Hyundai 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 147146

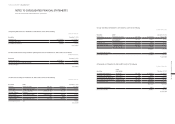

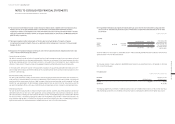

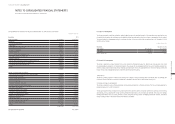

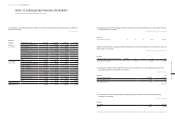

30. EXPENSES BY NATURE:

Expenses by nature for the years ended December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

Description 2014 2013

Changes in inventories ₩ (351,411) ₩ (389,147)

Raw materials and merchandise used 49,677,376 47,353,933

Employee benefits 8,537,685 8,308,494

Depreciation 1,843,802 1,768,985

Amortization 706,095 782,353

Others 22,600,885 22,233,974

Total (*) ₩ 83,014,432 ₩ 80,058,592

(*) Sum of cost of sales, selling and administrative expenses and other expenses in the consolidated statements of income.

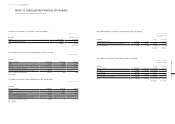

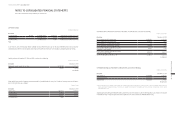

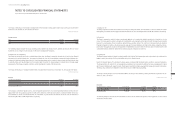

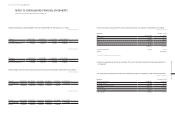

31. EARNINGS PER COMMON SHARE AND PREFERRED STOCK:

Basic earnings per common share and preferred stock are computed by dividing profit available to common shares and preferred stock

by the weighted-average number of common shares and preferred stock outstanding during the year. The Group did not compute dilut-

ed earnings per common share for the years ended December 31, 2014 and 2013, since there were no dilutive items during the years.

Basic earnings per common share and preferred stock for the years ended December 31, 2014 and 2013, are computed as follows:

In millions of Korean Won, except per share amounts

December 31, 2014

Description Profit available to share Weighted-average number of shares outstanding (*) Basic earnings per share

Common stock ₩ 5,656,688 209,221,204 ₩ 27,037

1st preferred stock 628,018 23,155,054 27,122

2nd preferred stock 994,937 36,608,682 27,178

3rd preferred stock 67,164 2,477,823 27,106

December 31, 2013

Description Profit available to share Weighted-average number of shares outstanding (*) Basic earnings per share

Common stock ₩ 6,579,651 209,269,769 ₩ 31,441

1st preferred stock 729,301 23,159,022 31,491

2nd preferred stock 1,154,838 36,613,865 31,541

3rd preferred stock 78,044 2,478,299 31,491

(*) Weighted-average number of shares outstanding includes the effects of treasury stock transactions.

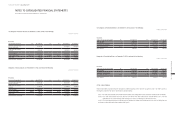

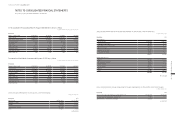

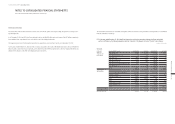

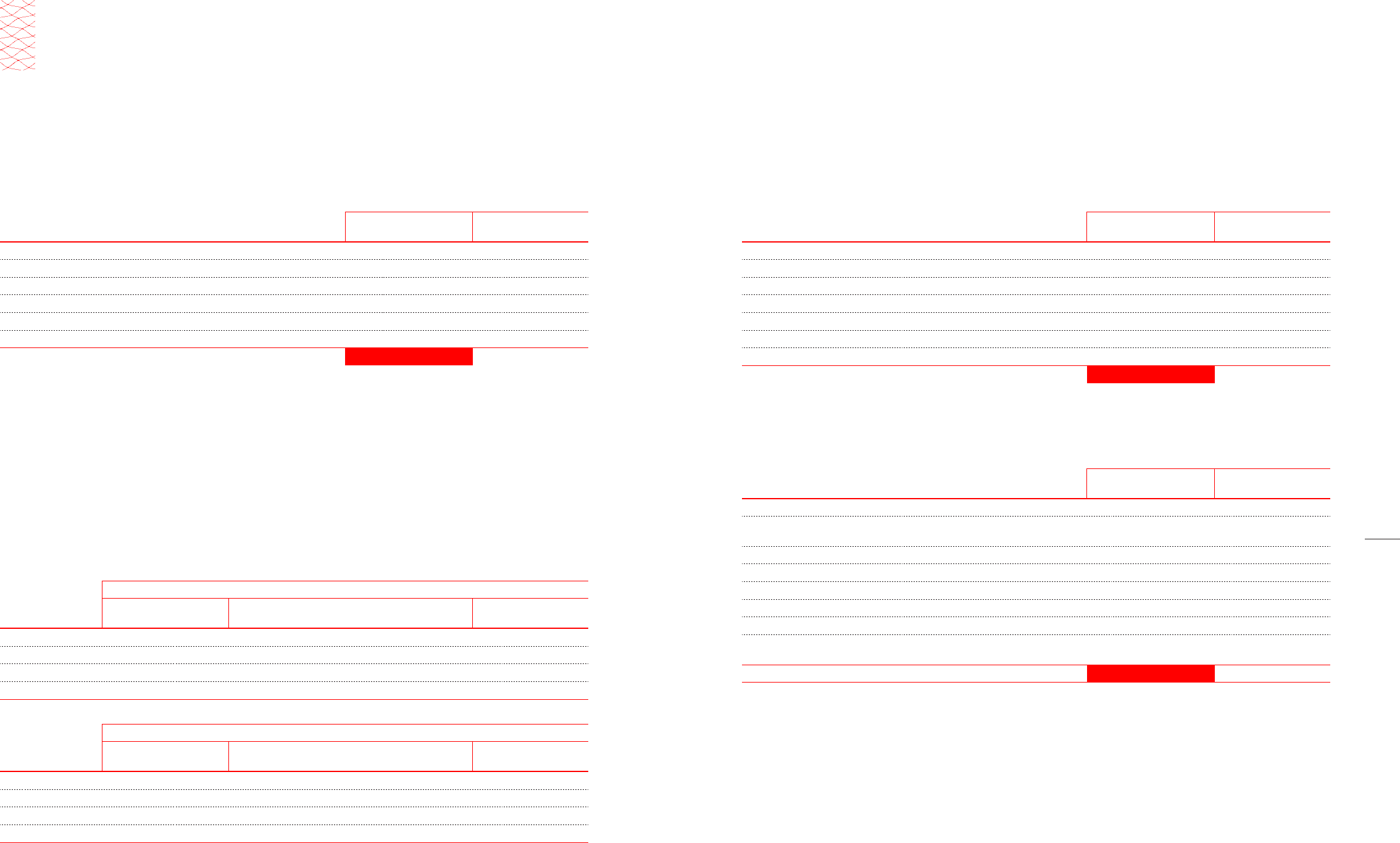

32. INCOME TAX EXPENSE:

(1) Income tax expense for the years ended December 31, 2014 and 2013, consist of the following:

In millions of Korean Won

Description 2014 2013

Income tax currently payable ₩ 1,643,888 ₩ 1,620,676

Adjustments recognized in the current year in relation to the prior years (52,349) 207,646

Changes in deferred taxes due to:

Temporary differences 818,276 1,138,556

Tax credits and deficits (247,876) (180,586)

Items directly charged to equity 231,519 (113,430)

Effect of foreign exchange differences (91,652) 30,347

Income tax expense ₩ 2,301,806 ₩ 2,703,209

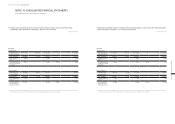

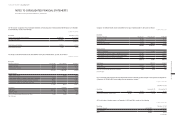

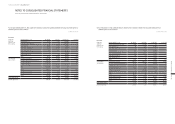

(2) The reconciliation from income before income tax to income tax expense pursuant to Corporate Income Tax Law of Korea for

the years ended December 31, 2014 and 2013, are as follows:

In millions of Korean Won

Description 2014 2013

Income before income tax ₩ 9,951,274 ₩ 11,696,706

Income tax expense calculated at current applicable tax rates

of 27.2% in 2014 and 27.0% in 2013 2,708,321 3,163,781

Adjustments:

Non-taxable income (111,489) (109,720)

Disallowed expenses 139,304 101,057

Tax credits (713,191) (685,584)

Others 278,861 233,675

(406,515) (460,572)

Income tax expense ₩ 2,301,806 ₩ 2,703,209

Effective tax rate 23.1% 23.1%

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013