Honeywell 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

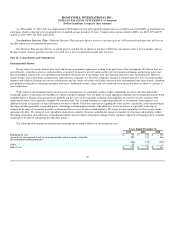

Other Matters

We are subject to a number of other lawsuits, investigations and disputes (some of which involve substantial amounts claimed) arising out of the

conduct of our business, including matters relating to commercial transactions, government contracts, product liability, prior acquisitions and divestitures,

employee benefit plans, intellectual property, and environmental, health and safety matters. We recognize a liability for any contingency that is probable of

occurrence and reasonably estimable. We continually assess the likelihood of adverse judgments of outcomes in these matters, as well as potential ranges of

possible losses (taking into consideration any insurance recoveries), based on a careful analysis of each matter with the assistance of outside legal counsel and,

if applicable, other experts. Included in these other matters are the following:

Allen, et al. v. Honeywell Retirement Earnings Plan—Pursuant to a settlement approved by the U.S. District Court for the District of Arizona in

February 2008, 18 of 21 claims alleged by plaintiffs in this class action lawsuit were dismissed with prejudice in exchange for approximately $35 million and

the maximum aggregate liability for the remaining three claims (alleging that Honeywell impermissibly reduced the pension benefits of certain employees of a

predecessor entity when the plan was amended in 1983 and failed to calculate benefits in accordance with the terms of the plan) was capped at $500 million.

Any amounts payable, including the settlement amount, have or will be paid from the Company's pension plan. In October 2009, the Court granted summary

judgment in favor of the Honeywell Retirement Earnings Plan with respect to the claim regarding the calculation of benefits. We continue to expect to prevail

on the remaining claims in light of applicable law and our substantial affirmative defenses, which have not yet been considered fully by the Court.

Accordingly, we do not believe that a liability is probable of occurrence and reasonably estimable with respect to these claims and we have not recorded a

provision for the remaining claims in our financial statements.

Quick Lube—On March 31, 2008, S&E Quick Lube, a filter distributor, filed suit in U.S. District Court for the District of Connecticut alleging that

twelve filter manufacturers, including Honeywell, engaged in a conspiracy to fix prices, rig bids and allocate U.S. customers for aftermarket automotive

filters. This suit is a purported class action on behalf of direct purchasers of filters from the defendants. Parallel purported class actions, including on behalf of

indirect purchasers of filters, have been filed by other plaintiffs in a variety of jurisdictions in the United States and Canada. The U.S cases have been

consolidated into a single multi-district litigation in the Northern District of Illinois. We intend to vigorously defend the claims raised in these actions. The

Antitrust Division of the Department of Justice notified Honeywell on January 21, 2010 that it has officially closed its investigation into possible collusion in

the replacement auto filters industry.

BorgWarner v. Honeywell—In this patent infringement suit in the District Court for the Western District of North Carolina, plaintiff BorgWarner is

claiming that Honeywell's manufacture and sale of cast titanium compressor wheels for turbochargers infringes three BorgWarner patents and is seeking

damages of up to approximately $120 million, which plaintiff asserts should be trebled for willful infringement. Because the process claimed in BorgWarner's

patents had already been described in detail in printed publications and had been offered for sale before BorgWarner's alleged invention, in violation of

statutory requirements for patentability, Honeywell asked the Court to enter summary judgment of invalidity of BorgWarner's patents. The Court declined to

enter summary judgment in September 2010, finding that the question should be decided by a jury. Trial is scheduled for May 2011. Honeywell will continue

its vigorous defense of this claim and expects to prevail at trial. In the event the Company is found liable, we do not believe that the evidence supports

damages of the magnitude claimed or any finding of willfulness. Honeywell has also asked the United States Patent and Trademark Office to reexamine all

three of BorgWarner's patents in light of the prior art publications. If the Patent Office ultimately invalidates the BorgWarner patents at issue prior to final

adjudication of the patent infringement litigation, plaintiff would not be entitled to recover damages.

Given the uncertainty inherent in litigation and investigations (including the specific matters referenced above), we do not believe it is possible to

develop estimates of reasonably possible loss in excess of current accruals for these matters. Considering our past experience and existing accruals, we do not

expect the outcome of these matters, either individually or in the aggregate, to have a material adverse effect on our consolidated financial position. Because

most contingencies are resolved over long periods of time, potential liabilities are subject to change due to new developments, changes in settlement strategy

or the impact of evidentiary requirements, which could cause us to pay damage awards or settlements (or become subject to equitable remedies) that could

have a material adverse effect on our results of operations or operating cash flows in the periods recognized or paid.

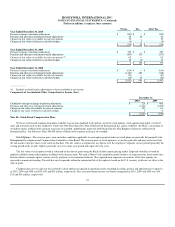

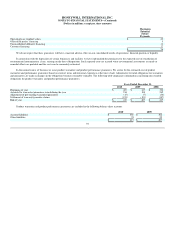

Warranties and Guarantees—We have issued or are a party to the following direct and indirect guarantees at December 31, 2010:

93