Honeywell 2010 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risks related to our defined benefit pension plans may adversely impact our results of operations and cash flow.

Significant changes in actual investment return on pension assets, discount rates, and other factors could adversely affect our results of operations and

pension contributions in future periods. U.S. generally accepted accounting principles require that we calculate income or expense for the plans using actuarial

valuations. These valuations reflect assumptions about financial markets and interest rates, which may change based on economic conditions. Funding

requirements for our U.S. pension plans may become more significant. However, the ultimate amounts to be contributed are dependent upon, among other

things, interest rates, underlying asset returns and the impact of legislative or regulatory changes related to pension funding obligations. For a discussion

regarding the significant assumptions used to estimate pension expense, including discount rate and the expected long-term rate of return on plan assets, and

how our financial statements can be affected by pension plan accounting policies, see "Critical Accounting Policies" included in "Item 7. Management's

Discussion and Analysis of Financial Condition and Results of Operations."

Additional tax expense or additional tax exposures could affect our future profitability.

We are subject to income taxes in both the United States and various non-U.S. jurisdictions, and our domestic and international tax liabilities are

dependent upon the distribution of income among these different jurisdictions. In 2010, our tax expense represented 28.4 percent of our income before tax,

and includes estimates of additional tax which may be incurred for tax exposures and reflects various estimates and assumptions, including assessments of

future earnings of the Company that could effect the valuation of our deferred tax assets. Our future results could be adversely affected by changes in the

effective tax rate as a result of a change in the mix of earnings in countries with differing statutory tax rates, changes in the overall profitability of the

Company, changes in tax legislation, changes in the valuation of deferred tax assets and liabilities, the results of audits and examinations of previously filed

tax returns and continuing assessments of our tax exposures.

Volatility of credit markets or macro-economic factors could adversely affect our business.

Changes in U.S. and global financial and equity markets, including market disruptions, limited liquidity, and interest rate volatility, may increase the

cost of financing as well as the risks of refinancing maturing debt. In addition, our borrowing costs can be affected by short and long-term ratings assigned by

independent rating agencies. A decrease in these ratings could increase our cost of borrowing.

Delays in our customers' ability to obtain financing, or the unavailability of financing to our customers, could adversely affect our results of operations

and cash flow. The inability of our suppliers to obtain financing could result in the need to transition to alternate suppliers, which could result in significant

incremental cost and delay, as discussed above. Lastly, disruptions in the U.S. and global financial markets could impact the financial institutions with which

we do business.

Item 1B. Unresolved Staff Comments

Not Applicable

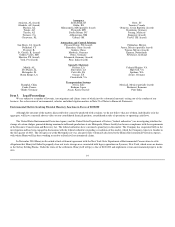

Item 2. Properties

We have approximately 1,300 locations consisting of plants, research laboratories, sales offices and other facilities. Our headquarters and administrative

complex is located in Morris Township, New Jersey. Our plants are generally located to serve large marketing areas and to provide accessibility to raw

materials and labor pools. Our properties are generally maintained in good operating condition. Utilization of these plants may vary with sales to customers

and other business conditions; however, no major operating facility is significantly idle. We own or lease warehouses, railroad cars, barges, automobiles,

trucks, airplanes and materials handling and data processing equipment. We also lease space for administrative and sales staffs. Our properties and equipment

are in good operating condition and are adequate for our present needs. We do not anticipate difficulty in renewing existing leases as they expire or in finding

alternative facilities.

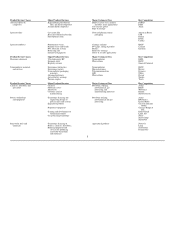

Our principal plants, which are owned in fee unless otherwise indicated, are as follows:

18