Honeywell 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts

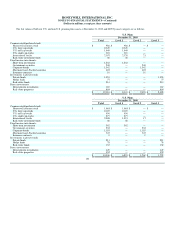

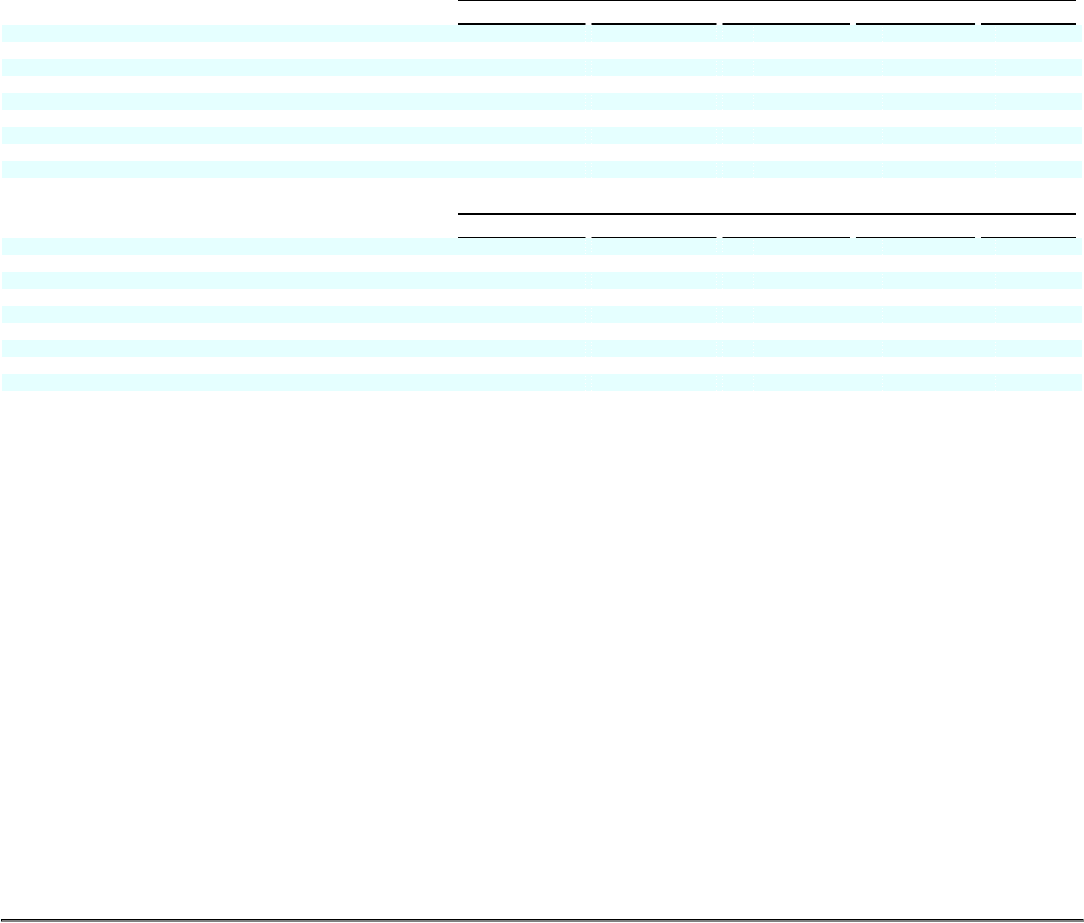

Note 26. Unaudited Quarterly Financial Information

2010 (1)

Mar. 31(2) June 30(3) Sept. 30(4) Dec. 31(5) Year

Net Sales $ 7,776 $ 8,161 $ 8,392 $ 9,041 $ 33,370

Gross Profit 1,918 2,012 2,023 1,898 7,851

Net Income attributable to Honeywell 489 566 598 369 2,022

Earnings per share - basic 0.63 0.74 0.77 0.47 2.61

Earnings per share - assuming dilution 0.63 0.73 0.76 0.47 2.59

Dividends paid 0.3025 0.3025 0.3025 0.3025 1.21

Market Price

High 45.27 48.52 44.46 53.72 53.72

Low 36.87 39.03 38.53 43.61 36.87

2009(1)

Mar. 31(6) June 30(7) Sept. 30(8) Dec. 31(9) Year

Net Sales 7,570 $ 7,566 $ 7,700 $ 8,072 $ 30,908

Gross Profit 1,772 1,842 1,861 1,421 6,896

Net Income attributable to Honeywell 375 431 592 150 1,548

Earnings per share - basic 0.51 0.58 0.78 0.20 2.06

Earnings per share - assuming dilution 0.51 0.57 0.77 0.20 2.05

Dividends paid 0.3025 0.3025 0.3025 0.3025 1.21

Market Price

High 36.04 35.79 40.17 41.31 41.31

Low 23.23 29.29 29.31 35.89 23.23

(1) As revised for the change in our method of recognizing pension expense. See Note 1 of Notes to Financial Statements for a discussion of the change

and the impacts of the change for the year ended December 31, 2009.

(2) For the quarter ended March 31, 2010 our retrospective change in recognizing pension expense increased Gross Profit by $124 million, Net income

attributable to Honeywell by $103 million, Earnings per share, basic by $0.13 and Earnings per share, assuming dilution by $0.13.

(3) For the quarter ended June 30, 2010 our retrospective change in recognizing pension expense increased Gross Profit by $120 million, Net income

attributable to Honeywell by $98 million, Earnings per share, basic by $0.13 and Earnings per share, assuming dilution by $0.13.

(4) For the quarter ended September 30, 2010 our retrospective change in recognizing pension expense increased Gross Profit by $121 million, Net income

attributable to Honeywell by $99 million, Earnings per share, basic by $0.13 and Earnings per share, assuming dilution by $0.13.

(5) The quarter ended December 31, 2010 includes $471 of pension expense as a result of mark-to-market adjustments. See Note of Notes to Financial

Statements for a discussion of our accounting policy.

(6) For the quarter ended March 31, 2009 our retrospective change in recognizing pension expense reduced Gross Profit by $42 million, Net income

attributable to Honeywell by $22 million, Earnings per share, basic by $0.03 and Earnings per share, assuming dilution by $0.03.

(7) For the quarter ended June 30, 2009 our retrospective change in recognizing pension expense reduced Gross Profit by $42 million, Net income

attributable to Honeywell by $19 million, Earnings per share, basic by $0.03 and Earnings per share, assuming dilution by $0.03.

(8) For the quarter ended September 30, 2009 our retrospective change in recognizing pension expense reduced Gross Profit by $42 million, Net income

attributable to Honeywell by $16 million, Earnings per share, basic by $0.02 and Earnings per share, assuming dilution by $0.02.

(9) For the quarter ended December 31, 2009 our retrospective change in recognizing pension expense reduced Gross Profit by $701 million, Net income

attributable to Honeywell by $548 million, Earnings per share, basic by $0.72 and Earnings per share, assuming dilution by $0.71. The quarter ended

December 31, 2009 includes $741 of pension expense as a result of mark-to-market adjustments. See Note of Notes to Financial Statements for a

discussion of our accounting policy.

109