Hyundai 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Hyundai annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HYUNDAI MOTOR COMPANY Annual Report 2014

FINANCIAL STATEMENTS / 151150

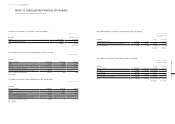

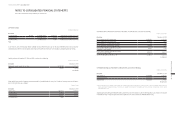

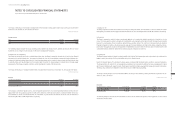

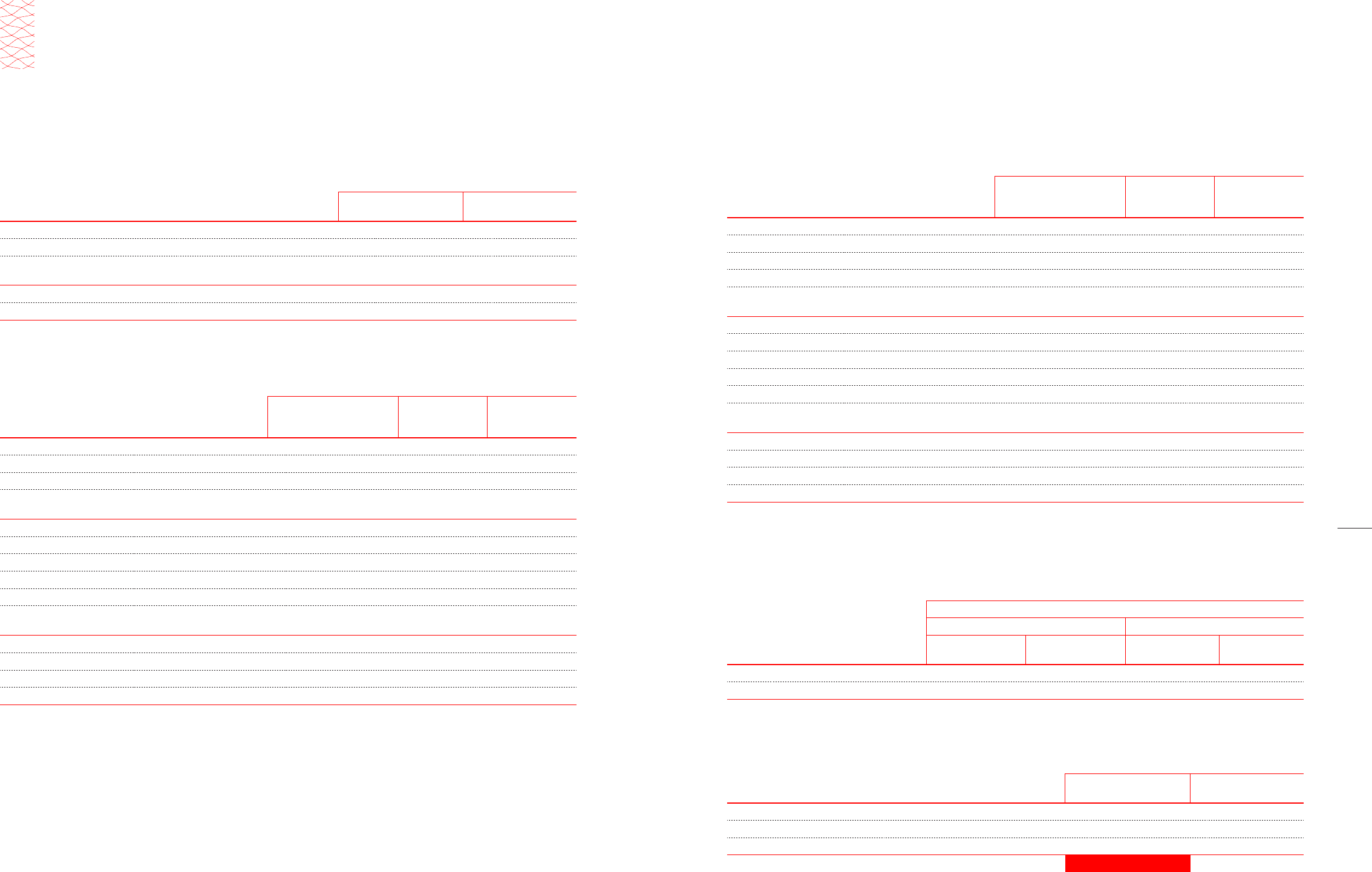

(3) The amounts recognized in the consolidated statements of financial position related to defined benefit plans as of December

31, 2014 and 2013, consist of the following:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Present value of defined benefit obligations ₩ 4,065,742 ₩ 3,131,966

Fair value of plan assets (3,471,803) (2,749,943)

₩ 593,939 ₩ 382,023

Net defined benefit liabilities 594,058 389,306

Net defined benefit assets (119) (7,283)

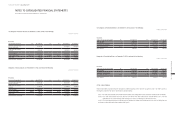

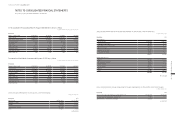

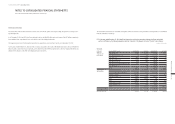

(4) Changes in net defined benefit assets and liabilities for the year ended December 31, 2014, are as follows:

In millions of Korean Won

Description

Present value of defined

benefit obligations

Fair value of

plan assets

Net defined

benefit liabilities

Beginning of the year ₩ 3,131,966 ₩ (2,749,943) ₩ 382,023

Current service cost 452,968 -452,968

Interest expenses (income) 136,845 (119,797) 17,048

3,721,779 (2,869,740) 852,039

Remeasurements:

Return on plan assets - 28,274 28,274

Actuarial gains arising from changes in demographic assumptions 25,672 -25,672

Actuarial gains arising from changes in financial assumptions 389,867 -389,867

Actuarial gains arising from experience adjustments 62,158 -62,158

477,697 28,274 505,971

Contributions - (724,424) (724,424)

Benefits paid (153,751) 101,627 (52,124)

Transfers in (out) 514 106 620

Effect of foreign exchange differences and others 19,503 (7,646) 11,857

End of the year ₩ 4,065,742 ₩ (3,471,803) ₩ 593,939

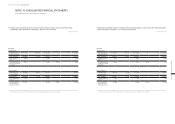

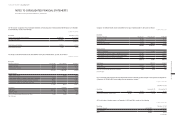

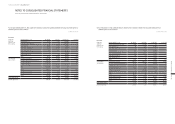

Changes in net defined benefit assets and liabilities for the year ended December 31, 2013, were as follows:

In millions of Korean Won

Description

Present value of defined

benefit obligations

Fair value of

plan assets

Net defined

benefit liabilities

Beginning of the year ₩ 2,975,771 ₩ (2,154,022) ₩ 821,749

Current service cost 473,463 -473,463

Past service cost 21,337 -21,337

Interest expenses (income) 115,713 (82,893) 32,820

3,586,284 (2,236,915) 1,349,369

Remeasurements:

Return on plan assets - (7,684) (7,684)

Actuarial gains arising from changes in demographic assumptions (85,942) -(85,942)

Actuarial gains arising from changes in financial assumptions (230,175) -(230,175)

Actuarial gains arising from experience adjustments (22,660) -(22,660)

(338,777) (7,684) (346,461)

Contributions - (590,241) (590,241)

Benefits paid (120,090) 80,259 (39,831)

Transfers in (out) 1,105 1,080 2,185

Effect of foreign exchange differences and others 3,444 3,558 7,002

End of the year ₩ 3,131,966 ₩ (2,749,943) ₩ 382,023

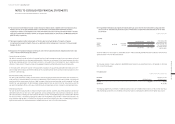

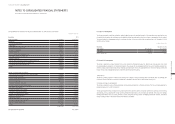

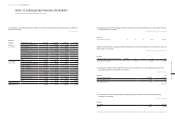

(5) The sensitivity analyses below have been determined based on reasonably possible changes of the significant assumptions as

of December 31, 2014 and 2013, while holding all other assumptions constant.

In millions of Korean Won

Effect on the net defined benefit liabilities

December 31, 2014 December 31, 2013

Description Increase by 1% Decrease by 1% Increase by 1% Decrease by 1%

Discount rate (431,595) 524,793 (326,031) 385,624

Rate of expected future salary increase 501,421 (423,593) 313,430 (275,984)

(6) The fair value of the plan assets as of December 31, 2014 and 2013, consists of the following:

In millions of Korean Won

Description December 31, 2014 December 31, 2013

Insurance instruments ₩ 3,230,405 ₩ 2,415,575

Debt instruments 102,734 66,149

Others 138,664 268,219

₩ 3,471,803 ₩ 2,749,943

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013