Honeywell 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

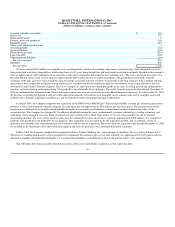

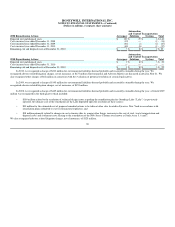

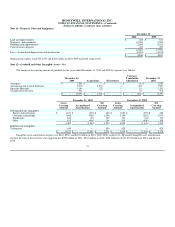

Note 4—Other (income) expense

Years Ended December 31,

2010 2009 2008

Equity (income)/loss of affiliated companies $ (29) $ (26) $ (63)

Gain on sale of non-strategic businesses and assets — (87) (635)

Interest income (40) (33) (102)

Foreign exchange 13 45 52

Other, net (39) 46 —

$ (95) $ (55) $ (748)

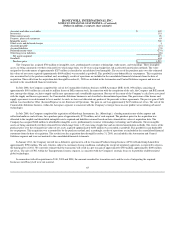

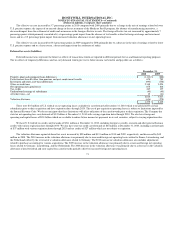

Other, net for 2010 includes a $62 million pre-tax gain, $39 million net of tax, related to the consolidation of a joint venture within our Specialty

Materials segment. The Company obtained control and the ability to direct those activities most significant to the joint venture's economic performance in the

third quarter, resulting in consolidation. Accordingly, we have i) recognized the assets and liabilities at fair value, ii) included the results of operations in the

consolidated financial statements from the date of consolidation and iii) recognized the above noted gain representing the difference between the carrying

amount and fair value of our previously held equity method investment. The Company has assigned $24 million to intangibles, predominantly the joint

venture's customer contracts. These intangible assets are being amortized over their estimated lives using the straight line method. The excess of the book

value over the estimated fair values of the net assets consolidated approximating $132 million, was recorded as goodwill. This goodwill is non-deductible for

tax purposes. The results from the consolidation date through December 31, 2010 are included in the Specialty Materials segment and were not material to the

consolidated financial statements.

Gain on sale of non-strategic businesses and assets for 2009 includes a $50 million pre-tax gain, $42 million net of tax, related to the deconsolidation of

a subsidiary within our Automation and Control Solutions segment. The subsidiary achieved contractual milestones at December 31, 2009 and as a result, we

are no longer the primary beneficiary, resulting in deconsolidation. We continue to hold a non-controlling interest which was recorded at its estimated fair

value of $67 million upon deconsolidation. The fair value was estimated using a combination of a market and income approaches utilizing observable market

data for comparable businesses and discounted cash flow modeling. Our non-controlling interest, classified within Investments and long-term receivables on

our Balance Sheet will be accounted for under the equity method on a prospective basis.

Other, net for 2009 includes an other than-temporary impairment charge of $62 million. See Note 16 Financial Instruments and Fair Value Measures for

further details.

Gain on sale of non-strategic businesses and assets for 2008 includes a $623 million pre-tax gain related to the sale of our Consumables Solutions

business. See Note 2 for further details.

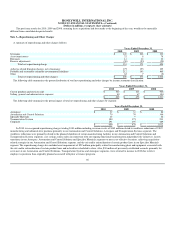

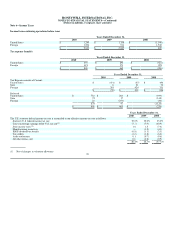

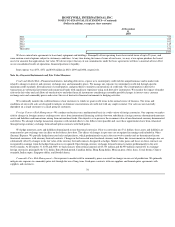

Note5—Interest and Other Financial Charges

Years Ended December 31,

2010 2009 2008

Total interest and other financial charges $ 402 $ 474 $ 482

Less—capitalized interest (16) (15) (26)

$ 386 $ 459 $ 456

The weighted average interest rate on short-term borrowings and commercial paper outstanding at December 31, 2010 and 2009 was 1.64 percent and

1.47 percent, respectively.

69