Honeywell 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Based on past performance and current expectations, we believe that our operating cash flows will be sufficient to meet our future operating cash needs.

Our available cash, committed credit lines, access to the public debt and equity markets as well as our ability to sell trade accounts receivables, provide

additional sources of short-term and long-term liquidity to fund current operations, debt maturities, and future investment opportunities. Based on our current

financial position and expected economic performance.

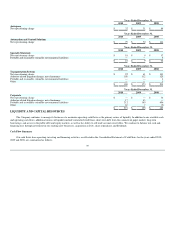

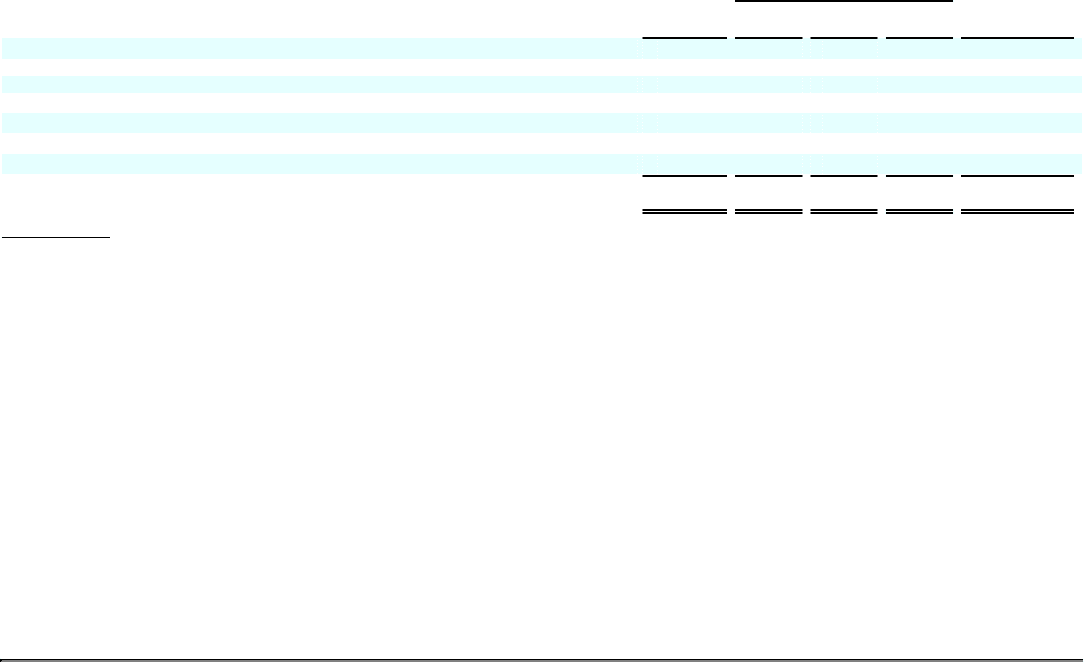

Contractual Obligations and Probable Liability Payments

Following is a summary of our significant contractual obligations and probable liability payments at December 31, 2010:

Payments by Period

Total(6) 2011

2012-

2013

2014-

2015 Thereafter

Long-term debt, including capitalized leases(1) $ 6,278 $ 523 $ 1,022 $ 608 $ 4,125

Interest payments on long-term debt, including capitalized leases 2,844 259 421 360 1,804

Minimum operating lease payments 1,353 318 437 266 332

Purchase obligations(2) 1,856 978 533 190 155

Estimated environmental liability payments(3) 753 325 300 100 28

Asbestos related liability payments(4) 1,719 162 916 329 312

Asbestos insurance recoveries(5) (875) (50) (133) (176) (516)

$ 13,928 $ 2,515 $ 3,496 $ 1,677 $ 6,240

(1) Assumes all long-term debt is outstanding until scheduled maturity.

(2) Purchase obligations are entered into with various vendors in the normal course of business and are consistent with our expected requirements.

(3) The payment amounts in the table only reflect the environmental liabilities which are probable and reasonably estimable as of December 31, 2010. See

Environmental Matters in Note 21 to the financial statements for additional information.

(4) These amounts are estimates of asbestos related cash payments for NARCO and Bendix based on our asbestos related liabilities which are probable and

reasonably estimable as of December 31, 2010. NARCO estimated payments are based on the terms and conditions, including evidentiary requirements,

specified in the definitive agreements or agreements in principle and pursuant to Trust Distribution Procedures. Projecting the timing of NARCO

payments is dependent on, among other things, the effective date of the Trust which could cause the timing of payments to be earlier or later than that

projected. Bendix payments are based on our estimate of pending and future claims. Projecting future events is subject to many uncertainties that could

cause asbestos liabilities to be higher or lower than those projected and recorded. See Asbestos Matters in Note 21 to the financial statements for

additional information.

(5) These amounts represent our insurance recoveries that are deemed probable for asbestos related liabilities as of December 31, 2010. The timing of

insurance recoveries are impacted by the terms of insurance settlement agreements, as well as the documentation, review and collection process

required to collect on insurance claims. Where probable insurance recoveries are not subject to definitive settlement agreements with specified payment

dates, but instead are covered by insurance policies, we have assumed collection will occur beyond 2015. Projecting the timing of insurance recoveries

is subject to many uncertainties that could cause the amounts collected to be higher or lower than those projected and recorded or could cause the

timing of collections to be earlier or later than that projected. We reevaluate our projections concerning insurance recoveries in light of any changes or

developments that would impact recoveries or the timing thereof. See Asbestos Matters in Note 21 to the financial statements for additional

information.

43