233,000

Asset-backed securities JP Morgan and others 0.46~0.71 5,607,169 3,535,460

Others Woori Bank and others 0.10~2.00 239,260 238,899

9,585,841 7,659,870

Less: present value discounts 125,375 134,025

Less: current maturities 2,030,037 2,859,815

₩ 7,430,429 ₩ 4,666,030

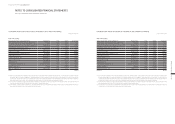

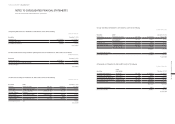

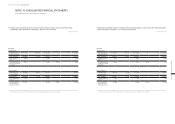

(3) Debentures as of December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

Description

Latest

maturity date

Annual interest rate (%)

December 31, 2014 December 31, 2014 December 31, 2013

Guaranteed public debentures June 8, 2017 3.75~4.50 ₩ 1,648,312 ₩ 1,583,399

Guaranteed private debentures April 25, 2015 5.68 82,440 79,148

Non-guaranteed public debentures April 29, 2021 2.08~7.20 21,247,129 20,298,628

Non-guaranteed private debentures February 6, 2019 1.45~3.63 4,079,019 2,383,997

Asset-backed securities December 15, 2020 0.18~6.52 10,976,262 10,891,176

38,033,162 35,236,348

Less: discount on debentures 81,616 88,129

Less: current maturities 7,649,461 5,825,439

₩ 30,302,085 ₩ 29,322,780

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013