Honeywell 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

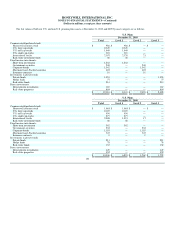

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts

Without Impact of

Medicare Subsidy

Net of

Medicare Subsidy

2011 $ 201 $ 188

2012 187 173

2013 175 161

2014 163 150

2015 153 140

2016-2020 624 564

Employee Savings Plans

We sponsor employee savings plans under which we match, in the form of our common stock, savings plan contributions for certain eligible employees.

Shares issued under the stock match plans were 2.4, 4.8 and 4.9 million at a cost of $105, $158 and $220 million in 2010, 2009, and 2008, respectively.

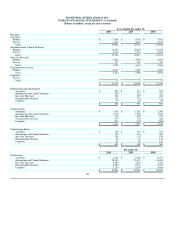

Note 23. Segment Financial Data

We globally manage our business operations through four reportable operating segments serving customers worldwide with aerospace products and

services, control, sensing and security technologies for buildings, homes and industry, automotive products and chemicals. Segment information is consistent

with how management reviews the businesses, makes investing and resource allocation decisions and assesses operating performance. Our four reportable

segments are as follows:

• Aerospace is organized by customer end-market (Air Transport and Regional, Business and General Aviation and Defense and Space) and

provides products and services which include auxiliary power units; propulsion engines; environmental control systems; electric power systems,

engine controls; repair and overhaul services; flight safety, communications, navigation, radar and surveillance systems; aircraft lighting;

management and technical services; logistic services; advanced systems and instruments; and aircraft wheels and brakes.

• Automation and Control Solutions includes Products (controls for heating, cooling, indoor air quality, ventilation, humidification, lighting and

home automation; advanced software applications for home/building control and optimization; sensors, switches, control systems and instruments

for measuring pressure, air flow, temperature and electrical current; security, fire and gas detection; personal protection equipment; access

control; video surveillance; remote patient monitoring systems; and automatic identification and data collection); Building Solutions (installs,

maintains and upgrades systems that keep buildings safe, comfortable and productive); and Process Solutions (provides a full range of automation

and control solutions for industrial plants, offering advanced software and automation systems that integrate, control and monitor complex

processes in many types of industrial settings as well as equipment that controls, measures and analyzes natural gas production and

transportation).

• Specialty Materials includes fluorocarbons, hydrofluoroolefins, caprolactam, resins, ammonium sulfate for fertilizer, specialty films, waxes,

additives, advanced fibers, customized research chemicals and intermediates, electronic materials and chemicals, catalysts and adsorbents.

• Transportation Systems includes Honeywell Turbo Technologies (turbochargers, charge-air and thermal systems, brake hard parts and other

friction materials); and the Consumer Products Group (car care products including antifreeze, filters, spark plugs, and cleaners, waxes and

additives).

The accounting policies of the segments are the same as those described in Note 1. Honeywell's senior management evaluates segment performance

based on segment profit. Segment profit is measured as business unit income (loss) before taxes excluding general corporate unallocated expense, other

income (expense), interest and other financial charges, pension and other postretirement benefits (expense), stock compensation expense, repositioning and

other charges and accounting changes.

105