Honeywell 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

We maintain a $2,800 million five year committed revolving credit facility with a group of banks, arranged by Citigroup Global Markets Inc. and

J.P.Morgan Securities Inc. which is in place through May 14, 2012. This credit facility contains a $700 million sub-limit for the issuance of letters of credit.

The credit facility is maintained for general corporate purposes, including support for the issuance of commercial paper. We had no borrowings outstanding or

letters of credit issued under the credit facility at December 31, 2010.

The credit agreement does not restrict our ability to pay dividends and contains no financial covenants. The failure to comply with customary conditions

or the occurrence of customary events of default contained in the credit agreement would prevent any further borrowings and would generally require the

repayment of any outstanding borrowings under the credit agreement. Such events of default include: (a) non-payment of credit agreement debt, interest or

fees; (b) non-compliance with the terms of the credit agreement covenants; (c) cross-default to other debt in certain circumstances; (d) bankruptcy; and (e)

defaults upon obligations under Employee Retirement Income Security Act. Additionally, each of the banks has the right to terminate its commitment to lend

additional funds or issue letters of credit under the agreement if any person or group acquires beneficial ownership of 30 percent or more of our voting stock,

or, during any 12-month period, individuals who were directors of Honeywell at the beginning of the period cease to constitute a majority of the Board of

Directors.

Loans under the credit facility are required to be repaid no later than May 14, 2012. We have agreed to pay a facility fee of 0.05 percent per annum on

the aggregate commitment.

Interest on borrowings under the credit facility would be determined, at Honeywell's option, by (a) an auction bidding procedure; (b) the highest of the

floating base rate publicly announced by Citibank, N.A., 0.5 percent above the average CD rate, or 0.5 percent above the Federal funds rate; or (c) the

Eurocurrency rate plus 0.15 percent (applicable margin).

The facility fee, the applicable margin over the Eurocurrency rate and the letter of credit issuance fee, are subject to change, based upon a grid

determined by our long term debt ratings. The credit agreement is not subject to termination based upon a decrease in our debt ratings or a material adverse

change.

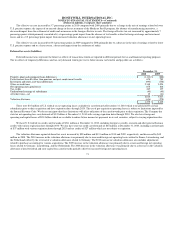

In February 2009, the Company issued $600 million 3.875% Senior Notes due 2014 and $900 million 5.00% Senior Notes due 2019 (collectively, the

"2009 Senior Notes"). The 2009 Senior Notes are senior unsecured and unsubordinated obligations of Honeywell and rank equally with all of Honeywell's

existing and future senior unsecured debt and senior to all of Honeywell's subordinated debt. The offering resulted in gross proceeds of $1,500 million, offset

by $12 million in discount and issuance costs.

In the first quarter of 2009, the Company repaid $493 million of its floating rate notes. In the third quarter of 2009, the Company repaid $500 million of

its floating rate notes and $100 million of its zero coupon bonds and money multiplier notes.

In the first quarter of 2010, the Company repaid $1,000 million of its 7.50% notes. The repayment was funded with cash provided by operating

activities.

As a source of liquidity, we sell interests in designated pools of trade accounts receivables to third parties. As of December 31, 2010 and December 31,

2009 none of the receivables in the designated pools had been sold to third parties. When we sell receivables, they are over-collateralized and we retain a

subordinated interest in the pool of receivables representing that over-collateralization as well as an undivided interest in the balance of the receivables pools.

The terms of the trade accounts receivable program permit the repurchase of receivables from the third parties at our discretion, providing us with an

additional source of revolving credit. As a result, program receivables remain on the Company's balance sheet with a corresponding amount recorded as either

Short-term borrowings or Long-term debt.

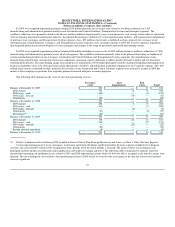

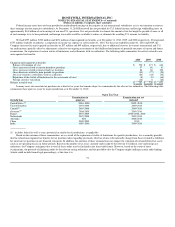

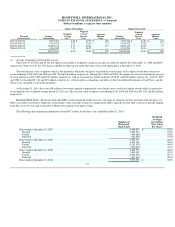

Note 15—Lease Commitments

Future minimum lease payments under operating leases having initial or remaining noncancellable lease terms in excess of one year are as follows:

77