Hyundai 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

CREDIT RATING

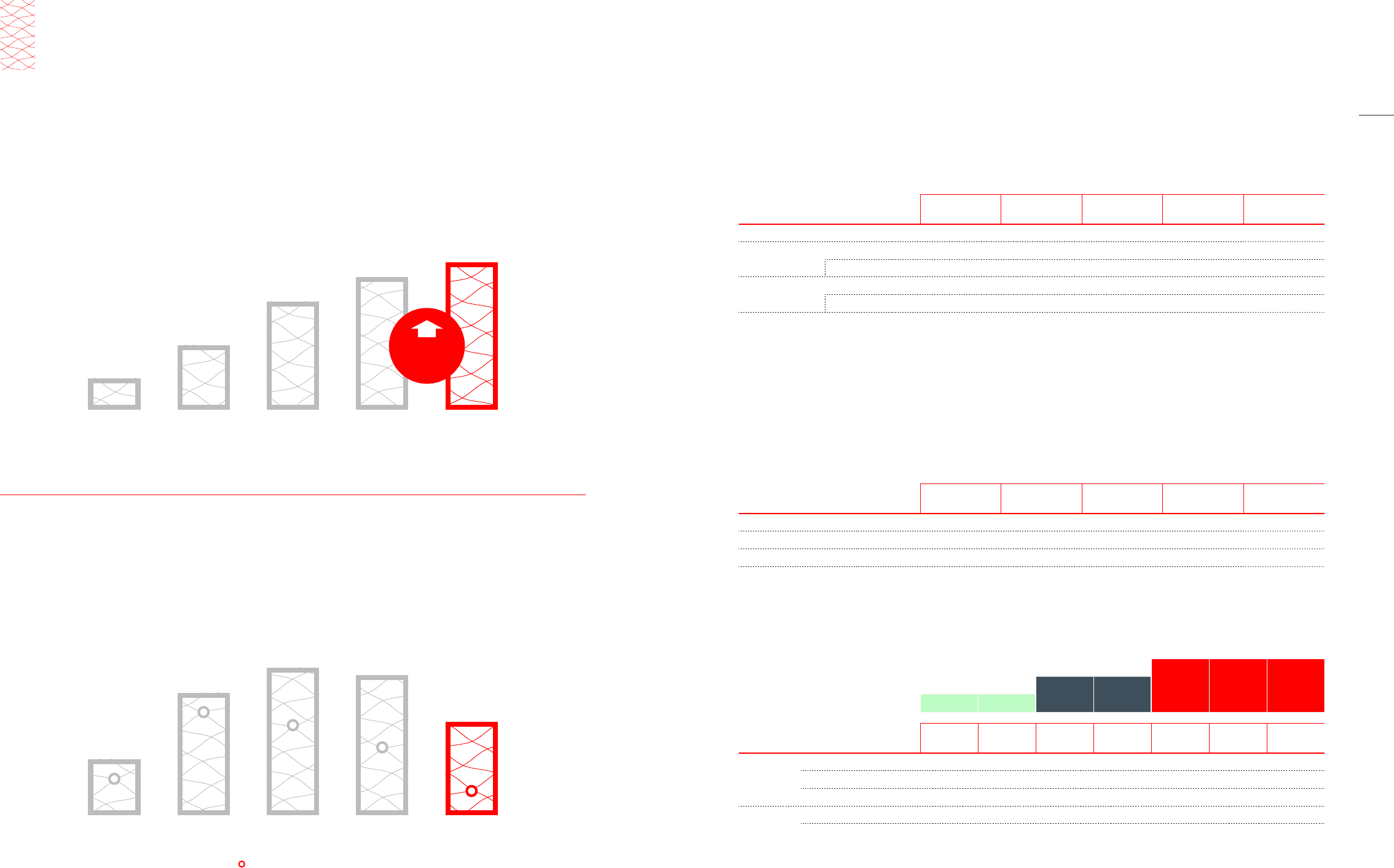

CONSOLIDATED STATEMENTS OF INCOME

FOR THE YEAR 2010 2011 2012 2013 2014

Sales Revenue166,985,271 77,797,895 84,469,721 87,307,636 89,256,319

Operating Income 5,918,492 8,028,829 8,440,601 8,315,497 7,549,986

Margin(%) 8.8% 10.3% 10.0% 9.5% 8.5%

Net Income26,001,182 8,104,863 9,061,132 8,993,497 7,649,468

Margin(%) 9.0% 10.4% 10.7% 10.3% 8.6%

Basic EPS(KRW)320,516 28,200 31,532 31,441 27,037

1 Business results of BHMC is accounted in equity income accounting

2 Net income includes non-controlling interest

3 Basic earnings per common share attributable to the owners of the Parent Company

2008 2009 2010 2011 2012 2013 2014

Domestic

KIS AA AA AA+ AA+ AAA AAA AAA

NICE AA AA AA+ AA+ AAA AAA AAA

Korea Rating AA AA AA+ AA+ AAA AAA AAA

Overseas S&P BBB- BBB- BBB BBB BBB+ BBB+ BBB+

Moody’s Baa3 Baa3 Baa2 Baa2 Baa1 Baa1 Baa1

*Jan. 2015, S&P upgraded the credit rating for HMC to A-

BBB/Baa2

BBB-/Baa3

2008 2009 2010 2011 2012 2013 2014

BBB+/Baa1

SALES REVENUE

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

Unit : KRW Million

AT YEAR END 2010 2011 2012 2013 2014

Assets 94,714,131 109,479,975 121,537,814 133,421,479 147,225,117

Liabilities 61,826,158 69,152,273 73,620,239 76,838,690 84,604,552

Shareholder’s Equity 32,887,973 40,327,702 47,917,575 56,582,789 62,620,565

Liab. to Eqt. Ratio(%) 188.0% 171.5% 153.6% 135.8% 135.1%

Unit : KRW Million

Unit : KRW Million

FINANCIAL HIGHLIGHTS

OPERATING INCOME

Unit : KRW Million

77,797,895

2011

66,985,271

2010

5,918,492

2010

84,469,721

2012

87,307,636

2013

89,256,319

2014

2.2%

8,028,829

2011

10.3

8.8

8,440,601

2012

10.0

8,315,497

2013

9.5

7,549,986

2014

8.5

Operating Income Margin(%)

Financial Highlights 06 / 07