Honeywell 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

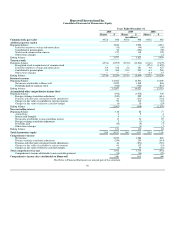

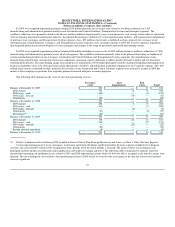

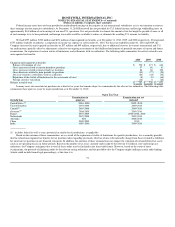

Accounts and other receivables $ 102

Inventories 118

Other current assets 28

Property, plant and equipment 65

Intangible assets 702

Other assets and deferred charges 3

Accounts payable (27)

Accrued liabilities (74)

Deferred income taxes (274)

Other long-term liabilities (26)

Net assets acquired 617

Goodwill 604

Purchase price $ 1,221

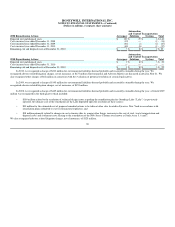

The Company has assigned $702 million to intangible assets, predominantly customer relationships, trade names, and technology. These intangible

assets are being amortized over their estimated lives which range from 1 to 20 years using straight line and accelerated amortization methods. The value

assigned to the trade names of approximately $257 million is classified as an indefinite lived intangible. The excess of the purchase price over the estimated

fair values of net assets acquired (approximately $604 million) was recorded as goodwill. This goodwill is non-deductible for tax purposes. This acquisition

was accounted for by the purchase method, and, accordingly, results of operations are included in the consolidated financial statements from the date of

acquisition. The results from the acquisition date through December 31, 2008 are included in the Automation and Control Solutions segment and were not

material to the consolidated financial statements.

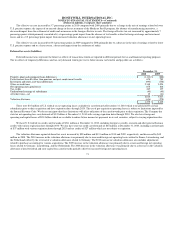

In July 2008, the Company completed the sale of its Consumables Solutions business to B/E Aerospace (B/E) for $1,050 million, consisting of

approximately $901 million in cash and six million shares of B/E common stock. In connection with the completion of the sale, the Company and B/E entered

into, among other things, exclusive supply and license agreements and a stockholder agreement. Because of the extent of the Company's cash flows associated

with the supply and license agreements, the Consumables Solutions business is not classified as discontinued operations. The provisions of the license and

supply agreements were determined to be at-market. As such, we have not allocated any portion of the proceeds to these agreements. The pre-tax gain of $623

million was classified as Other (Income)/Expense in our Statement of Operations. The gain on sale was approximately $417 million net of tax. The sale of the

Consumables Solutions business, within the Aerospace segment, is consistent with the Company's strategic focus on core product areas utilizing advanced

technologies.

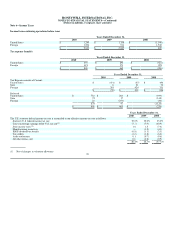

In July 2008, the Company completed the acquisition of Metrologic Instruments, Inc. (Metrologic), a leading manufacturer of data capture and

collection hardware and software, for a purchase price of approximately $715 million, net of cash acquired. The purchase price for the acquisition was

allocated to the tangible and identifiable intangible assets acquired and liabilities assumed based on their estimated fair values at acquisition date. The

Company has assigned $248 million to identifiable intangible assets, predominantly customer relationships, technology and trademarks. These intangible

assets are being amortized over their estimated lives which range from 1-15 years using straight line and accelerated amortization methods. The excess of the

purchase price over the estimated fair values of net assets acquired (approximately $440 million) was recorded as goodwill. This goodwill is non-deductible

for tax purposes. This acquisition was accounted for by the purchase method, and, accordingly, results of operations are included in the consolidated financial

statements from the date of acquisition. The results from the acquisition date through December 31, 2008, are included in the Automation and Control

Solutions segment and were not material to the consolidated financial statements.

In January 2011, the Company entered into a definitive agreement to sell its Consumer Products Group business (CPG) to Rank Group Limited for

approximately $950 million. The sale, which is subject to customary closing conditions, including the receipt of regulatory approvals, is expected to close in

the third quarter of 2011. We currently estimate that the transaction will result in a pre-tax gain of approximately $350 million, approximately $200 million

net of tax. The sale of CPG, within the Transportation Systems segment, is consistent with the Company's strategic focus on its portfolio of differentiated

global technologies.

In connection with all acquisitions in 2010, 2009 and 2008, the amounts recorded for transaction costs and the costs of integrating the acquired

businesses into Honeywell were not material.

65