Hyundai 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 155154

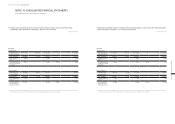

The Group’s sensitivity to a 5% change in exchange rate of the functional currency against each foreign currency on income before

income tax as of December 31, 2014, would be as follows:

In millions of Korean Won

Foreign Currency

Foreign Exchange Rate Sensitivity

Increase by 5% Decrease by 5%

USD ₩ 3,724 ₩ (3,724)

EUR (11,391) 11,391

JPY (5,800) 5,800

The sensitivity analysis includes the Group’s monetary assets, liabilities and derivative assets, liabilities but excludes items of income

statements such as changes of sales and cost of sales due to exchange rate fluctuation.

b) Interest rate risk management

The Group has borrowings with fixed or variable interest rates. Also, the Group is exposed to interest rate risk arising from financial

instruments with variable interest rates. To manage the interest rate risk, the Group maintains an appropriate balance between bor-

rowings with fixed and variable interest rates for short-term borrowings and has a policy to borrow funds with fixed interest rates

to avoid the future cash flow fluctuation risk for long-term debt if possible. The Group manages its interest rate risk through regular

assessments of the change in markets conditions and the adjustments in nature of its interest rates.

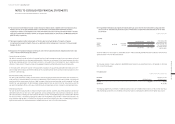

The Group’s sensitivity to a 1% change in interest rates on income before income tax as of December 31, 2014, would be as follows:

In millions of Korean Won

Accounts

Interest Rate Sensitivity

Increase by 1% Decrease by 1%

Cash and cash equivalents ₩ 22,623 ₩ (22,623)

Financial assets at FVTPL (7,474) 7,731

Short-term financial instruments 3,166 (3,166)

Borrowings and debentures (93,809) 93,809

The Company’s subsidiaries, Hyundai Card Co., Ltd. and Hyundai Capital Services, Inc., that are operating financial business, are man-

aging interest rate risk by utilizing value at risk (VaR). VaR is defined as a threshold value which is a statistical estimate of the max-

imum potential loss based on normal distribution. As of December 31, 2014 and 2013, the amounts of interest rate risk measured at

VaR are ₩119,847 million and ₩137,835 million, respectively.

c) Equity price risk

The Group is exposed to market price fluctuation risk arising from equity instruments. As of December 31, 2014, the amounts of held for

trading equity instruments and AFS equity instruments measured at fair value are ₩106,293 million and ₩2,106,719 million, respectively.

2) Credit risk

The Group is exposed to credit risk when a counterparty defaults on its contractual obligation resulting in a financial loss for the

Group. The Group operates a policy to transact with counterparties who only meet a certain level of credit rating which was evaluated

based on the counterparty’s financial conditions, default history, and other factors. The credit risk in the liquid funds and derivative

financial instruments is limited as the Group transacts only with financial institutions with high credit-ratings assigned by interna-

tional credit-rating agencies. Except for the guarantee of indebtedness discussed in Note 37, the book value of financial assets in the

consolidated financial statements represents the maximum amounts of exposure to credit risk.

3) Liquidity risk

The Group manages liquidity risk based on maturity profile of its funding. The Group analyses and reviews actual cash outflow and its

budget to match the maturity of its financial liabilities to that of its financial assets.

Due to the inherent nature of the industry, the Group requires continuous R&D investment and is sensitive to economic fluctuations.

The Group minimizes its credit risk in cash equivalents by investing in risk-free assets. In addition, the Group has agreements in place

with financial institutions with respect to trade financing and overdraft to mitigate any significant unexpected market deterioration.

The Group, also, continues to strengthen its credit rates to secure a stable financing capability.

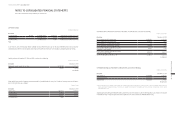

The Group’s maturity analysis of its non-derivative liabilities according to their remaining contract period before expiration as of De-

cember 31, 2014, is as follows:

In millions of Korean Won

Description

Remaining contract period

Not later than

one year

Later than one year and

not later than five years

Later than

five years Total

Non interest-bearing liabilities ₩ 13,682,337 ₩ 1,848 ₩ 490 ₩ 13,684,675

Interest-bearing liabilities 17,718,878 38,564,699 933,850 57,217,427

Financial guarantee 1,023,692 182,373 39,713 1,245,778

The maturity analysis is based on the non-discounted cash flows and the earliest maturity date at which payments, i.e. both principal

and interest, should be made.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013